[ad_1]

In a latest evaluation, JP Morgan’s World Markets Technique group has make clear key developments inside the Ethereum community that might considerably affect its classification below securities regulation. The report comes at a crucial juncture for ETH, because the Swiss-based basis is under investigation by the US Securities and Change Fee (SEC).

Why Ethereum Is Not A Safety

JP Morgan highlights the continued lower in Lido’s share of staked ETH, which has fallen from about one-third a 12 months in the past to roughly 1 / 4 at the moment. This shift in the direction of a extra decentralized staking ecosystem might alleviate regulatory issues relating to centralization inside the Ethereum community.

“Optimistic for the ethereum community, the share of Lido in staked ETH has decreased farther from round one third a 12 months in the past to round 1 / 4 in the meanwhile. This could scale back issues about focus within the Ethereum community, thus elevating the possibility that Ethereum will keep away from being designated as safety sooner or later,” the report states.

The analysts additionally reference the so-called “Hinman paperwork,” launched final June, which have performed a pivotal position in shaping the SEC’s stance on digital tokens. Based on these paperwork, the diploma of community decentralization is essential, as tokens on a sufficiently decentralized community might not be categorised as securities.

It learn:

Specifically SEC officers had acknowledged up to now that tokens on a sufficiently decentralized community are now not securities as a result of there isn’t any “controlling group” within the Howey take a look at.

Neighborhood Views On Decentralization

The Ethereum group has reacted positively to those developments. Anthony Sassano, founding father of The Each day Gwei and co-founder of EthHub, commented on the reducing dominance of Lido, attributing it to elevated competitors within the staking area. This, in keeping with Sassano, is a step in the direction of a extra decentralized and wholesome ETH staking ecosystem.

“I’ve been saying for a very long time that one of the simplest ways to cease Lido from rising and lowering its market share is to extend competitors within the staking area which we’ve got now finished! The Ethereum staking ecosystem has by no means been more healthy,” Sassano remarked.

Nonetheless, opinions on the present crop of restaking initiatives stay blended, with some customers questioning if restaking initiatives “are higher.” In response, Sassano argued, “The talk is barely in a position available as soon as we’ve got a vibrant free market of Ethereum staking initiatives – not a handful that dominate many of the market share.”

Seraphim, head of development at Ethena Labs, offered a practical tackle the state of affairs, suggesting that providing higher yields is a simpler technique than criticism, stating: “Seems offering extra yield is best enterprise technique than whining like Rocketpool trolls Completely happy for LRT initiatives even tho I’m Lido-biased. This accelerates the area into one thing new and thrilling.”

Extra Positives For Ethereum

JP Morgan additionally highlighted the importance of the Dencun improve of their report, which is a serious technological development because the earlier Shanghai improve. By introducing blobs and cryptographic schemes such because the KZG dedication scheme, the Dencun improve has “considerably decreased the transaction prices on Ethereum layer 2,” in keeping with the report.

Trying forward, the anticipated Petra improve is predicted to introduce Verkle timber, facilitating environment friendly knowledge storage and additional bolstering Ethereum’s scalability and effectivity. The report optimistically notes, “Petra… would introduce options like Verkle timber for environment friendly knowledge storage which purpose at simplifying block verification by pruning historic blocks older than one 12 months, thus conserving storage and bandwidth.”

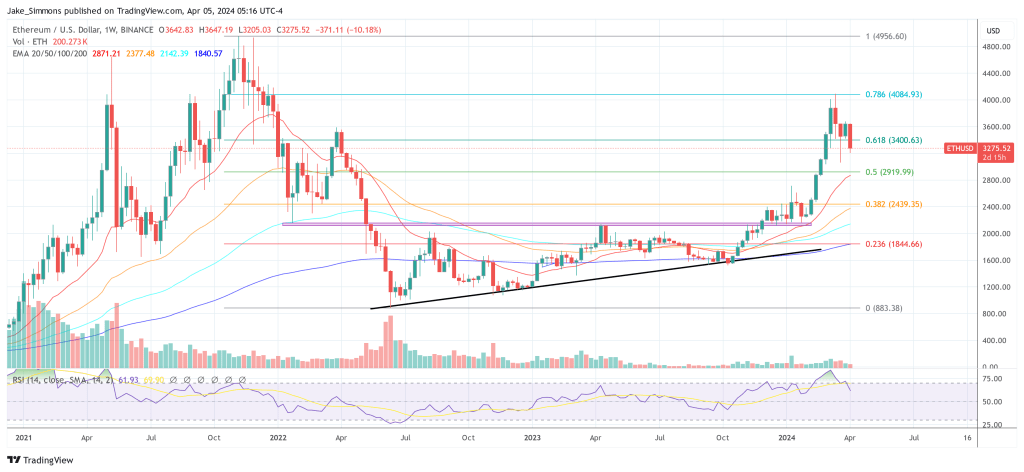

At press time, ETH traded at $3,275.

Featured picture from Gagadget.com, chart from TradingView.com

[ad_2]

Source link