[ad_1]

- A number of flash crashes for BTC occurred throughout centralized exchanges.

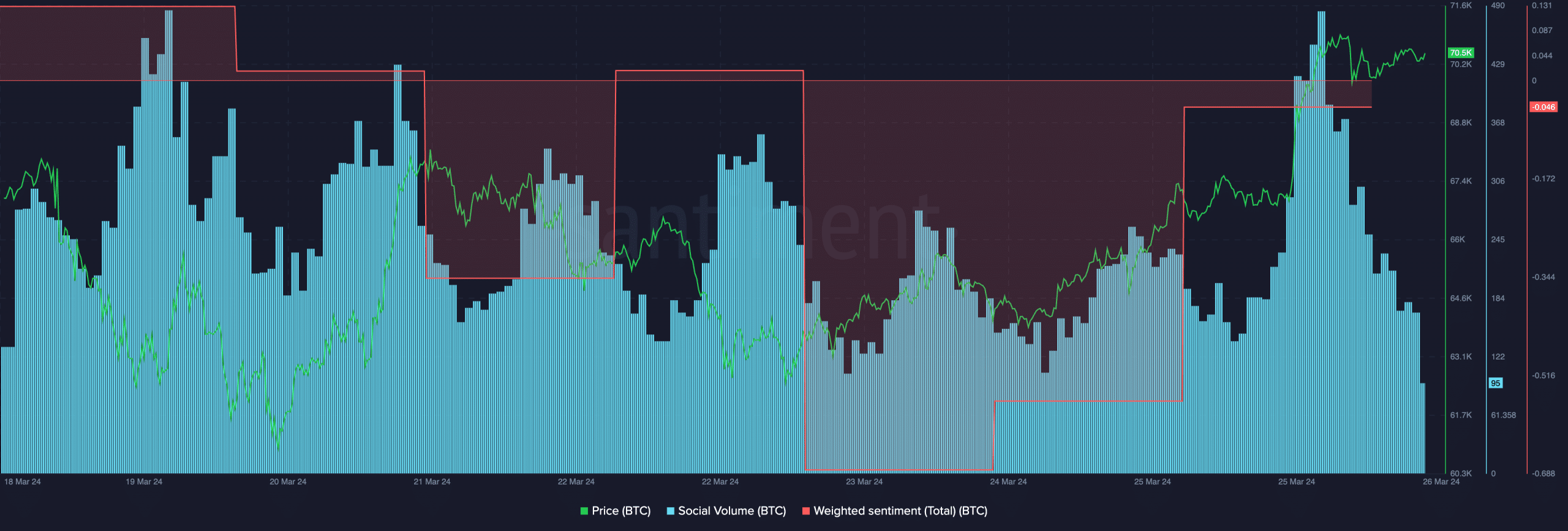

- Sentiment round BTC declined, however worth remained steady.

Bitcoin [BTC] has impressed hope from merchants in the previous couple of days as a result of its latest rally.

Nevertheless, the tides may change quickly in opposition to BTC’s favor, primarily as a result of mishaps occurring on Centralized Exchanges (CEXes).

Some sudden crashes

Extra particularly, the sentiment round BTC could possibly be impacted negatively as a result of flash crashes occurring on CEXes.

For context, flash crashes confer with sudden and excessive drops within the worth of an asset or safety, usually occurring inside a really brief time period, usually only a few minutes and even seconds.

Throughout a flash crash, costs can plummet dramatically earlier than shortly rebounding.

These occasions are usually triggered by fast and enormous sell-offs, generally exacerbated by automated buying and selling algorithms or liquidity shortages available in the market.

In the previous couple of weeks, the occurrences of flash crashes of BTC throughout varied exchanges has grown.

One of many situations of the flash crash occurred on the 18th of March, when the BTC-USDT worth on Bitmex skilled a brief crash to $7,800.

At this cut-off date, it was nonetheless buying and selling at $66,000 on different exchanges.

In a latest put up on X (previously Twitter), the trade attributed the sudden drop in costs to aggressive promoting from a number of accounts.

Quite a few massive promote orders, starting from 10 to twenty BTC, have been executed, together with one exceptionally massive order of 100 BTC, roughly valued at $6.6 million.

One other occasion of this occurred within the European market the place BTC-EUR costs on Coinbase fell from €63,000 to €48,000.

Unhealthy optics

These mishaps which have occurred on CEXes could contribute to a adverse perspective round Bitcoin, particularly amidst new market contributors and retail traders.

Anybody who’s new to the crypto sector could initially begin their journey by shopping for a number of blue chip cash comparable to BTC and ETH on their accounts.

If worth crashes happen for these cash, it may erode the belief of recent customers and deter customers from venturing additional into crypto. This adverse perspective was additional showcased by the Weighted Sentiment indicator.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

AMBCrypto’s evaluation of Santiment’s sentiment knowledge indicated that the adverse feedback round BTC had outnumbered the constructive ones.

These elements may show to be a hurdle to BTC’s rally, going ahead.

[ad_2]

Source link