- Galaxy analysis famous that since Dencun, transactions on Ethereum layer 2s have greater than doubled, seemingly due to bots.

- The Ethereum mainnet has additionally seen a notable decline in complete income and ETH burned.

The Ethereum [ETH] Dencun improve went stay in March this 12 months. Whereas it had the specified impact of creating layer 2s scalable and cost-efficient, it has additionally had an unintended draw back.

Per an in-depth evaluation by Galaxy, the EIP-4844 improve noticed prices for Ethereum rollups cut back considerably, which fueled their utilization. This additionally shifted income away from the Ethereum mainnet.

Galaxy researcher Christine Kim notes that since this improve, the Ethereum community has seen a decline in income and burn price.

Knowledge from Ultrasound Money confirmed that because the thirteenth of March, when the Dencun improve went stay, ETH’s burn price has dropped by round 0.18%.

Bots driving transaction surge?

Ethereum rollups have a Complete Worth Locked (TVL) of $33 billion per L2Beat information. This TVL has grown by greater than 200% prior to now 12 months.

In addition to the surging TVL, Galaxy famous that transactions on layer-2s have greater than doubled to six.6 million transactions since Dencun. This enhance comes as transaction prices additionally lowered considerably.

Nevertheless, the excessive transaction rely has coincided with a rise in failure charges. Base has the best transaction failure price at 21%. It’s intently adopted by Arbitrum with a 15.4% failure price and Optimism with 10.4%.

The analysis attributed this failure price to bot exercise. As a result of low transaction prices, addresses making over 100 transactions per day, that are seemingly bots, have elevated.

Influence on ETH

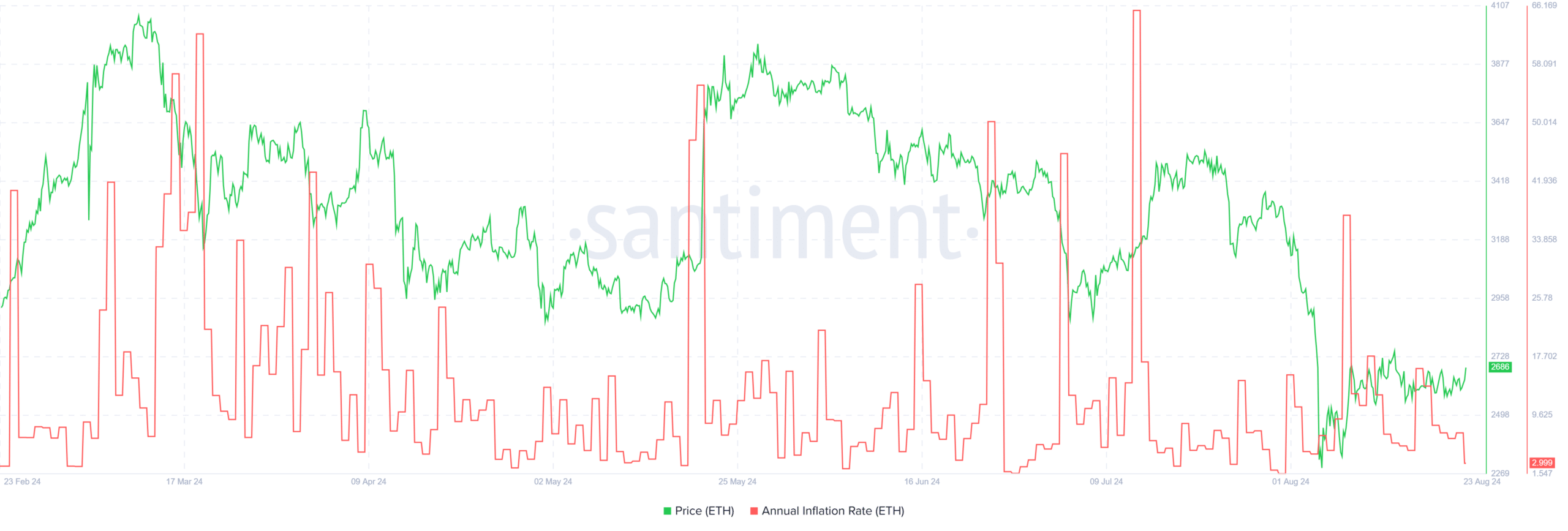

The lowering income and slowing burn price on Ethereum have stifled ETH worth development. Ether is down by 22% within the final 30 days, a big hole from Bitcoin’s 7.5% dip.

ETH was buying and selling at $2,668 on the time of writing after a 1.3% acquire in 24 hours. A have a look at the Chaikin Cash Movement reveals shopping for stress, however the pattern is weakening.

Whereas the index was constructive, the CMF line was tipping south at press time, displaying that sellers could be coming into the market.

Merchants ought to be careful for the important thing assist stage at $2,572. If ETH fails to carry this assist, a attainable liquidity sweep under $2,200 is probably going.

Ether’s uptrend additionally faces a key barrier at $2,689. The worth has failed to interrupt this stage because the nineteenth of August.

Is your portfolio inexperienced? Try the ETH Profit Calculator

Whereas the implications of rising provide could be hampering ETH worth motion, the annual inflation price, which is approaching month-to-month lows, pointed to a constructive image.

A drop on this metric tends to extend investor confidence and, consequently, worth.