- Satoshi searches spike throughout Bitcoin’s bull runs, correlating with retail market euphoria.

- A drop in curiosity relating to Satoshi could sign a peaceful earlier than Bitcoin’s subsequent large transfer.

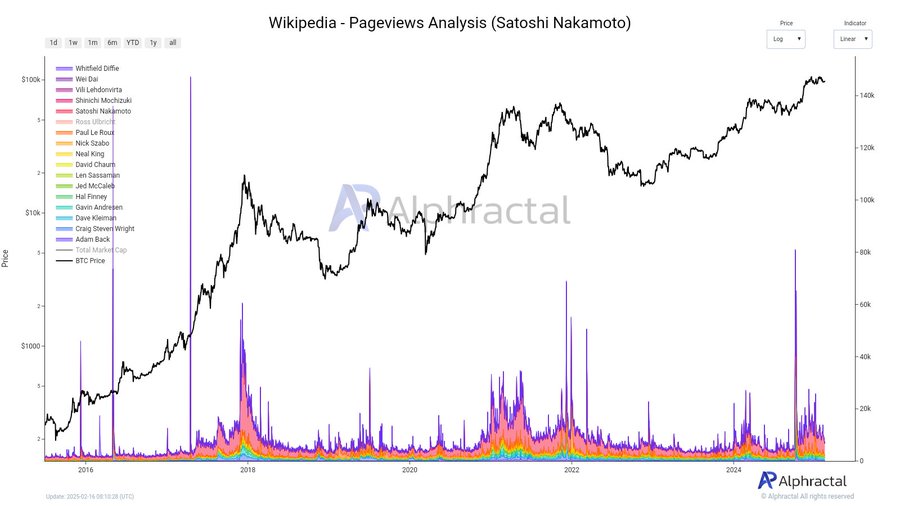

Public curiosity in Bitcoin’s [BTC] mysterious creator, Satoshi Nakamoto, tends to spike in sync with Bitcoin’s bull runs, reflecting the thrill of retail traders, media buzz, and market euphoria.

As Bitcoin consolidates beneath key resistance ranges, interest in Satoshi has begun to fade. Traditionally, public curiosity round Satoshi has mirrored BTC’s value actions.

This usually offers a refined sign for the market’s subsequent course.

Satoshi searches surge throughout Bitcoin bull runs

Public interest in Satoshi Nakamoto and different key figures like Hal Finney, Nick Szabo, and Gavin Andresen has traditionally surged throughout BTC bull runs.

Information spikes in Wikipedia searches for these figures align with BTC’s main rallies in 2017 and 2021. Throughout these intervals, market euphoria drew retail traders deeper into Bitcoin’s origins, fueling hypothesis and curiosity.

Every surge in Bitcoin’s value mirrored heightened public curiosity in its creator, reinforcing the hyperlink between market sentiment and Satoshi-related searches.

Fading curiosity amid Bitcoin’s consolidation

In current months, curiosity in Satoshi Nakamoto surged due to HBO’s Cash Electrical: The Bitcoin Thriller, hypothesis surrounding Ross Ulbricht’s launch, and rising discussions about Len Sassaman.

Nonetheless, as BTC struggles beneath key resistance ranges, this wave of curiosity has largely dissipated. We are able to see this mirrored in reducing Wikipedia pageviews and Google searches.

This signaled that retail curiosity could also be cooling throughout Bitcoin’s value consolidation.

Retail vs. institutional curiosity

Retail traders usually chase narratives, with hypothesis round Satoshi appearing as a hype indicator throughout value surges. Institutional gamers give attention to liquidity, macroeconomic tendencies, and regulatory readability.

Retail-driven searches spike in bull markets, whereas institutional curiosity stays regular, prioritizing BTC’s fundamentals.

This divergence means that whereas retail pleasure could wane, institutional involvement continues to develop. Such an involvement may doubtlessly stabilize the market throughout low-sentiment phases.

What fading Satoshi curiosity means for BTC

Does this fading curiosity in Satoshi signify market complacency, or may or not it’s the calm earlier than BTC’s subsequent main transfer? Traditionally, intervals of low retail enthusiasm are sometimes adopted by vital value shifts — both a breakout or a downturn.

As retail hypothesis wanes, institutional involvement continues to develop, serving to to stabilize the market throughout quieter intervals.

Whereas it’s unsure which course BTC will take, the present lull in Satoshi-related searches might be a sign for one thing large on the horizon.