[ad_1]

Thorchain, a cross-chain liquidity community, has emerged as a frontrunner in cross-chain transfers, surpassing its rivals in quantity and transaction exercise, on-chain information reveals.

Thorchain Buying and selling Quantity Expands As Prominence Will increase

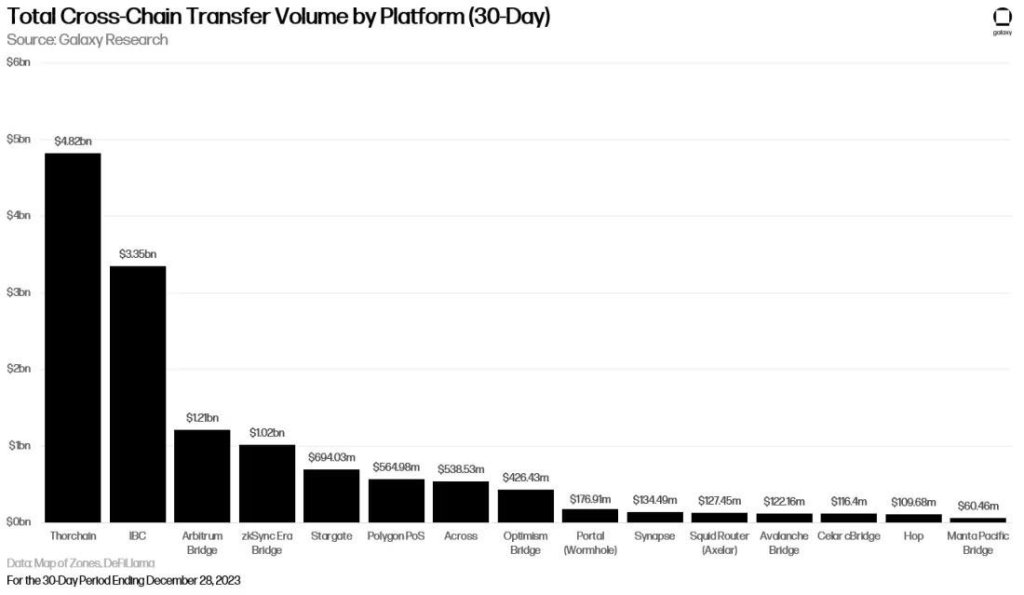

Citing Galaxy Analysis information, a person on X, Bullion, noted that Thorchain processed $4.82 billion in cross-chain transactions over the previous 30 days, whereas Cosmos’ Inter-Blockchain Communication (IBC) protocol dealt with $3.35 billion value of transactions throughout the identical interval.

Amongst layer-2 bridges, Arbitrum Bridge led the pack with $1.21 billion in cross-chain quantity. Others, like Polygon POS and Stargate, processed $564 million and $694 million, respectively.

The spike in Thorchain’s buying and selling quantity and liquidity signifies the protocol’s rising significance within the broader decentralized finance (DeFi) panorama. The protocol’s distinctive options and revolutionary options have made it a most well-liked vacation spot for cross-chain asset transfers.

On the coronary heart of Thorchain is its potential to facilitate cross-chain asset swapping in a trustless and non-custodial method. On this association, and like fashionable decentralized exchanges like Uniswap, Thorchain permits customers to retain management of their funds with out relying on intermediaries.

The stream swaps expertise appears to be drawing person consideration to Thorchain. This characteristic permits customers to swap with near-slippage free even with out excessive liquidity. Technically, and as anticipated in decentralized exchanges, the decrease the liquidity, the upper the slippage. The supply for low or zero slippage offers Thorchain a major benefit over different cross-chain swaps.

Past buying and selling, Thorchain has included different defi options, together with lending. On this association, Thorchain now helps the trustless lending of property with out liquidity danger or curiosity, a deviation from conventional lending protocols, together with Aave.

As DeFi TVL Recovers, Will RUNE Break To New 2024 Highs?

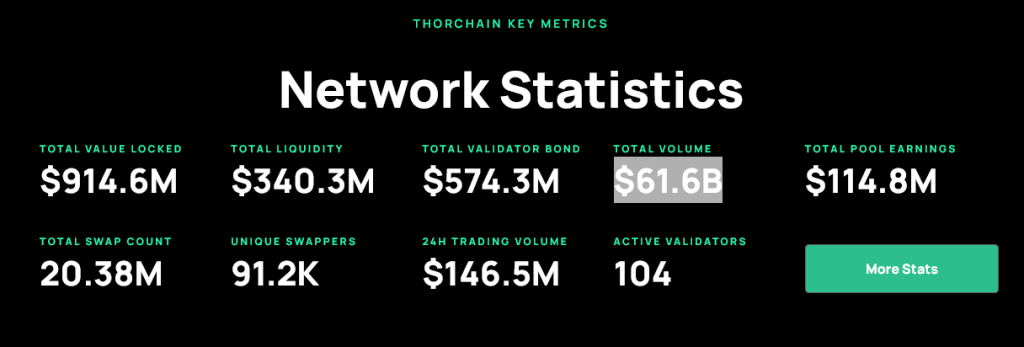

Collectively, these options have contributed to Thorchain’s rising buying and selling quantity, additional cementing its place within the recovering DeFi scene. In response to DeFiLlama, Thorchain has a complete worth locked (TVL) of round $322 million.

In the meantime, Thorchain claims to have over 91,000 swappers. Cumulatively, the protocol has processed over $61 billion in buying and selling quantity.

As DeFi expands from 2022 pits, RUNE, the platform’s native token, has additionally benefited. Wanting on the RUNE every day chart, it’s up roughly 5X from 2023 lows.

Regardless of the re-pricing of asset costs on January 3, RUNE stays resilient. Costs are trending inside a bull flag. Any breakout above $6.5 and native resistances may catalyze demand, lifting the coin above $7.3 to new 2024 highs.

Characteristic picture from Canva, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal danger.

[ad_2]

Source link