Stay informed with free updates

Simply sign up to the Cryptocurrencies myFT Digest — delivered directly to your inbox.

The head of crypto exchange Kraken has hit out at UK rules on the promotion of digital financial assets, arguing that they hinder retail investors by slowing down the movement of funds.

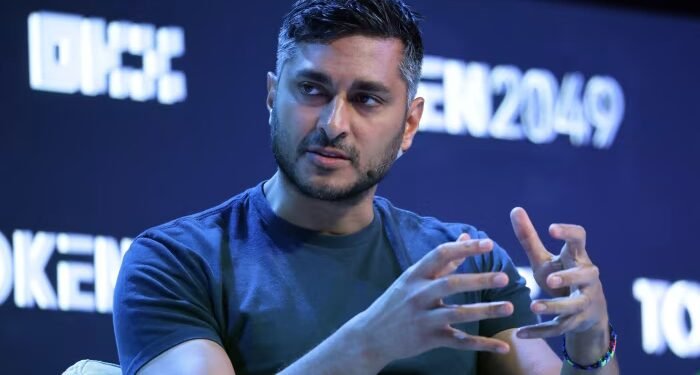

Arjun Sethi, co-chief executive, told the Financial Times: “In the UK today, if you go to any crypto website, including Kraken’s, you see the equivalent to a cigarette box [warning] — ‘use this and you’re going to die’.”

He added: “Because of the speed at which they have to do the transaction, it’s worse for consumers. Disclosures are important . . . but if there are 14 steps, it’s worse.”

Sethi’s comments mark the first major criticism of the UK’s approach since the Financial Conduct Authority introduced financial promotion rules in late 2023.

Companies marketing their crypto services in the UK must comply with the rules. They involve posting clear risk warnings on their website and apps, banning incentives to invest, creating “positive frictions” and making users fill out “appropriateness assessments” to check whether they understand the risks of buying crypto.

Some customers may also be deterred from investing in crypto at all, therefore missing out on potential gains, Sethi said.

The FCA said its rules ensured that customers understood the benefits and risks of investing in crypto. “Customers must answer questions before a firm makes a financial promotion to them, but this is not required every time a customer makes a trade, so should not generally prevent them acting where they want to.

“Some consumers may make an informed decision that investing in crypto is not right for them — that is our rules working as intended.”

The UK regulator has long come under fire from digital asset executives for taking an overly cautious approach to the industry.

British regulators have faced calls to be more accommodating to crypto this year, since the US under President Donald Trump has embraced the industry.

The FCA last month sued HTX for failure to comply with the financial promotions rules. The crypto exchange is linked to Justin Sun, a China-born billionaire who has invested millions of dollars in Trump’s digital asset ventures.

Kraken was founded in 2011 and is one of the world’s 15 biggest exchanges by trading volumes.

Sethi has co-led Kraken since October 2024 alongside David Ripley, and also chairs Silicon Valley venture capital firm Tribe Capital. He said stricter UK rules and consumer protection efforts meant Kraken users in Britain could not access about three-quarters of the crypto products available to those in the US, such as earning more yield and lending through decentralised finance protocols.

Kraken also runs a tokenised stock exchange, enabling investors to trade digital representations of public equities. Sethi said the company would not branch out into offering tokenised versions of private companies, in contrast to Robinhood, which faced a backlash earlier this year for offering representations of shares in OpenAI.

“The argument Vlad [Tenev, head of Robinhood] is using is flawed,” Sethi said, adding that tokenising private company stocks was a “terrible idea” because investors risked facing difficulties selling their investments.

Kraken is also preparing to list in New York, although Sethi declined to comment on timing.