Bitcoin has shattered earlier information, hovering previous the $100,000 milestone for the primary time ever to achieve an all-time excessive of $104,088 late Wednesday in New York. The flagship cryptocurrency had dipped to $94,587 on Wednesday however staged a outstanding comeback. A number of key components contributed to this unprecedented surge:

#1 Fed Chair Powell Compares Bitcoin To Gold

In a big acknowledgment from the normal monetary sector, Federal Reserve Chair Jerome Powell mentioned Bitcoin through the New York Instances DealBook Summit. When questioned in regards to the notion of Bitcoin as an emblem of religion or lack thereof within the US greenback and the Federal Reserve, Powell supplied a nuanced perspective.

“I don’t assume that’s how individuals give it some thought,” Powell remarked. “Individuals use Bitcoin as a speculative asset, proper? It’s like gold. It’s identical to gold, solely it’s digital. It’s digital. Individuals are not utilizing it as a type of cost or as a retailer of worth. It’s extremely risky. It’s not a competitor for the greenback; it’s actually a competitor for gold.”

This comparability to gold, a conventional retailer of worth, was in all probability seen by many as one other robust legitimization of Bitcoin within the monetary ecosystem.

In case your central financial institution owns gold, however rejects digital gold… they’re accomplished. How did betting towards digitalization work for kodak, blockbuster, sears, phone book, information papers, taxis, postal service, libraries, journey brokers, and so on?

It’s the obvious commerce in historical past https://t.co/tdJp8XCTjO

— David Bailey🇵🇷 $0.85mm/btc is the ground (@DavidFBailey) December 4, 2024

#2 Russia’s Putin Indicators Openness To Bitcoin

Including to the momentum, Russian President Vladimir Putin made feedback through the Russia Calling discussion board that many interpret as an endorsement of Bitcoin.

“Who can ban Bitcoin? No person,” Putin acknowledged. “And who can prohibit using different digital technique of cost? No person. As a result of these are new applied sciences. And it doesn’t matter what occurs to the greenback, these instruments will develop a technique or one other as a result of everybody will attempt to cut back prices and enhance reliability.”

Associated Studying

The backdrop to Putin’s feedback consists of hypothesis a couple of forthcoming “Bitcoin House Race” between world superpowers. President-elect Donald Trump, throughout his election marketing campaign and on the Bitcoin 2024 convention in Nashville, pledged to ascertain a Strategic Bitcoin Reserve in america. He even advised that a part of the US debt could be “paid off” with Bitcoin.

David Bailey, CEO of BTC Inc and advisor to Trump’s staff, emphasised the urgency of this initiative on X: “The Bitcoin House Race is right here. […] It couldn’t be extra clear what’s occurring. It have to be a nationwide precedence to face up the Strategic Bitcoin Reserve within the first 100 days of the Trump admin. We want an aggressive plan to develop USA’s proportional possession of the Bitcoin provide.”

It couldn’t be extra clear what’s occurring.

It have to be a nationwide precedence to face up the Strategic Bitcoin Reserve within the first 100 days of the Trump admin. We want an aggressive plan to develop USA’s proportional possession of the Bitcoin provide. https://t.co/a85wLNoXSS

— David Bailey🇵🇷 $0.85mm/btc is the ground (@DavidFBailey) December 4, 2024

#3 Robust Spot Demand And Institutional Curiosity

The surge was underpinned by strong spot market exercise and vital institutional participation. In the course of the ascent, open curiosity in Bitcoin futures skyrocketed by greater than $4 billion, in keeping with data by Coinalyze. Funding charges additionally reached unprecedented ranges, surpassing peaks seen two weeks in the past when Bitcoin first hit $99,500.

Importantly, the rally was pushed by spot markets and never solely by-product hypothesis, indicating a wholesome and sustained demand. The notorious “Nice Promote Wall” at $100,000, which had beforehand resisted upward motion, was decisively breached on the second try.

Associated Studying

Market analysts are speculating that main gamers like Michael Saylor might have been behind the substantial shopping for stress. Notably, MARA Holdings, Inc., the most important publicly traded Bitcoin mining firm by market capitalization, not too long ago raised $850 million by means of an providing of zero-coupon convertible senior notes due 2031. Whereas unconfirmed, there’s a robust risk that MARA utilized these funds to build up Bitcoin through the worth run-up.

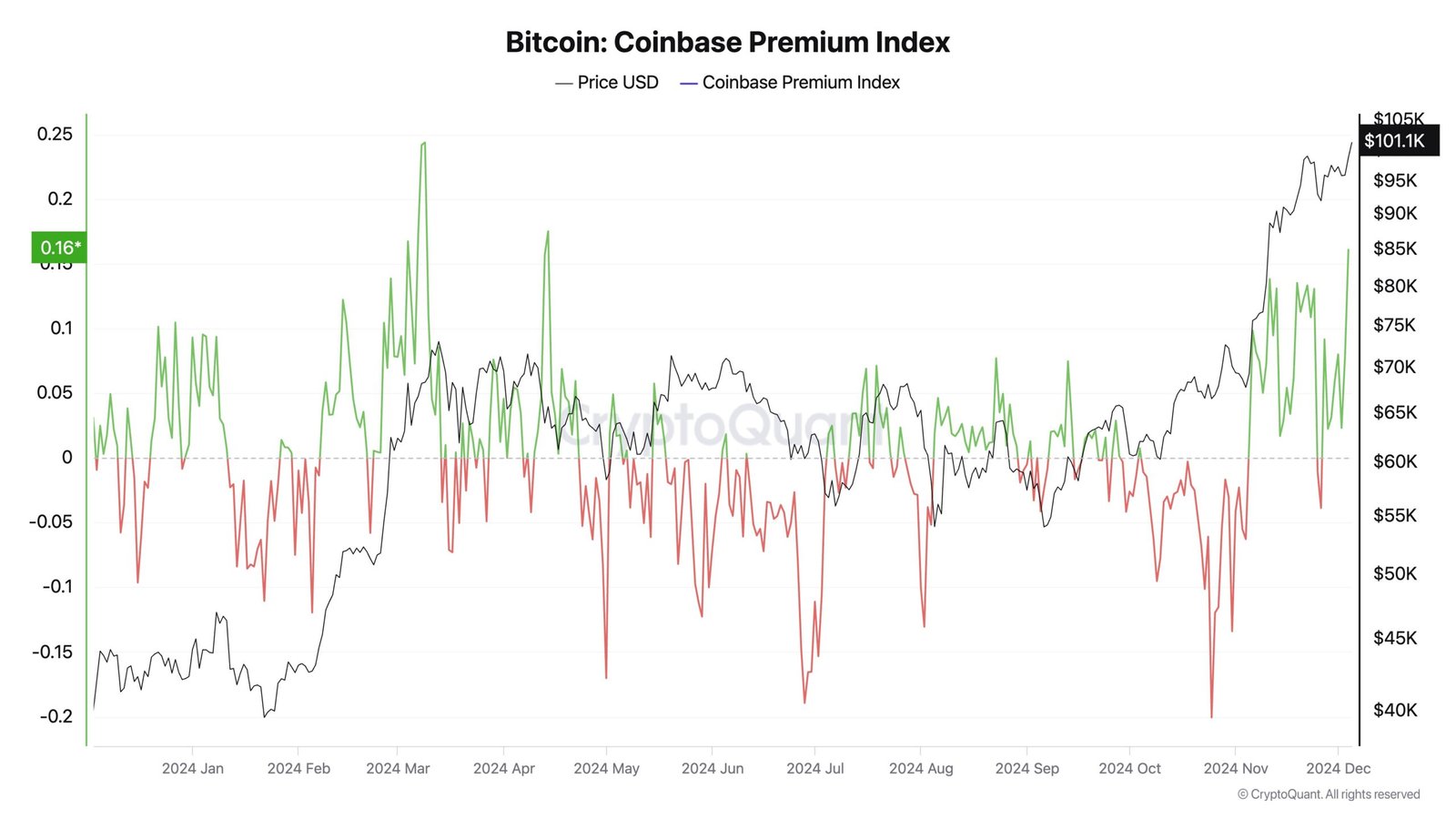

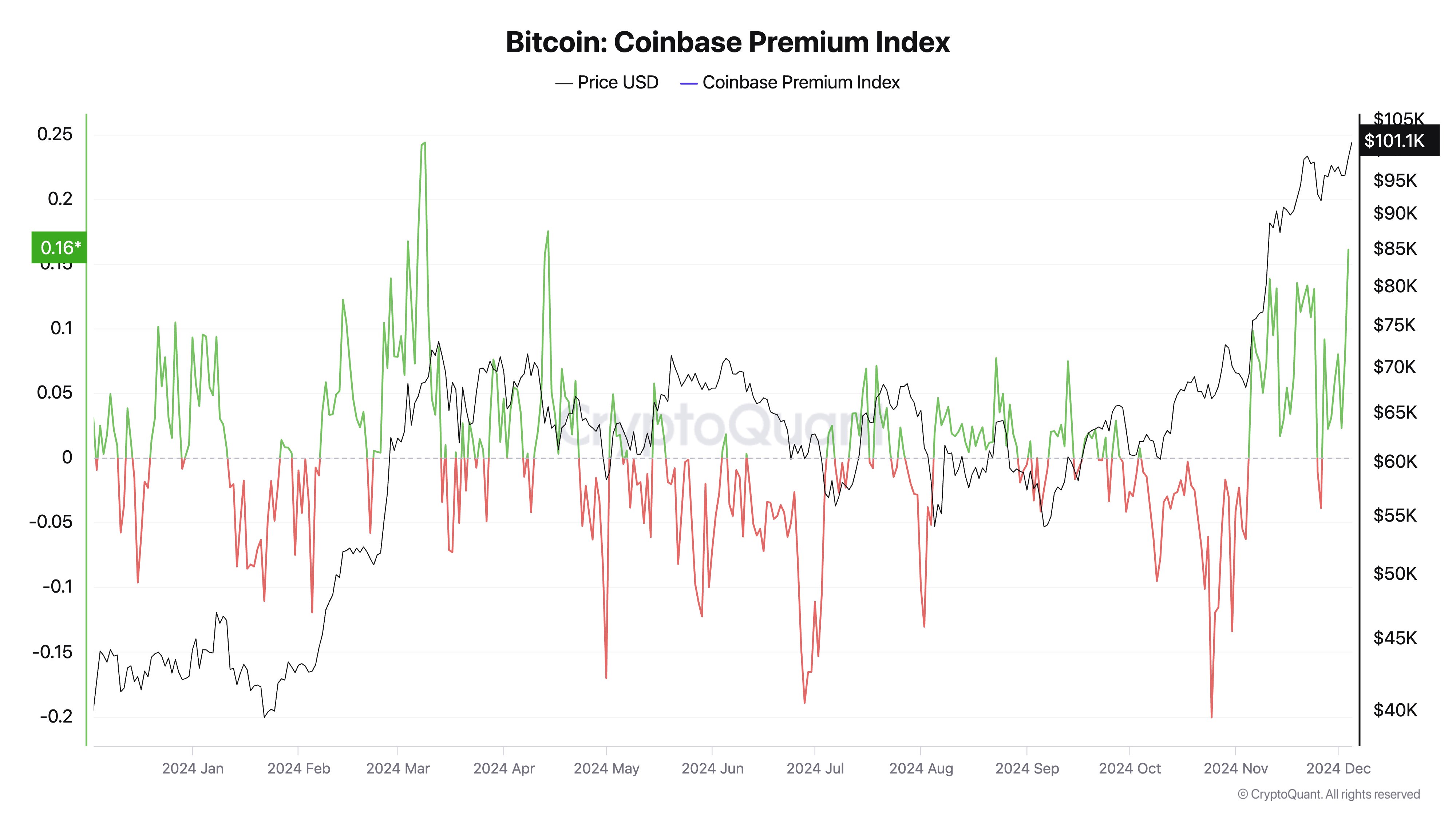

Supporting this notion, CryptoQuant reported: “Bitcoin passes $100k as institutional demand drives the market. The Coinbase Premium Index highlights sustained shopping for stress from US traders.”

#4 Retail Market In Disbelief

Regardless of the bullish momentum, retail merchants look like in a state of disbelief. On-chain analytics agency Santiment noticed that whereas whale accumulation continues to strengthen, retail sentiment stays cautious.

Santiment famous: “With whale accumulation persevering with to look robust, the one issue holding again $100K BTC historical past being made is retail merchants’ pleasure.” The agency highlighted that the beginning of December noticed growing skepticism and expectations of a big worth retracement following November’s historic beneficial properties. Nevertheless, the present social media panorama displays “hesitance and uncertainty from merchants,” with a ratio of destructive to optimistic commentary.

“With quite a few indications through the years that crypto markets transfer the other way of the gang’s expectations, we must always really feel inspired by our fellow merchants’ FUD and excessive profit-taking,” Santiment added. “There could also be a bit extra of a battle between bulls and bears at this stage, however we might see the long-awaited milestone come to fruition very shortly so long as key stakeholders proceed their assortment of an increasing number of BTC.”

At press time, BTC traded at $102,681.

Featured picture created with DALL.E, chart from TradingView.com