The Bitcoin worth started Friday, August 16 from beneath the $57,000 stage, following a sudden 7% fall on Thursday. Whereas the premier cryptocurrency is exhibiting good indicators of restoration, a outstanding crypto analyst has defined how the newest price decline could have pushed the BTC worth right into a bearish section.

Bitcoin MVRV Drops Under 1-Yr SMA – Affect On Value?

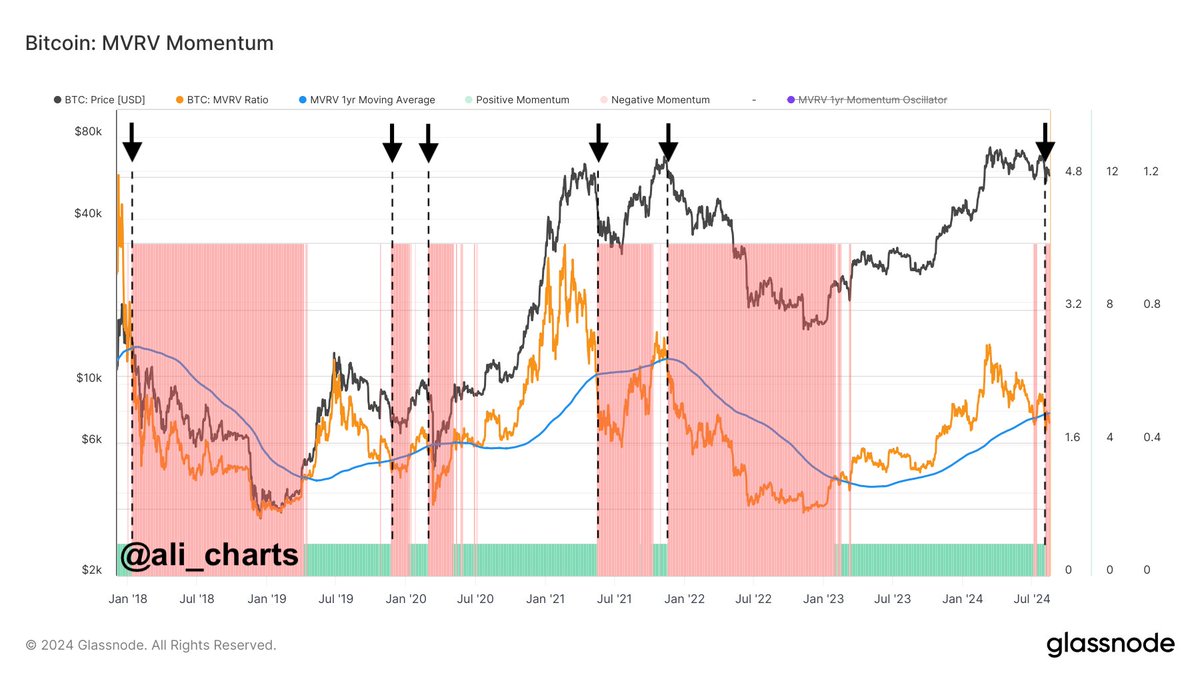

In a put up on the X platform, in style crypto analyst Ali Martinez shared that the Bitcoin worth has skilled a shift in its cycle following the newest worth dip. This on-chain revelation relies on the Glassnode MVRV (Market Worth to Realized Worth) Momentum indicator, which serves as a instrument for figuring out macro market traits.

The MVRV Momentum indicator primarily consists of the MVRV ratio and the 1-year easy shifting common (SMA). When the MVRV ratio breaks above this SMA, it signifies a transition into the bull market. In the meantime, a break under the 1-year easy shifting common indicators a shift to the bearish section.

Usually, robust breaches above the MVRV 1-year SMA recommend that enormous volumes of Bitcoin had been acquired under the present worth, exhibiting that the holders are actually in revenue. On the flip aspect, when there’s a robust break beneath the shifting common, it signifies that enormous volumes of BTC had been bought above the present worth, with the holders within the pink.

A chart exhibiting the Bitcoin worth and the MVRV momentum indicator | Supply: Ali_charts/X

In accordance with Martinez, the BTC cycle transitioned to a bearish section after the Bitcoin worth slumped under $61,500. This newest important break of the MVRV ratio beneath the SMA reveals {that a} important quantity of BTC was acquired above $61,500. Nevertheless, the cash are actually in loss, which can doubtlessly result in heavy distribution by traders who wish to reduce their losses.

When numerous investors are in the red, there’s an elevated stress to promote, which may put additional downward stress on the Bitcoin worth. Finally, this might result in a scenario the place falling costs end in extra asset offloading, thereby strengthening the momentum of the bearish section.

Bitcoin Value At A Look

As of this writing, the price of Bitcoin continues to hover round $59,000, reflecting a 2.5% improve prior to now 24 hours. Nonetheless, the premier cryptocurrency is down by almost 3% on the weekly timeframe, in keeping with knowledge from CoinGecko.

The value of Bitcoin hovers across the $59,000 stage on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView