- Saylor believes the world’s largest cryptocurrency is a ‘digital energy’

- MSTR outperformed BTC throughout its most up-to-date restoration

Some TradFi analysts criticized Bitcoin [BTC] just lately, discrediting its use as a hedge after large volatility pulled down its worth by 15% on 5 August. And but, Chairman of MicroStrategy Michael Saylor continues to defend the world’s largest digital asset’s volatility. Terming it the “price you pay” for its utility and liquidity, he stated,

“The volatility is the value you pay with the intention to create billions of {dollars} of credit score and liquidity at your fingertips all instances, in every single place, for everyone.”

In keeping with Saylor,

“Nobody who understands Bitcoin is afraid of the volatility.”

Saylor’s Bitcoin recommendation to governments

That wasn’t all although as Saylor additionally took a swipe at conventional finance’s (TradFi) inefficiency in opposition to Bitcoin. He commented,

“There’s a revolution within the international capital markets and conventional finance operates 19% of the time for 10% of the world. That makes it a 2% answer. #Bitcoin is a 100% answer. It’s not partisan; it’s simply a good suggestion.”

For perspective, conventional finance exchanges just like the NYSE halted equities buying and selling over the previous few weeks after reported glitches. Quite the opposite, Bitcoin has been up and on-line for over 99% of its existence.

Moreover, Saylor bolstered BTC as a ‘digital power’ that must be adopted by any authorities. In doing so, he equated it to nuclear and area energy.

Bitcoin technique development

The chief echoed a equally bullish sentiment in a current Fox Enterprise interview. In keeping with the exec, his agency’s share, MicroStrategy (MSTR), outperformed all the things as a result of it adopted the Bitcoin technique.

“MicroStrategy is outperforming all the things since they adopted #Bitcoin…It’s crushed all the things.”

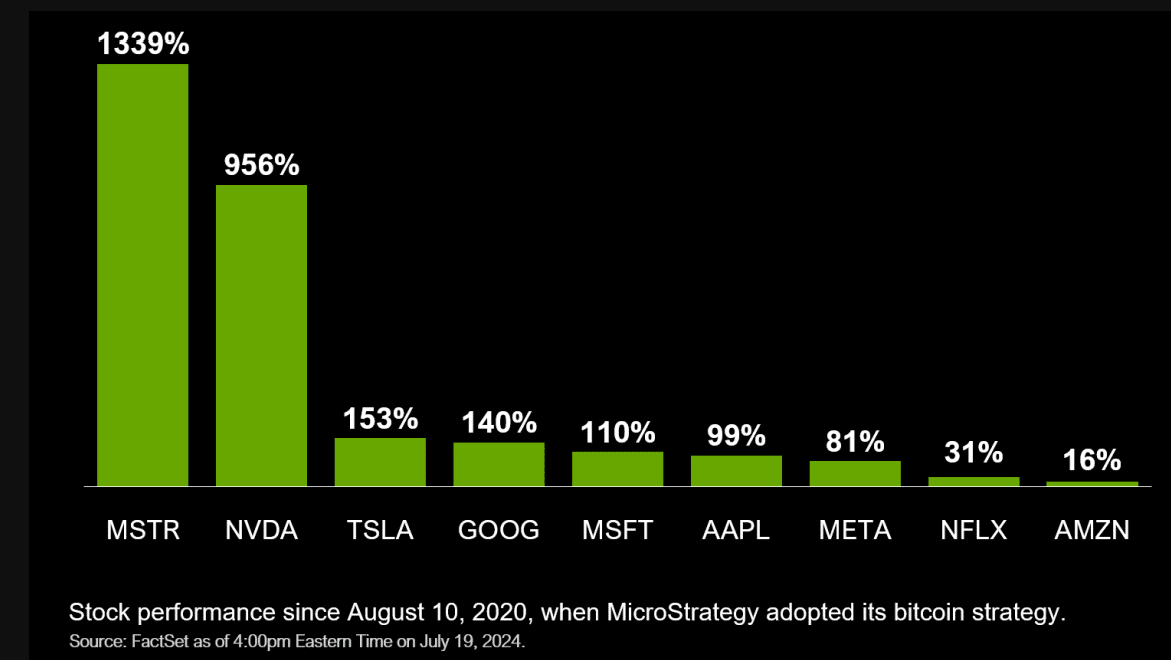

The truth is, MSTR has eclipsed all its friends, rallying by over 1000% since adopting the cryptocurrency again in 2020.

As of August, MicroStrategy held over 226k BTC and planned to accumulate one other $2 billion value of BTC. Saylor himself holds about $1 billion in BTC in a person capability and is able to stash extra too.

Apparently, different corporations have additionally adopted MicroStrategy’s Bitcoin technique. In the USA, for example, Block Inc., based by Jack Dorsey and a father or mother agency to Money App, is likely one of the firms which have an lively BTC technique.

Abroad, Japanese funding agency Metaplanet is maybe probably the most aggressive adopter of this technique. The agency just lately secured ¥1 billion so as to add extra BTC to its portfolio. In consequence, the agency’s TKO inventory is now up +600% in year-to-date (YTD) efficiency (in Japanese Yen phrases).

Over the identical interval, MSTR outperformed even BTC, at over 97%, in opposition to the digital asset’s 37%.

In the meantime, MSTR’s inventory successfully carried out the 10-1 inventory cut up on 8 August, meant to make the inventory extra inexpensive. In consequence, there could be 10 instances extra MSTR shares at a tenth of its earlier worth.

At press time, MSTR was trading at $135. It rebounded by 27% in opposition to BTC’s 12% over the past 5 buying and selling days.