- BlackRock surpassed Grayscale in ETFs holdings for the primary time.

- BlackRock ETFs hit $21,217,107,987, whereas Grayscale ETFs stood at $21,202,480,698 at press time.

BlackRock ETFs have made a historic shift, overtaking Grayscale ETFs for the primary time. In accordance with an X (previously Twitter) publish by Arkham Intelligence,

” Rocket ETF holdings overtake Grayscale for the primary time. BlackRock’s ETFs IBIT and ETHA have simply overtaken Grayscale’s ETFs GBTC, BTC Mini, ETHE and ETH Mini in on-chain holdings. Blackrock ETFs now have the most important collective holdings of any supplier.”

This improvement positions BlackRock because the chief within the ETF market after overtaking Grayscale, which has been the dominant participant for a very long time.

At press time, BlackRock’s whole holdings hit $21,217,107,987, whereas Grayscale ETF’s whole holdings adopted carefully behind at $21,202,480,698.

Implications for Ethereum, Bitcoin

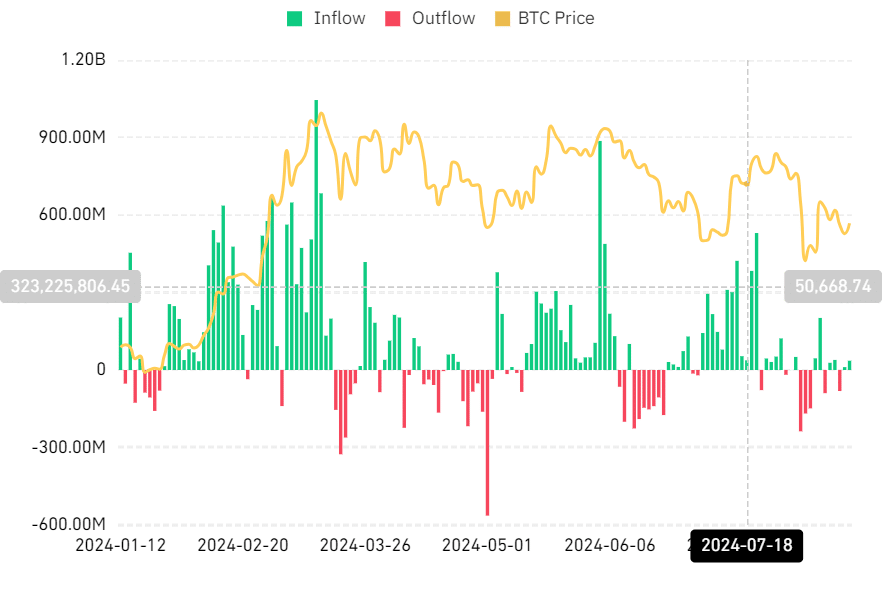

The cryptocurrency market skilled important actions in ETF flows since this information broke.

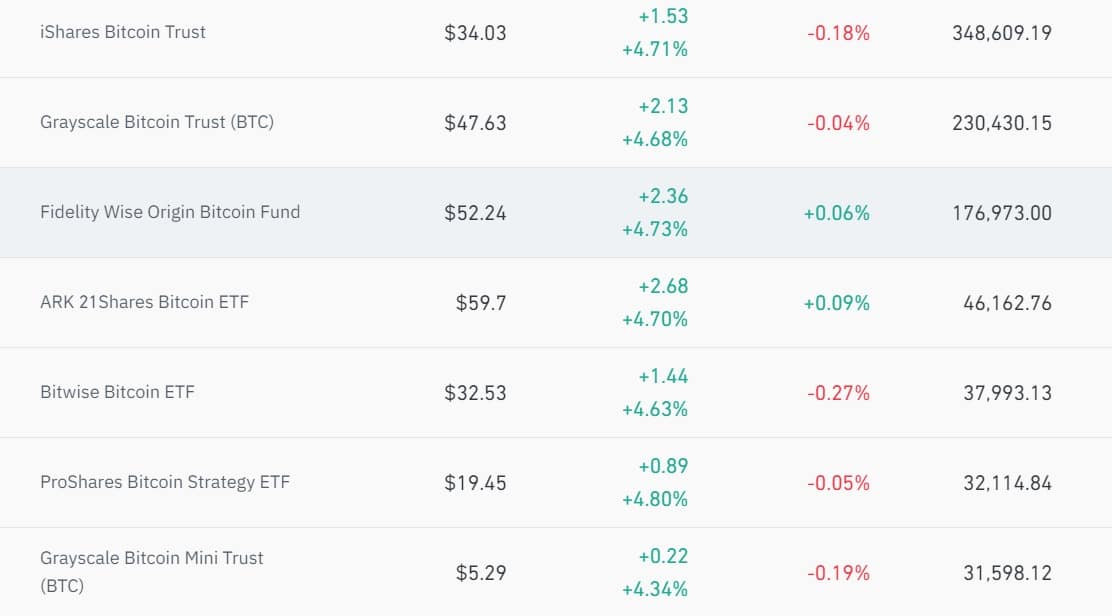

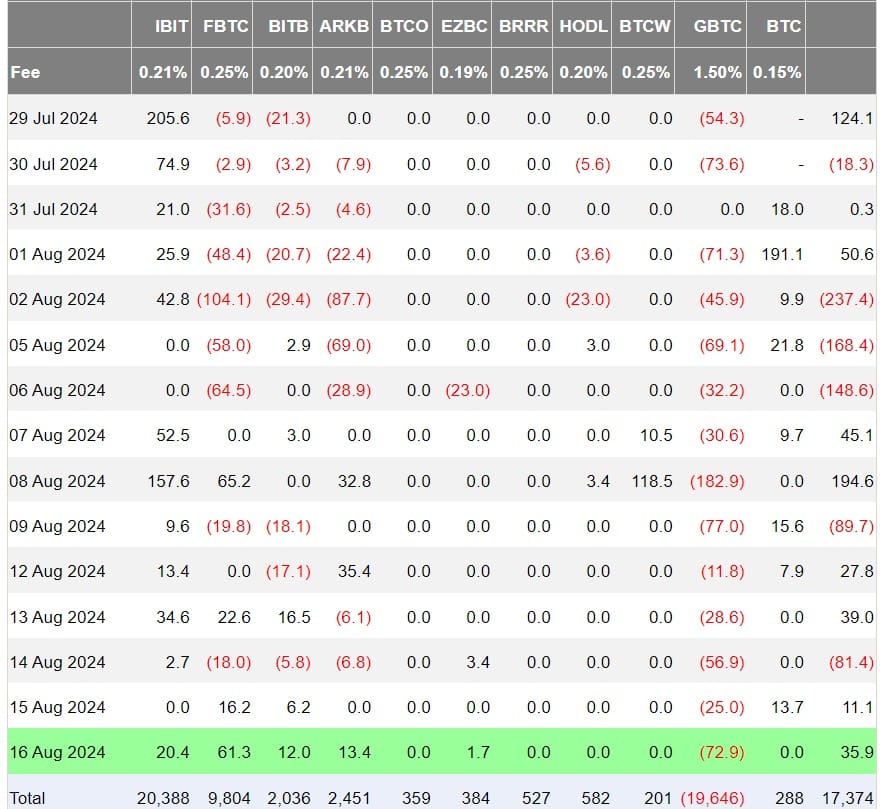

Notably, spot Bitcoin [BTC] ETFs noticed a web influx of roughly $35.9 million, with notable contributions from Constancy ($61.3 million) and BlackRock ($20.4 million).

In the meantime, Grayscale’s Bitcoin Belief (GBTC) noticed an outflow of $72.9 million.

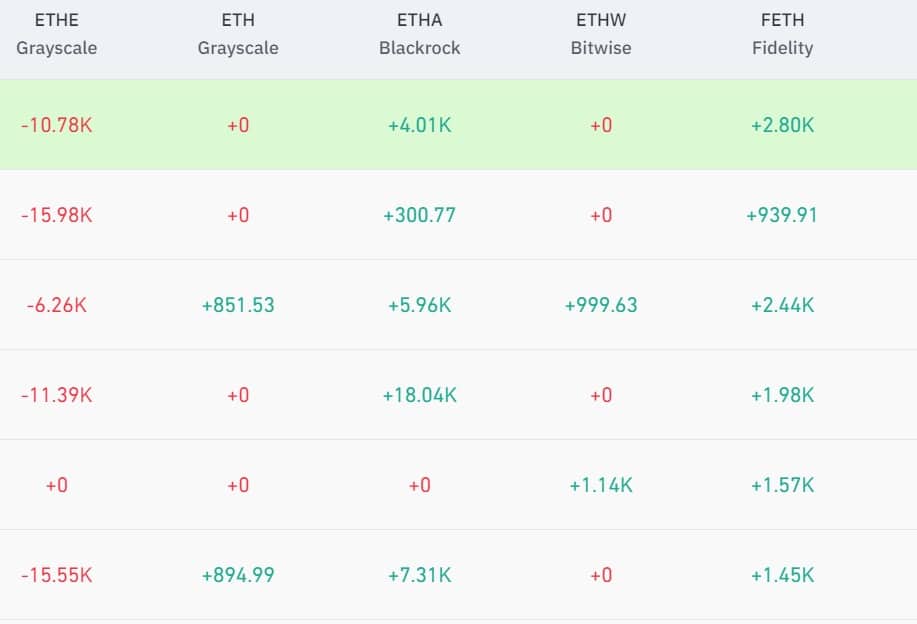

Ethereum [ETH] ETFs noticed main actions as effectively. Spot Ethereum ETFs recorded a web outflow of $15 million.

Throughout the Ethereum ETFs, Grayscale’s ETHE had an outflow of $27.743 million, whereas BlackRock’s ETHA and Constancy’s FETH had inflows of $10.33 million and $7.21 million, respectively.

Due to this fact, the entire web circulate for ETH spot ETFs was $7.352 billion at press time.

The shift in choice between BlackRock and Grayscale might considerably impression crypto, particularly concerning investor confidence.

Elevated demand for ETFs

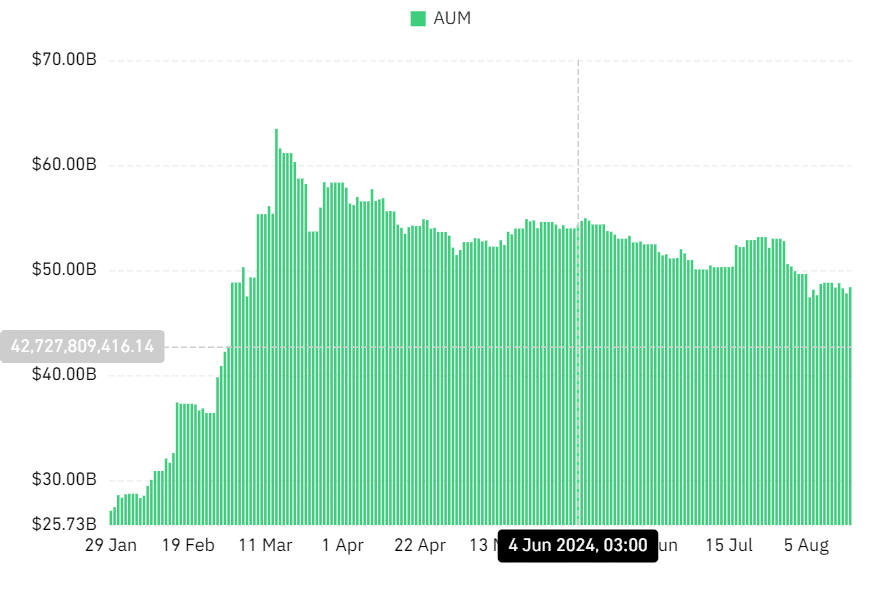

The demand for ETFs has skilled exponential progress YoY. As an illustration, in 2022, the web share issuance of ETFs was $609 billion. In 2023, it was $597 billion.

Nonetheless, there was a drastic surge in demand in 2024 because the approval of Bitcoin spot ETFs in January, and Ethereum spot ETFs in July.