Bitcoin’s recent slide has left traders squinting at charts and asking the same blunt question: correction or crash? Prices have tumbled sharply, but some market watchers still see this as a deep pullback inside a longer uptrend. Others warn the data points to something colder.

Related Reading

Price Decline And Hard Numbers

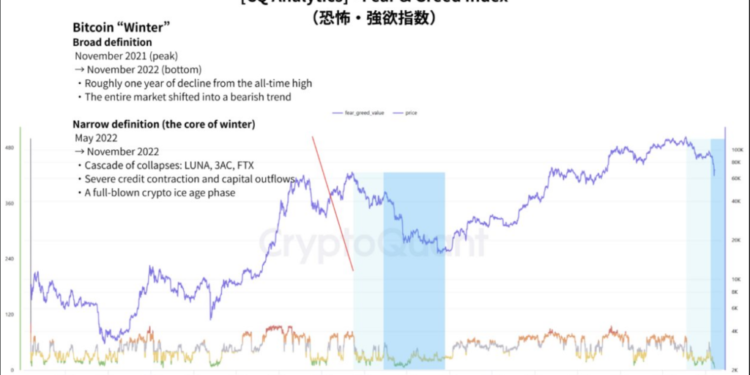

According to XWIN Research’s CryptoQuant analysis, Bitcoin has fallen about 46% from a peak near $126,000 and now trades around $67,900 after five straight months of losses.

The Fear & Greed Index sits at 14 — a reading labeled Extreme Fear. Reports note that net realized losses recently hit over $13 billion, a level that matched the worst stretches of the 2022 slump.

In 2024, roughly $10 billion of inflows helped lift market cap. Then in 2025, more than $300 billion flowed in while the overall market value shrank. That odd mix of heavy inflows and falling market cap suggests selling pressure is higher than fresh buying.

How Rising Prices Are Masking a Quiet Shift in Bitcoin’s Structure

“The base scenario is that Bitcoin may already be entering winter, with higher prices and stronger structure delaying recognition.” – By @xwinfinance

Read more ⤵️https://t.co/7soxNoBhqi pic.twitter.com/fEsSXpAmuK

— CryptoQuant.com (@cryptoquant_com) February 11, 2026

Capital Flows Versus Price Action

Based on reports, the capital flow numbers are the most awkward fact for bulls. Money moved in, but value fell. Who was selling into that demand? Large holders, paper traders, or complex derivatives desks might have taken profits or hedged positions.

The data alone doesn’t name the seller, but the pattern is a red flag. On-chain measures also reveal shrinking realized gains even as prices remained far above prior bear-era levels. That tends to weaken the internal strength of the market over time.

Sentiment And Historical Echoes

Some traders point to a quirk of memory: high nominal prices make pain feel milder. People don’t want to relive the chaos of 2022. Reports say the launch of spot ETFs and deeper institutional access have changed the market’s plumbing, and that gives many confidence.

Yet sentiment readings at extreme fear often show up near capitulation points. It’s worth remembering that in 2022 realized losses peaked about five months before the market bottom, which means big losses can precede a final low by a long stretch.

Technical Patterns And The Bigger Picture

Bitcoin posted four consecutive losing months and a 41% decline across that stretch — a streak last seen during 2018 rather than 2022. That pattern matters because similar sequences have led to extended downturns in the past.

Related Reading

Bitcoin At A Crossroads As XWIN Flags Early Signs Of Crypto Winter

For XWIN Research, the message is simple: price alone does not define the cycle. What matters is who is buying, who is selling, and whether demand can absorb supply without market value shrinking.

Right now, that balance looks strained. Until inflows begin translating into sustained market cap growth and realized losses cool meaningfully, the firm believes the market should be treated with caution rather than optimism. Winter may not have fully arrived, but based on the data, the temperature is clearly dropping.

Featured image from Unsplash, chart from TradingView