[ad_1]

- Ethereum’s web flows into exchanges rose to a two-year excessive this week.

- Market sentiment stays considerably bearish.

Ethereum [ETH] web flows into crypto exchanges rallied to a two-year high this week amid the “authorized marketing campaign” to categorise the main altcoin as a safety.

AMBCrypto beforehand reported that the US Securities and Exchanges Fee (SEC) had despatched investigative subpoenas to U.S. firms, amongst which is the Swiss-based Ethereum Basis, the non-profit entity that helps the community.

In line with the report, the regulatory watchdog launched its investigation into the Ethereum Basis after the Ethereum community transitioned from a Proof-of-Work consensus mechanism to a Proof-of-Stake (PoS) mannequin in September 2022.

Hike in coin sell-offs

IntoTheBlock’s knowledge confirmed that ETH web flows into exchanges this week totaled $720 million. In line with the info supplier, the final time the coin’s weekly movement into exchanges was this excessive was in September 2022.

When an asset witnesses a rally in its web movement into exchanges, it usually signifies that its holders are shifting their tokens onto buying and selling platforms to promote for revenue or hedge in opposition to additional losses.

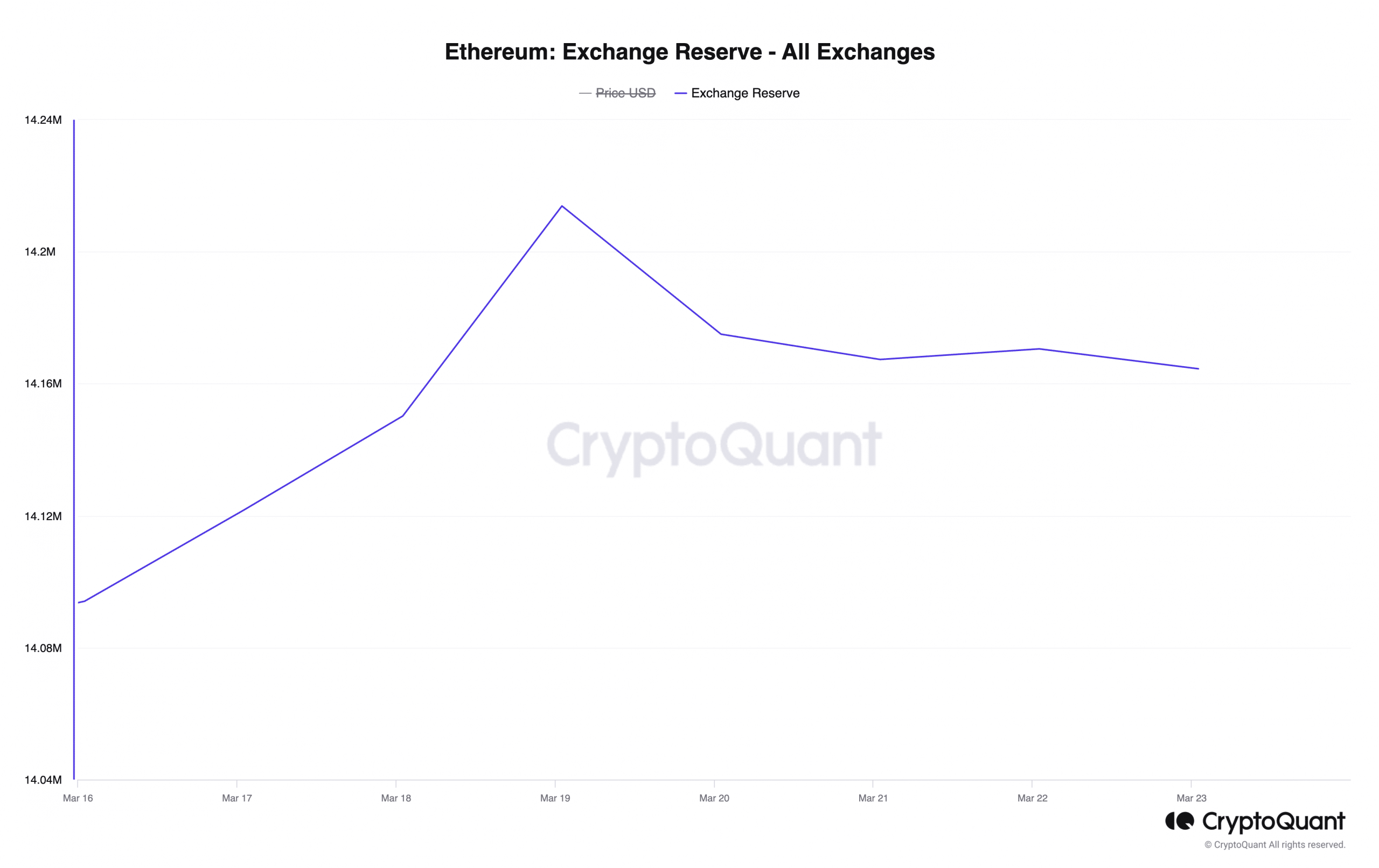

These inflows resulted in a minor uptick in ETH’s alternate reserve throughout the interval beneath evaluate. In line with CryptoQuant’s knowledge, it elevated by 1%. At press time, 14.2 million ETH valued at round $47 million had been held throughout exchanges.

Whereas the spike in ETH’s influx into exchanges this week was partly as a result of SEC’s transfer in opposition to the Ethereum Basis, it was additionally attributable to the overall market decline recorded throughout that interval.

Per CoinGecko’s knowledge, the worldwide cryptocurrency market capitalization dropped by 4% up to now seven days as a result of surge in coin sell-offs.

ETH holders strategy with warning

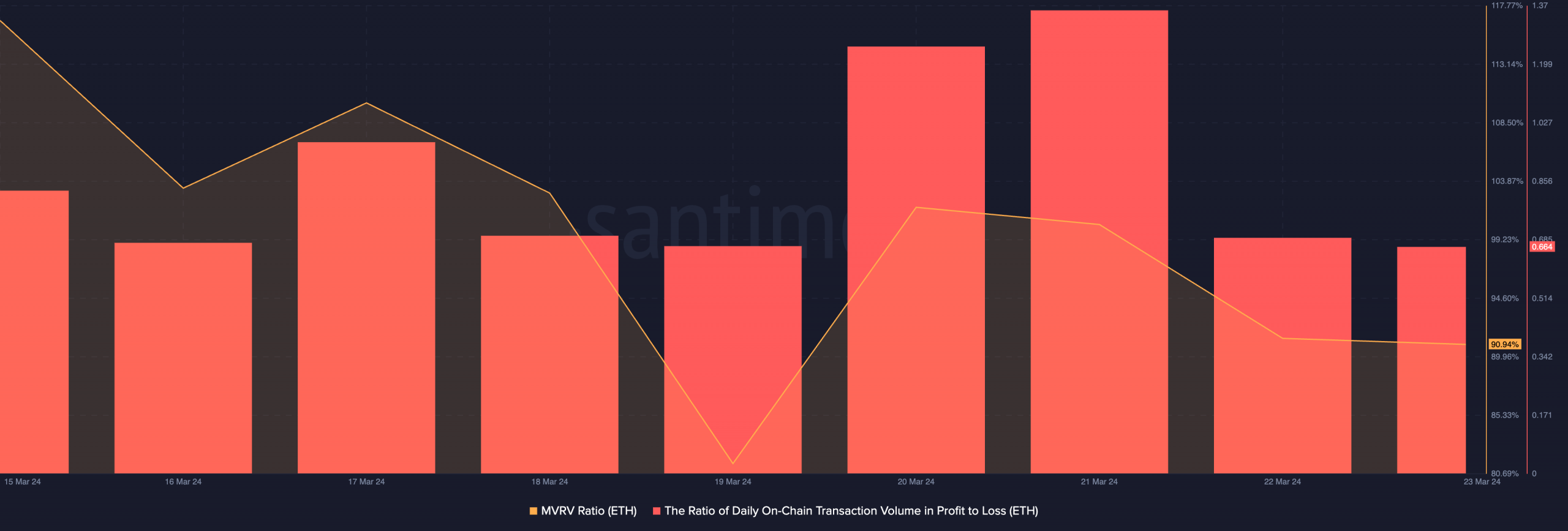

This week’s evaluation of how worthwhile ETH transactions had been, revealed important bearish sentiments out there.

ETH’s Market Worth to Realized Worth (MVRV) ratio plummeted by 22%, to be noticed at 90% at press time. Likewise, the every day ratio of ETH’s transaction quantity in revenue to loss plunged to a low of 0.664.

A holistic consideration of those two key on-chain metrics presents a divergence. ETH’s MVRV ratio of 90% suggests potential undervaluation, which may imply it’s a good time to purchase.

How a lot are 1,10,100 ETHs worth today?

Then again, the 0.664 every day ratio of ETH’s transaction quantity in revenue to loss confirmed that there are extra buyers who’re promoting their cash at a loss.

This divergence means that though ETH is at present undervalued, and now could also be time to purchase. Quick-term sentiment amongst buyers stays cautious or bearish. It is because buyers are keen to promote at a loss moderately than maintain or purchase extra cash.

[ad_2]

Source link