- Bitcoin’s worth rebounds above $97,000, rising 2.3% after dropping to $94,000.

- A shift within the MVRV ratio and dormant coin motion could point out long-term holders are influencing market traits.

Bitcoin [BTC] has skilled a noteworthy shift in momentum after a gentle decline final week introduced its worth as little as $94,000.

Within the early hours of the tenth of February, BTC started to recuperate, with its worth climbing above $97,000—a 2.3% enhance over the day past.

Whereas this upward motion is a constructive improvement, a deeper evaluation of the community’s underlying metrics sheds mild on the potential future route for the main cryptocurrency.

A latest evaluation from CryptoQuant highlighted a major motion on the Bitcoin community. On the tenth of February, roughly 14,000 Bitcoins, dormant for seven to 10 years, have been immediately moved.

Importantly, these cash weren’t despatched to exchanges, suggesting they weren’t meant for fast liquidation.

The CryptoQuant analyst reporting this significantly wrote:

“It’s vital to notice that the typical acquisition worth of those cash is sort of low, which may affect the holders’ future choices concerning potential gross sales.”

Bitcoin present MVRV ratio and its implications

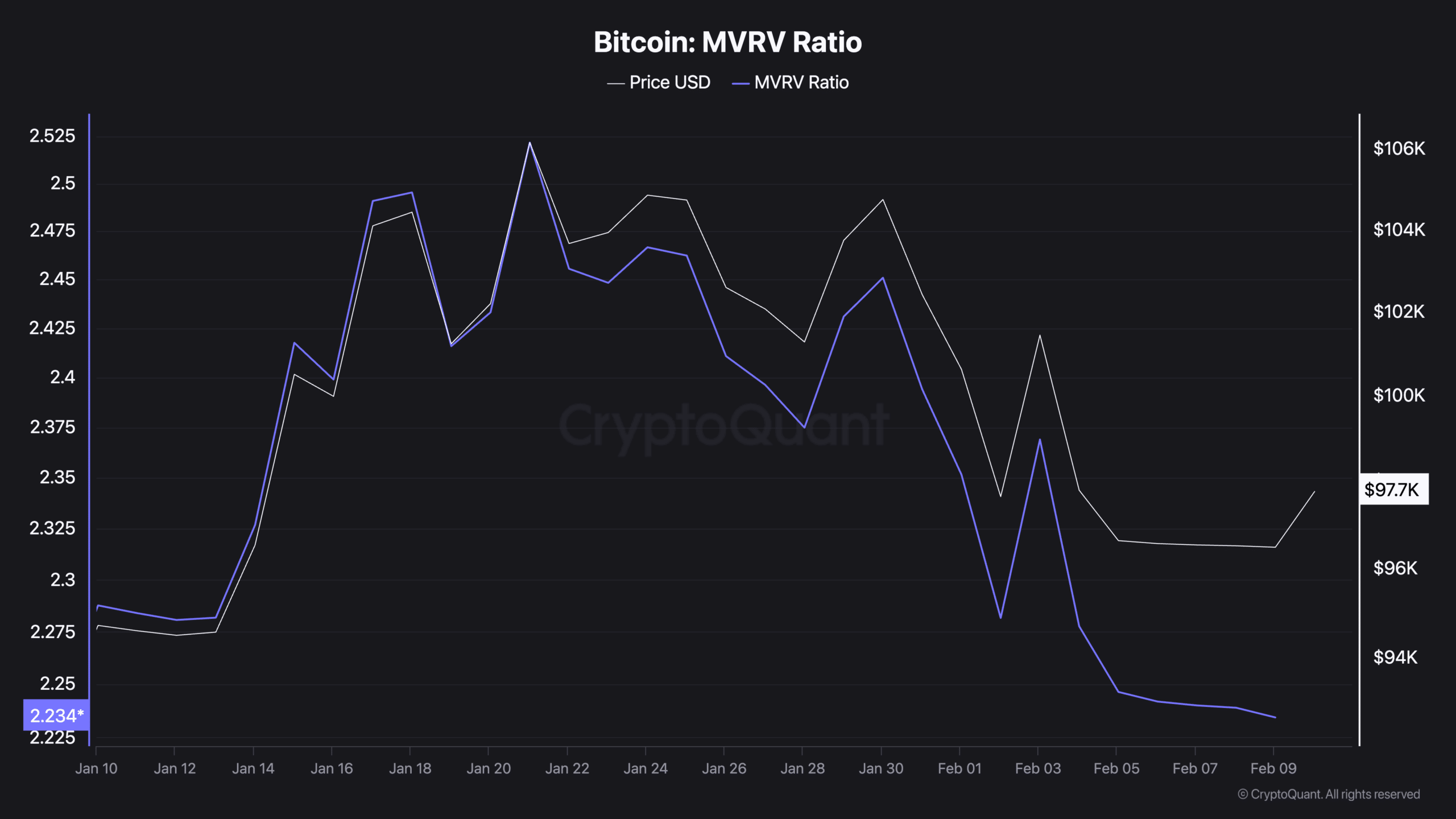

Extra importantly, the MVRV ratio additionally supplied useful insights into Bitcoin’s market well being.

The MVRV (Market Worth to Realized Worth) ratio measures the market capitalization of Bitcoin in opposition to its realized worth—the whole worth of all cash on the worth they final moved on the blockchain.

This ratio can function an indicator of whether or not the asset is overvalued or undervalued at present worth ranges.

Current data from CryptoQuant additionally revealed a downward pattern in Bitcoin’s MVRV ratio, aligning with its latest worth declines.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

On the twenty first of January, the MVRV ratio stood at 2.52. Nevertheless, following the drop in BTC’s market worth, it had fallen to 2.23 as of the ninth of February.

Traditionally, when the MVRV ratio dips, it has signaled potential entry factors for long-term buyers. Nevertheless, if the ratio continues to say no, it could point out lingering market weak point or warning amongst buyers.