- Ethereum’s dominance dipped under 14%

- Quick-term internet inflows urged promoting strain, whereas long-term outflows indicated potential accumulation

Ethereum’s (ETH) dominance inside the crypto market fell from 18.85% a 12 months in the past to 13.36%. This represented a substantial drop in ETH’s share of the whole crypto market, as noted by analyst Benjamin Cowen. The truth is, the aforementioned drop could be seen as an indication of persistent promoting strain. Particularly as ETH struggles to carry greater dominance ranges.

Traditionally, Ethereum has confronted resistance on the 16% and 22% dominance ranges, failing to interrupt via these boundaries a number of instances since 2018. Its ongoing decline is a part of a descending triangle sample – Typically an indication of a bearish pattern.

Within the connected chart, the higher trendline highlighted decrease highs, whereas the decrease trendline acted as a long-term assist degree.

Free-fall to 9-10% ETH dominance?

In keeping with Cowen, if the downward momentum continues, the subsequent main assist degree may very well be between the 9% and 10% dominance ranges. This might characterize a deeper decline, pushed by falling shopping for curiosity.

The historic assist round 9% may grow to be an important level for ETH, particularly if broader market developments don’t favor the altcoin sector within the coming months.

If this assist degree holds, ETH’s dominance would possibly stabilize, setting the stage for a possible rebound in 2025. Nevertheless, if ETH breaks under the 9% mark, it may sign a extra prolonged interval of underperformance, relative to different altcoins and the general crypto market.

Ethereum’s current worth motion and market exercise

Ethereum was buying and selling at $2,542.29 at press time, with a 0.59% hike within the final 24 hours and a -3.11% decline over the previous week. Its 24-hour buying and selling quantity stood at roughly $17.6 billion – An indication of lively buying and selling. With a circulating provide of 120 million ETH, the market cap appeared to be round $306.29 billion.

In keeping with DefiLlama data, the Whole Worth Locked (TVL) on Ethereum’s community was $47.91 billion at press time, with every day charges amounting to $3.55 million and income at $2.55 million. Over the previous 24 hours, inflows to the community had been about $38.78 million, and the variety of lively addresses was 372,911.

These metrics, collectively, highlighted Ethereum’s sustained use, regardless of its declining dominance.

Netflow knowledge underlines short-term promoting strain

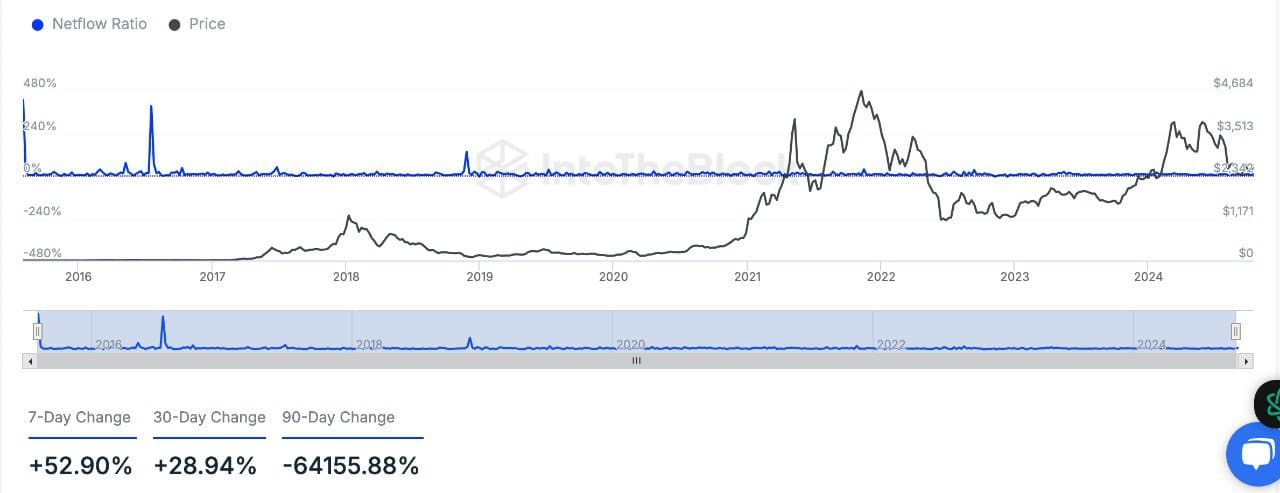

Lastly, knowledge from IntoTheBlock highlighted a +52.90% hike over the previous 7 days and a +28.94% uptick over the past 30 days, indicating an increase in inflows to exchanges. Such a pattern is commonly seen as merchants transfer belongings to platforms in preparation for promoting or profit-taking.

Over a 90-day interval, nonetheless, there was a large -64,155.88% shift in direction of internet outflows – Pointing to a longer-term pattern of traders withdrawing ETH from exchanges.

The hike in short-term inflows aligns with the market’s wider bearish sentiment. Particularly as extra Ethereum is moved to exchanges, sometimes signalling an intent to promote.

Quite the opposite, internet outflows over an extended interval point out attainable accumulation, as customers transfer ETH off exchanges for storage or staking.

Taken collectively, analysts imagine that whereas ETH may see additional declines within the brief time period, a possible bounce could be anticipated in 2025.