- Ethereum’s funding charge indicators a possible rebound for ETH.

- ETH has declined by 16.48% over the previous 7 days.

Since hitting $4109, Ethereum [ETH] has skilled robust downward stress. As such, over the previous week, the altcoin has declined to a low of $3095 dropping by 16.48%.

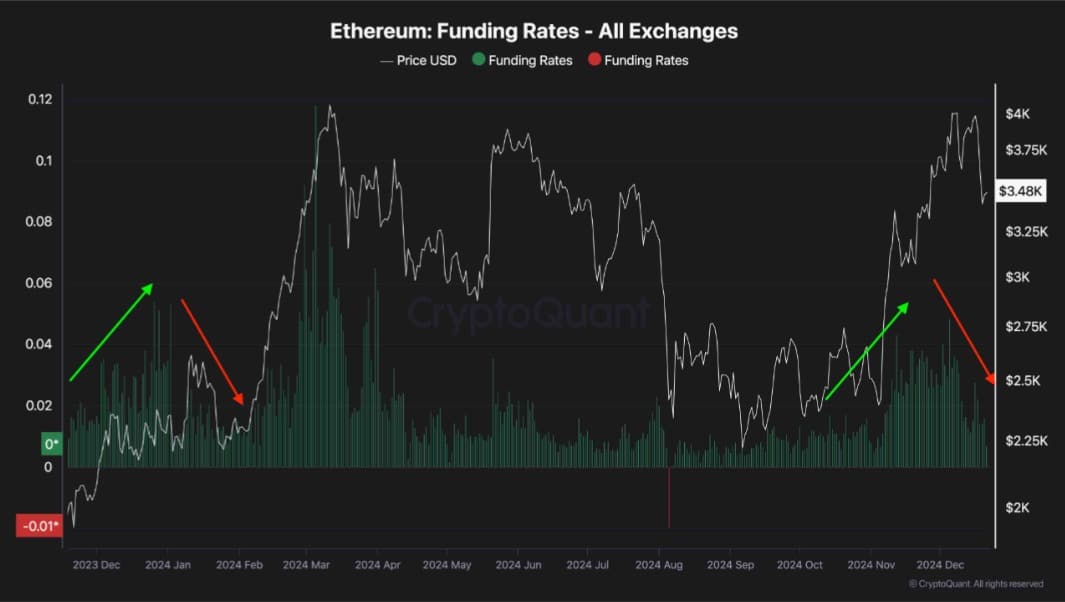

Regardless of the current dip, Ethereum appears positioned for a comeback to $3,300. It’s because Ethereum’s funding charge has cooled since going through two rejections at $4k.

Ethereum’s Futures market cools after $4k rejection

In keeping with Cryptoquant, Ethereum’s failure to reclaim the $4k resistance resulted in huge liquidations within the futures markets.

This resulted in an enormous market crash with ETH hitting lows. Whereas ETH’s funding charge surged final week, the altcoin’s failure to carry above $4k introduced the funding charge again to wholesome ranges. These ranges are properly appropriate for a bullish pattern.

Subsequently, the cooling impact from this might probably pave the way in which for a extra sustainable rally within the coming weeks.

Traditionally, such a sample occurred in January 2024 when the drop in funding charges cooled the futures market strengthening ETH for a significant uptrend.

Throughout this rally, Ethereum rallied from $2169 to $4091. This historic precedent signifies that the present market reset may mark the start of one other bullish part.

What ETH charts recommend

Whereas Ethereum has skilled robust downward stress over the previous week, the prevailing market situations level in the direction of restoration.

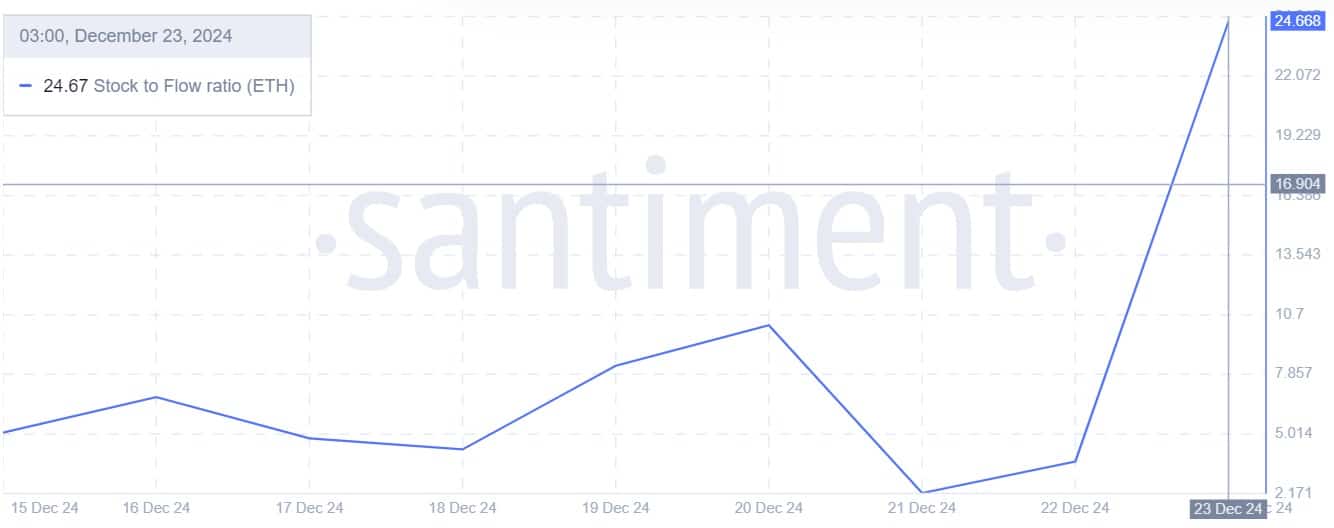

For starters, Ethereum’s stock-to-flow ratio has surged over the previous week from 2.19 to 24.67. When SFR rises it implies that ETH has turn out to be extra scarce amidst elevated accumulation by massive holders.

As such, the altcoin has turn out to be extra scarce. Coupled with rising demand, this pushes costs up by provide squeeze.

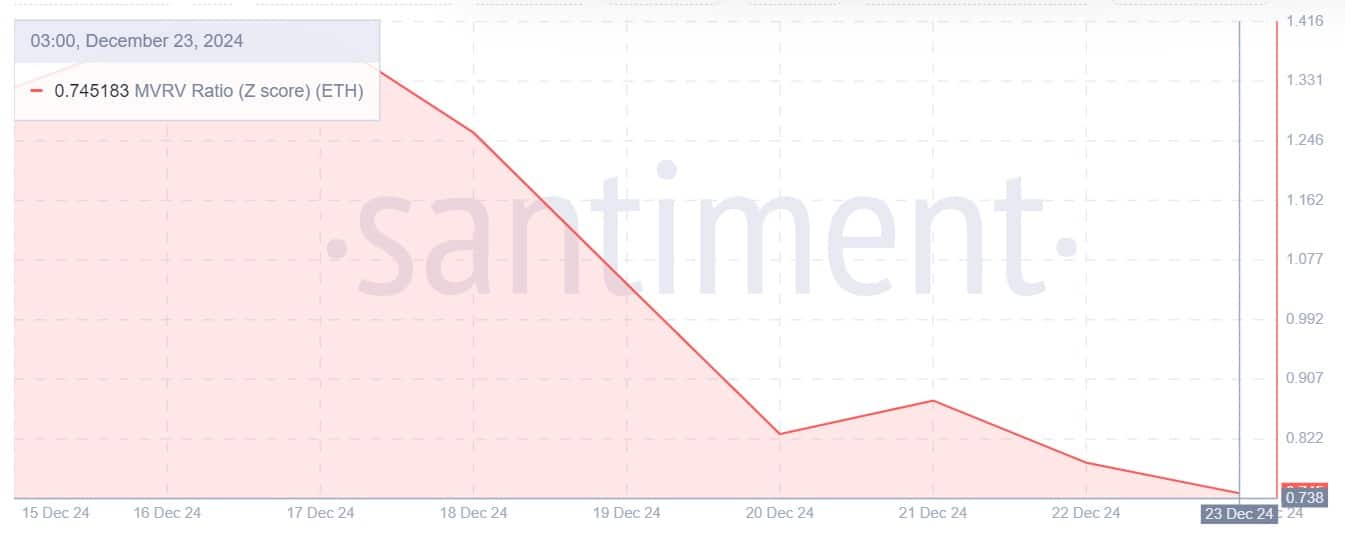

Moreover, the Ethereum MVRV Z rating ratio has declined over the previous week to 0.745. When the MVRV rating hits such low ranges, it indicators ETH is at the moment undervalued offering a great sign for accumulation amongst long-term holders.

This pattern has been witnessed over the previous week with whales turning to purchase the dip. Elevated accumulation often creates the next shopping for stress which causes upward stress on costs by excessive demand.

Lastly, Ethereum’s Bitmex foundation ratio has surged over the previous few days from -0.22 to 0.07. When this ratio turns constructive, it displays optimism within the futures market as merchants anticipate costs to rise after the dip.

Is a comeback doubtless?

As noticed above futures market is bullish and expects ETH costs to get better. Equally, the spot demand for Ethereum is consistently rising creating wholesome situations for value features.

Learn Ethereum’s [ETH] Price Prediction 2024-25

With the market optimistic, ETH may get better from the $3300 dip and reclaim greater resistance. If these situations maintain, ETH will reclaim the $3700 resistance.

A transfer from right here may strengthen Ethereum to maneuver in the direction of $3900. Nonetheless, with bears nonetheless robust, if bulls fail to retake the market, ETH will drop to $3160.