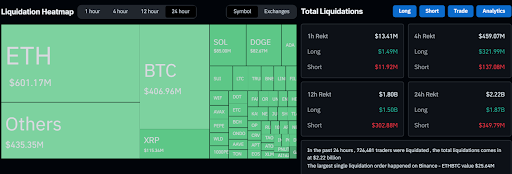

Your complete cryptocurrency market has skilled a steep decline over the previous 24 hours, with its whole market cap plunging by double digits following a barrage of unstable worth swings. Unsurprisingly, this sharp downturn has led to widespread liquidations amongst a number of property throughout the previous buying and selling day. Notably, this wave of liquidations has led to over $2.22222 billion being wiped from cryptocurrencies up to now 24 hours. In keeping with Coinglass information, Dogecoin merchants have witnessed significant losses, with numbers inserting the meme coin among the many hardest-hit property on this liquidation occasion.

Dogecoin Merchants Lose Over $82 Million In 24 Hours

Data from Coinglass reveals that Dogecoin liquidations have been among the many most extreme available in the market over the previous 24 hours, as leveraged positions crumbled underneath the burden of fast worth swings. A more in-depth have a look at the info exhibits that the overwhelming majority of those liquidations stemmed from lengthy positions, with bullish merchants struggling losses amounting to $69.32 million. These merchants, principally anticipating a rally this week or a minimum of a secure market, had been caught off guard as Dogecoin’s worth took a sharp turn downward alongside the remainder of the market, forcing liquidations and cascading losses.

Associated Studying

Curiously, regardless of the broader pattern leaning towards a worth decline, brief sellers weren’t spared from the liquidation frenzy. Information exhibits that $13.35 million price of brief positions had been liquidated, suggesting that transient worth spikes occurred in the course of the normal downtrend. These momentary surges might have triggered cease losses for some brief merchants, resulting in compelled liquidations whilst the general trajectory remained bearish.

Market-Large Liquidations Prime $2.22 Billion Amid Excessive Volatility

The cryptocurrency market has kicked off the brand new week on a bearish word following a interval of consolidation all through the earlier week. Bitcoin, which had maintained relative stability, noticed a sharp decline because the weekend got here to an in depth, breaking beneath the $100,000 mark on Sunday and continued to increase the draw back transfer from there.

Associated Studying

Bitcoin’s decline triggered a broader market sell-off, with a number of main cryptocurrencies following swimsuit. On the time of writing, the worldwide crypto market cap has dropped by roughly 11% over the previous 24 hours and is now at $3 trillion, its lowest degree since November 15, 2024. As such, the broader cryptocurrency market has skilled a brutal shakeout up to now 24 hours, with liquidations surpassing $2.22 billion.

Bitcoin and Ethereum merchants have taken the most important hits on this liquidation spree. Bitcoin alone has recorded over $406.96 million in liquidated positions, with the bulk being lengthy trades of $341.36 million up to now 24 hours. Nevertheless, Ethereum merchants have experienced the heaviest liquidations, with $601 million in positions worn out.

With Dogecoin experiencing $82.67 million in liquidations, the aftermath of this sell-off may set the stage for elevated volatility alongside different cryptocurrencies in the short term. On the time of writing, Dogecoin is buying and selling at $0.235, down by 22.5% up to now 24 hours.

Featured picture from Adobe Inventory, chart from Tradingview.com