[ad_1]

- There was an uptick in trade influx quantity from BTC long-term holders.

- This means that these buyers are actually taking revenue.

Main coin Bitcoin [BTC] could witness a short-term worth correction as on-chain information suggests a motion of cash from long-term holders (LTHs) to short-term holders (STHs).

In a brand new report, CryptoQuant analyst Yosei Dent assessed the coin’s trade exercise and located that when it crossed the $51,000 worth mark on the 14th of February, there was an uptick within the quantity of long-held BTCs that had been transferred to exchanges.

LTHs pause to take revenue

In response to Dent:

“As quickly as BTC breached the $51k mark on the 14th, 5,153 BTC from the 6m-12m age band had been inflowed into exchanges.”

Dent added that the BTC holders on this investor cohort acquired their cash through the 2023 bull market run, which began in October and triggered the coin’s worth to shut the buying and selling yr at a multi-month excessive of $42,000.

As well as, on the identical day, the trade influx quantity of coin holders who’ve had their BTCs for 3 to 5 years briefly climbed to 2,123 BTC.

In response to Dent, most of those buyers purchased their cash through the bull run from 2019 to 2021. Subsequently, the current spike in trade influx quantity from them recommended they took revenue.

“Contemplating that the BTC worth was at $48k on February 14, 2021, plainly a portion of the 3y-5y cohort buyers could have exited the market at their break-even level,” Dent stated.

When BTC sees a rise in trade influx from these investor cohorts, it means that cash are shifting from the fingers of LTHs to STHs.

The motion is commonly accompanied by worth pull-back. It is because STHs are sometimes “weak fingers,” which have their cash prepared on the market at any trace of unfavourable sentiment.

Nevertheless, Dent famous:

“Nevertheless, in comparison with the LTH Alternate Influx in earlier cycles, this scale is comparatively small.”

Many BTC holders are “above water”

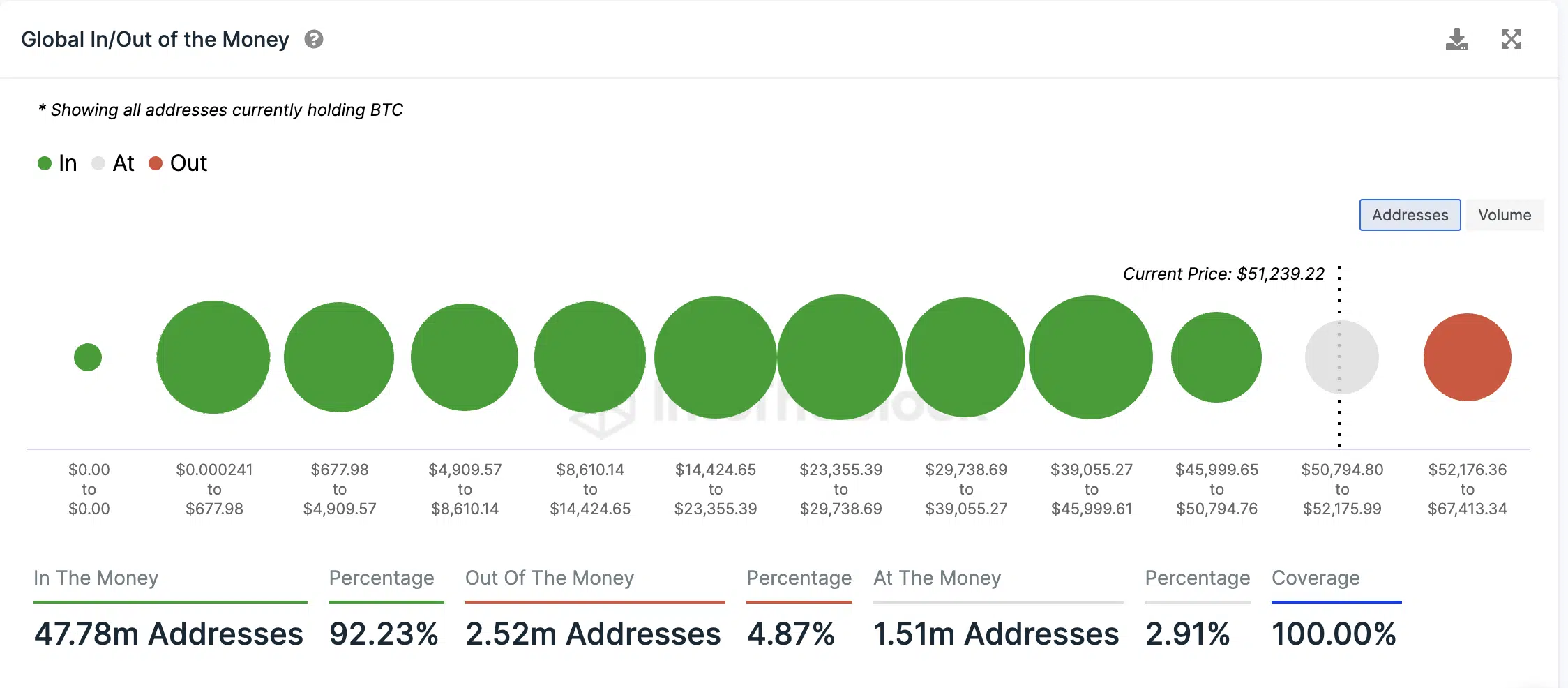

At press time, BTC exchanged fingers at $51,245, in keeping with CoinMarketCap. Within the final month alone, its worth has risen by virtually 30%.

Learn Bitcoin’s [BTC] Price Prediction 2024-2025

Of all addresses holding BTC, 92.23% are deemed to be “within the cash.” This implies they at present maintain the main asset at a revenue.

Then again, 5%, which is made up of two million addresses at present holding their BTCs at a loss. These holders acquired their cash when BTC traded between the $52,000 and $67,000 worth vary.

[ad_2]

Source link