- Ethereum dropped 9%, however whales and establishments aggressively purchased the dip.

- BlackRock now holds 1.5M ETH, signaling long-term bullish sentiment.

Ethereum [ETH]’s market efficiency took a pointy hit on the thirteenth of June, plunging by 9% and liquidating $298 million throughout 80,000 merchants.

Ethereum’s present market dynamics

Whereas panic gripped a lot of the market, opportunistic traders noticed worth within the decline, scooping up ETH below the $2,500 mark.

The asset dropped from $2,771 to a low of $2,443 earlier than stabilizing close to $2,509.

Commerce battle anxieties fueled the broader sell-off, however a better look reveals bullish undercurrents.

Open Curiosity surged to $35.22 billion in simply 24 hours, with prime exchanges like CME, Binance, Gate, and Bitget every seeing a mean of $4 billion in ETH publicity.

This coincided with a modest restoration of ETH’s worth to $2,538.66 at press time, up 0.37% in accordance with CoinMarketCap.

Furthermore, amidst heightened market volatility, a serious Ethereum whale has signaled sturdy bullish conviction by opening a considerable $16.6 million lengthy place.

BlackRock chooses Ethereum regardless of volatility

Regardless of these combined indicators, BlackRock, presently the most important asset supervisor globally with $73 billion in crypto publicity, has persistently purchased Ethereum every day for over two weeks.

This follows BlackRock’s announcement about its aim to considerably increase affect throughout each private and non-private markets, with a plan to spice up income from $20 billion in 2023 to over $35 billion by 2030.

If realized, this progress may additional solidify BlackRock’s position in shaping institutional funding tendencies throughout conventional and crypto belongings alike.

This sample of strategic shopping for from deep-pocketed entities suggests a long-term outlook that sees present worth ranges as a chance quite than a threat.

Execs weigh in

Remarking on the identical, Jeremy noted,

“BlackRock has been shopping for Ethereum each single day for the previous two weeks. They’ve now amassed $570M price of $ETH. Sensible cash isn’t slowing down, they’re doubling down.”

As optimism continues to construct round Ethereum, institutional accumulation has grow to be more and more evident.

Knowledge from Arkham Intelligence reveals that BlackRock now holds over 1.5 million ETH, valued at roughly $3.83 billion, cementing its place as a dominant pressure within the Ethereum market.

In actual fact, SharpLink Gaming additionally lately purchased 176,271 ETH price $463 million, positioning itself as the highest publicly listed Ethereum holder.

Is ETH gearing up for a rally?

Moreover, ETH ETFs additionally noticed inflows surging till June, and thus, the query arises: Is Ethereum poised for one more rally?

Nicely, technical indicators like RSI and MACD are each under impartial ranges, which factors to lingering bearish strain.

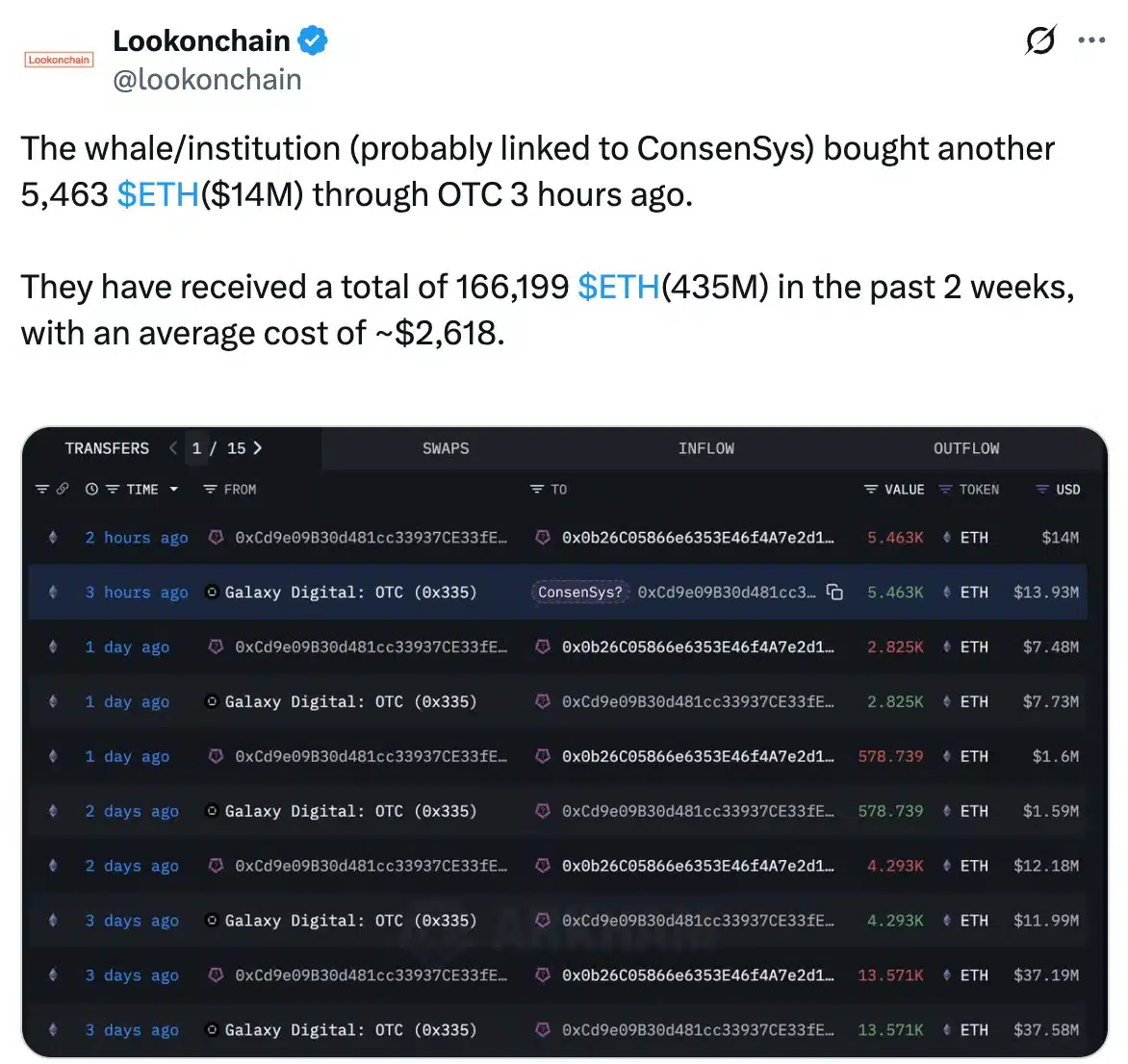

Nevertheless, Lookonchain information revealed that whale accumulation of ETH, which factors to rising bullish momentum forward.

In conclusion, IntoTheBlock information additional confirmed the upcoming bullish transfer as over 77% of ETH holders are presently in revenue, which can replicate sturdy holder confidence and trace at potential upward momentum within the close to time period.