Norges Financial institution Funding Administration (NBIM), Norway’s sovereign wealth fund large, has been discreetly growing its Bitcoin publicity—with a singular twist.

They’ve strategically elevated their oblique holdings by 153% by putting a shrewd wager on MicroStrategy, quite than speeding headfirst into the unstable crypto market.

By the conclusion of 2024, NBIM had acquired roughly $500 million in MicroStrategy, which amounted to greater than 1.1 million shares.

Norway is ready to pursue the potential benefits of Bitcoin with out the discomfort of direct crypto possession, due to this intelligent technique.

Betting On Bitcoin—With out Buying A Single Coin

An important level is Norway’s fund doesn’t actively take part in Bitcoin. As a substitute, they’re utilizing MicroStrategy’s vital BTC holdings—akin to investing in a gold rush shovel producer as a substitute of digging for gold alone.

🇳🇴 Norway’s Daring Crypto Transfer!

💰 $500M Funding: Norway’s sovereign fund acquires 1.123M shares in MicroStrategy

📈 Bitcoin Publicity: Holdings surge 153% in 2024, now at 3,821 BTC

🌍 World Positioning: Now among the many largest institutional Bitcoin holders

🔄 Strategic Shift:… pic.twitter.com/GRKJ3KVadL

— MoneyDubai (@MoneyDubai_ae) January 30, 2025

Maintaining MicroStrategy shares helps NBIM keep away from the issues associated to cryptocurrencies: no regulatory grey areas, custody points, or stressed nights introduced on by market swings.

And it’s paying off; their oblique crypto publicity rose from about 1,506 BTC to three,821 BTC at 12 months’s finish. Not unhealthy for a fund formally freed from cryptocurrencies.

Norway’s oblique publicity to Bitcoin has nearly tripled over the previous 12 months, because of elevated allocations to crypto-related corporations, based on K33 Analysis.

The Norwegian sovereign wealth fund (NBIM) not directly holds 3,821 BTC, reflecting a rise of 1,375 BTC since June 30, 2024, and a yearly progress of two,314 BTC—a 153% improve in comparison with its end-of-year 2023 holdings.

It is very important spotlight that this publicity doubtless… pic.twitter.com/seQ12cM2Rn— Vetle Lunde (@VetleLunde) January 29, 2025

What’s The Rationale Behind MicroStrategy?

Subsequently, why do they align themselves with this group? MicroStrategy has emerged because the embodiment of the company Bitcoin craze. Their inventory has grow to be a Bitcoin barometer because of their aggressive buying spree; as BTC will increase, so does their share worth.

BTCUSD buying and selling at $104,103 on the each day chart: TradingView.com

This means that Norway’s fund can capitalize on Bitcoin’s potential with out experiencing the cryptocurrency market’s volatility. It’s a win-win scenario: keep the soundness of typical investments whereas gaining a glimpse of the untamed facet of crypto by way of a good middleman.

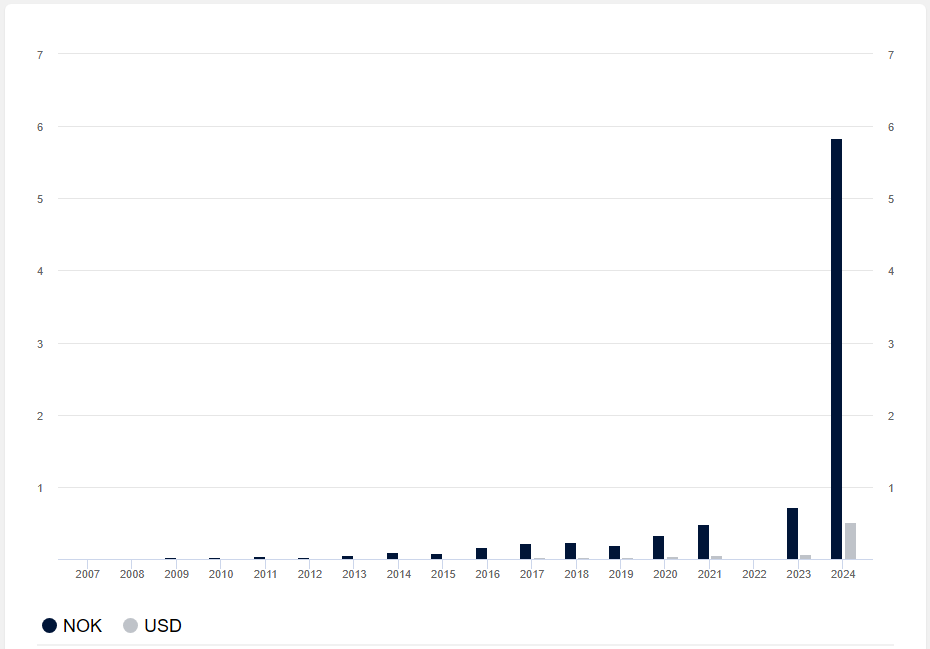

NBIM's MicroStrategy funding worth. Chart: NBIM

Massive Cash’s Crypto Playbook

This isn’t solely a Norwegian anomaly; it’s a element of a extra intensive pattern. Institutional traders are regularly turning into extra favorable towards cryptocurrency; nonetheless, they continue to be cautious relating to their very own possession of digital currencies. Relatively, they’re using their creativeness. They’re coming into the crypto waters with out completely immersing themselves by supporting firms resembling MicroStrategy.

Eggs In Different Baskets

Aside from MicroStrategy, Norges Financial institution Funding Administration additionally owns inventory in a number of firms that take care of Bitcoin. These embody Tokyo-based Metaplanet, cryptocurrency alternate Coinbase, Bitcoin mining firms Marathon Digital and Riot Platforms, and Tesla.

Featured picture from Gemini Imagen, chart from TradingView