- Ethereum value mirrored Bitcoin, exhibiting volatility, with latest staking inflows main to cost declines.

- Analysts predicted a possible rally for Ethereum, focusing on a $3,000 value level amid market changes.

Ethereum [ETH], being the second-largest crypto by market cap, has continued to observe Bitcoin [BTC] intently in its struggles to realize new highs. Up to now, Ethereum has declined 2.1% prior to now week.

This decline seems to have prolonged to even the previous day by which ETH dropped by a modest 0.2%— this value efficiency has now introduced the asset to at the moment commerce at a value of $2,619, on the time of writing.

Ethereum staking inflows soars

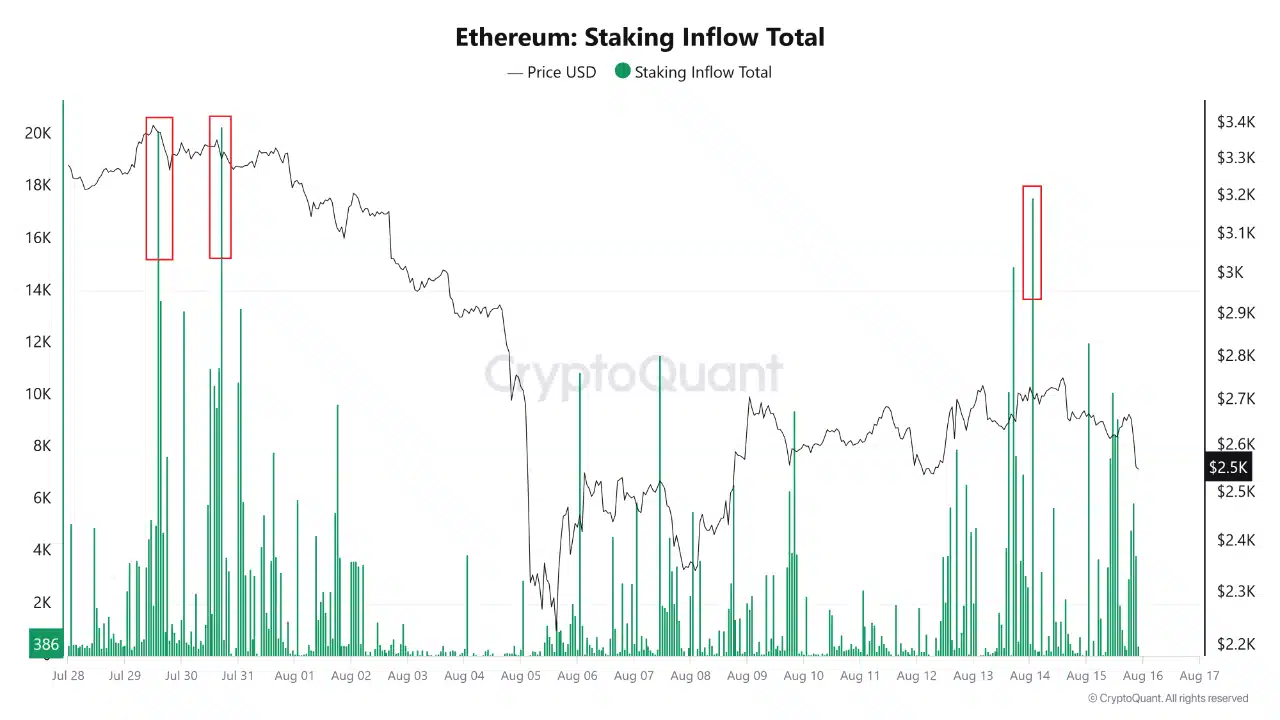

Ethereum has not too long ago seen a surge in staking inflows, as reported by CryptoQuant, indicating a rising curiosity in securing the community by means of its Proof of Stake (PoS) mechanism.

This inflow has pushed whole staking volumes previous 16,000 ETH. Nonetheless, there seems to be a correlation between these inflows and subsequent value drops.

In response to the CryptoQuant analyst reporting this surge in staking influx, historic information from July and mid-August exhibits that vital will increase in staked ETH usually precede noticeable declines in Ethereum’s market price.

These patterns recommended that whereas staking strengthened community safety and stakeholder dedication, it additionally launched short-term value volatility because of the locking up of liquidity.

Is a near-term surge to $3,000 nonetheless doable?

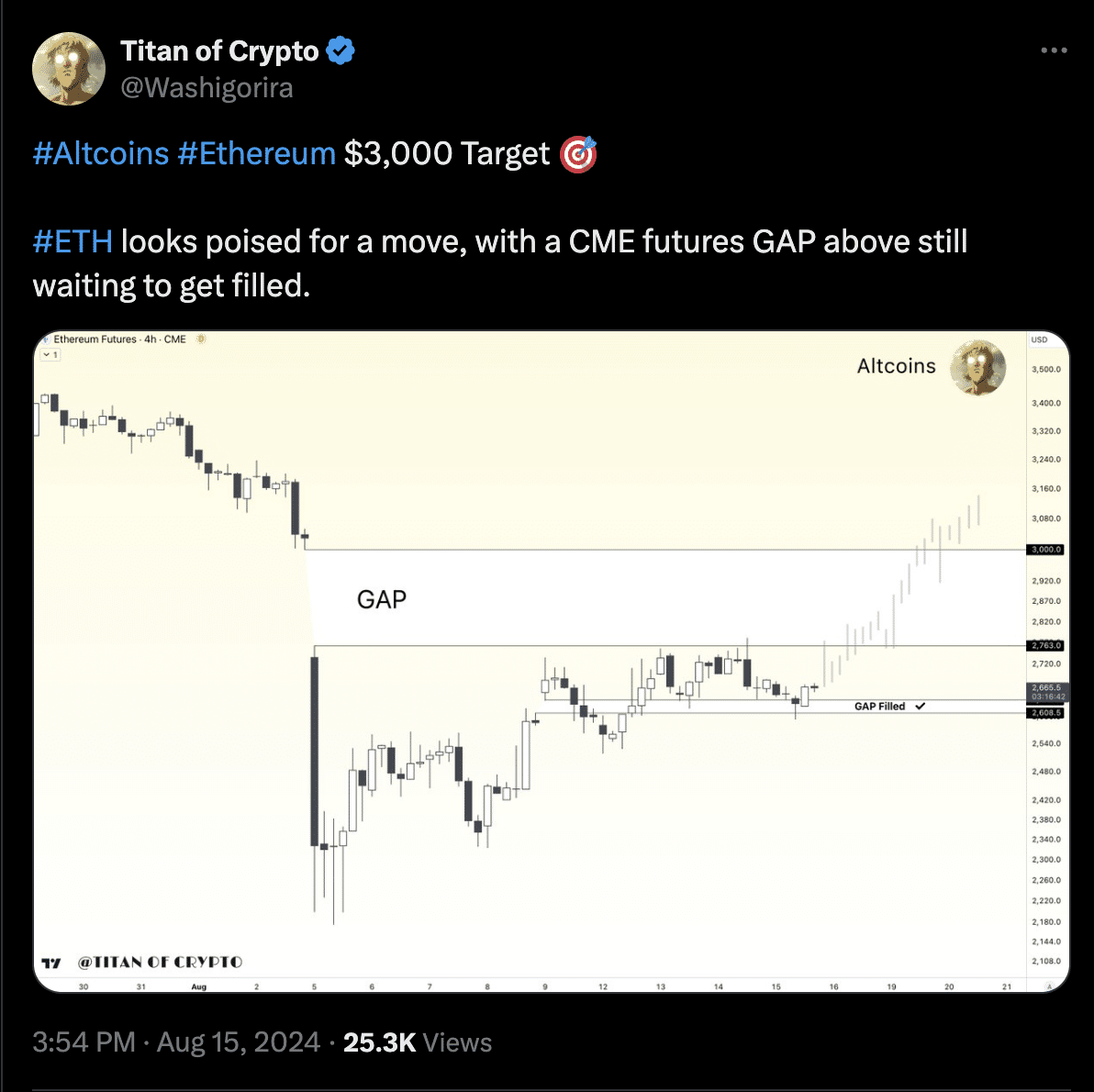

In the meantime, another analysts remained optimistic about Ethereum’s potential for restoration and progress.

A outstanding crypto analyst, identified on X (previously Twitter) as “Titan of Crypto,” has projected a goal value of $3,000 for Ethereum.

This prediction is partly based mostly on the presence of an unfilled CME futures hole, which traditionally signifies a possible upward motion in value.

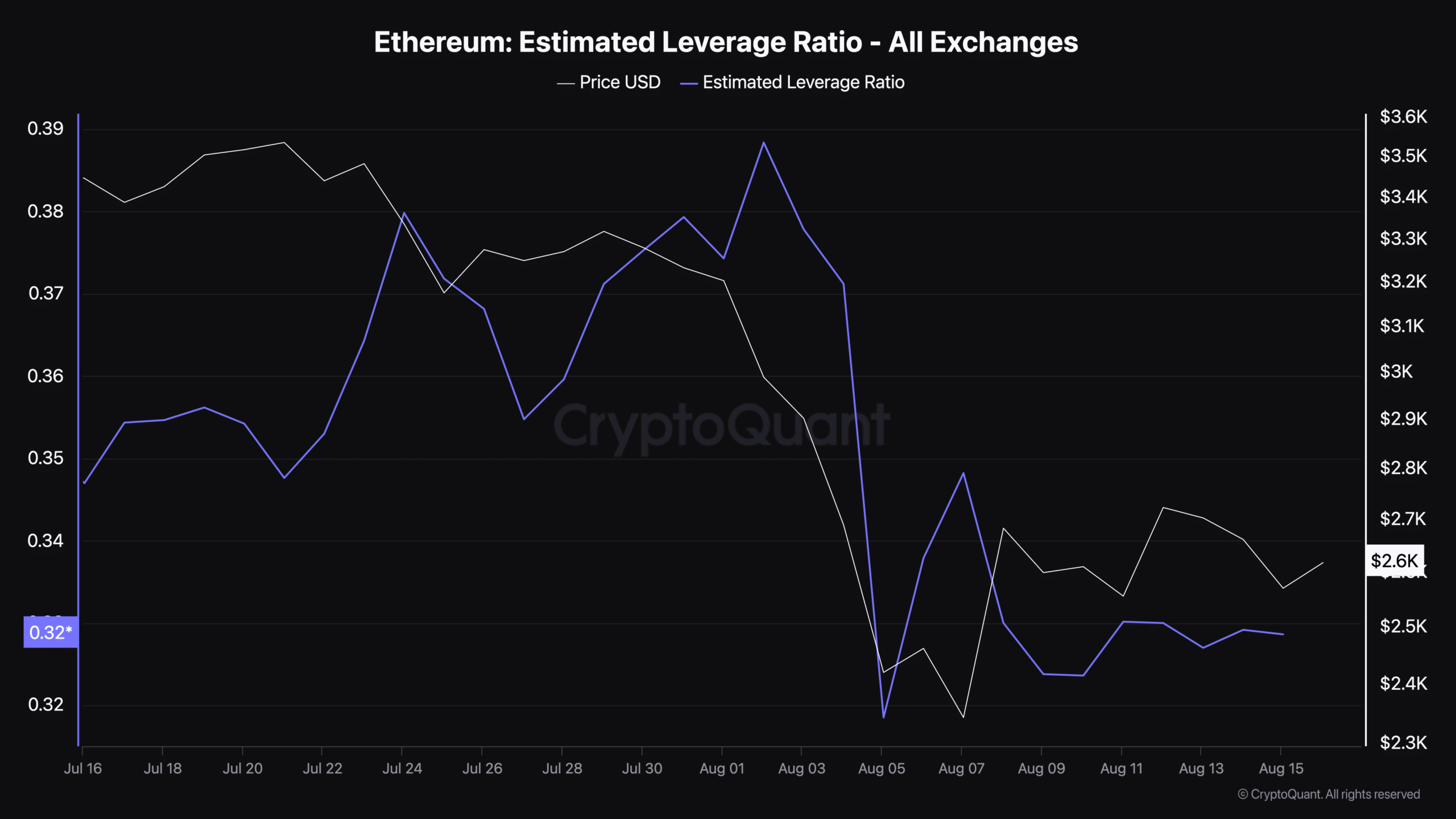

Furthermore, Ethereum’s basic indicators, such because the estimated leverage ratio — at 0.328 at press time in keeping with data from CryptoQuant — recommended a conservative but steady market leverage state of affairs.

Learn Ethereum’s [ETH] Price Prediction 2024-25

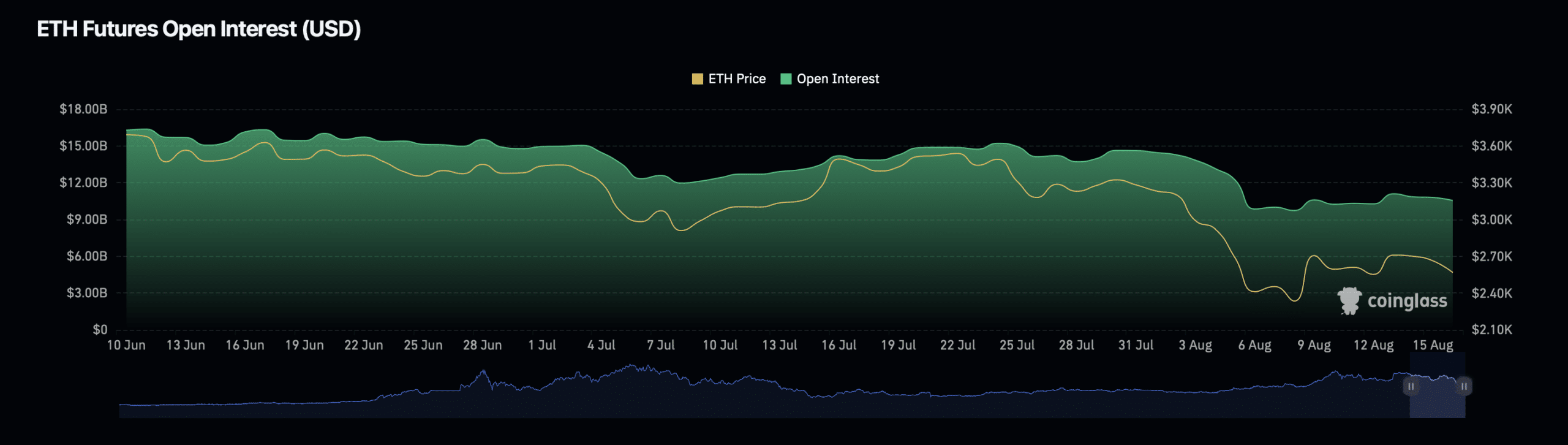

This ratio, when evaluated alongside the present decline in Ethereum’s Open Curiosity from Coinglass, hinted at a cautious market sentiment.

Nonetheless, it additionally highlighted the room for bullish momentum ought to market situations enhance.