- Crypto mining shares have misplaced $12 billion, regardless of Bitcoin’s stability

- Decoupling between mining shares and Bitcoin may foreshadow volatility and deeper market stress

Crypto mining shares have taken a pointy hit, shedding over $12 billion in market worth and returning to early 2024 ranges. What’s significantly notable isn’t simply the dimensions of the drop, however the timing – Occurring regardless of Bitcoin’s [BTC] relative worth stability. This decoupling between mining shares and BTC is elevating issues. Particularly because it typically precedes durations of market turbulence.

May this be an indication of tough waters forward for the crypto sector?

The $12 billion retreat

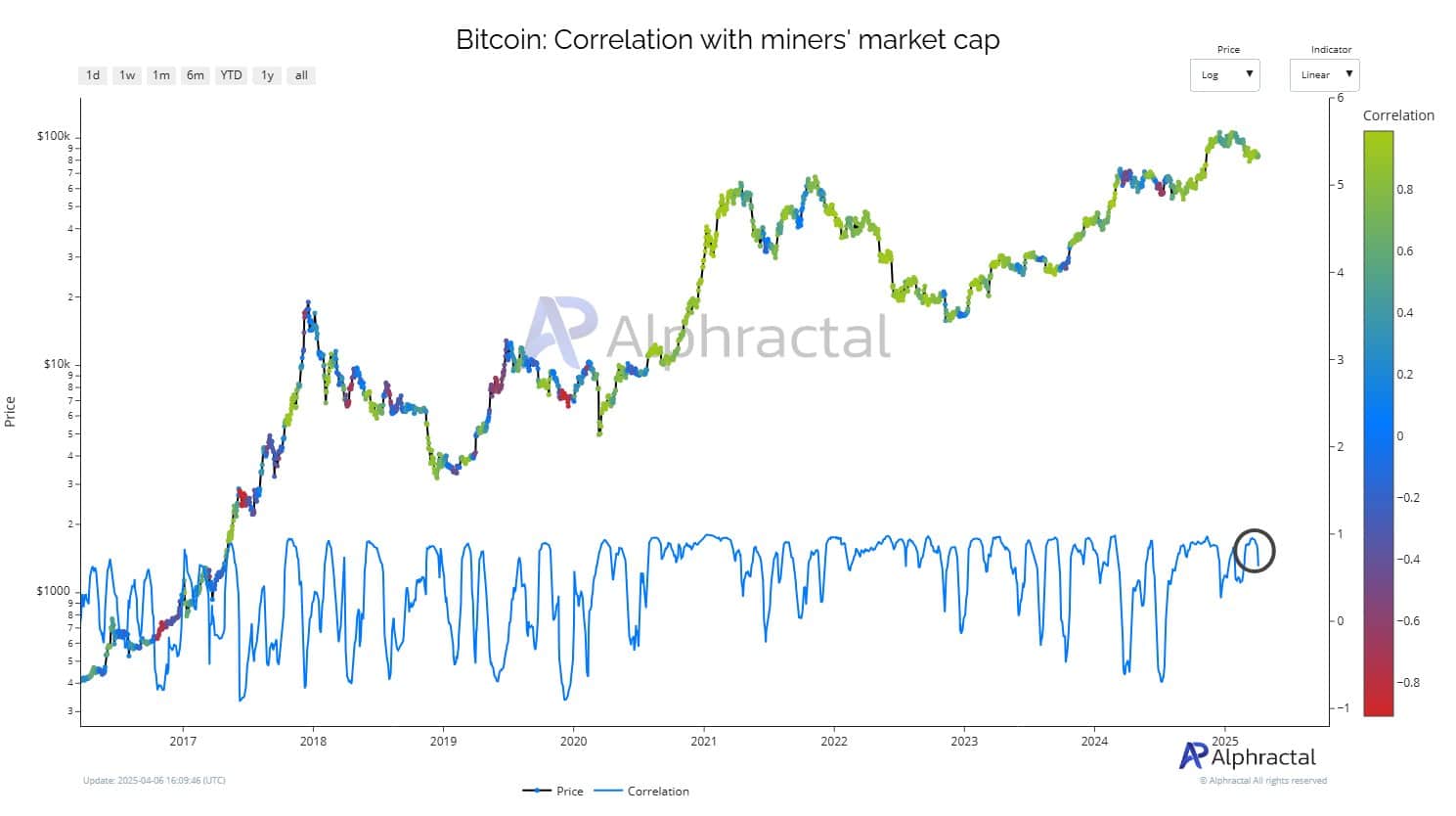

Supply: Alphractal

Bitcoin mining stocks have misplaced over $12 billion in market worth since February, falling from above $36 billion to beneath $24 billion – Erasing all good points made in early 2024. Key miners have seen sharp double-digit declines.

What’s notable is that this plunge comes at the same time as Bitcoin’s worth stays comparatively steady.

Decoupling from BTC – A pink flag?

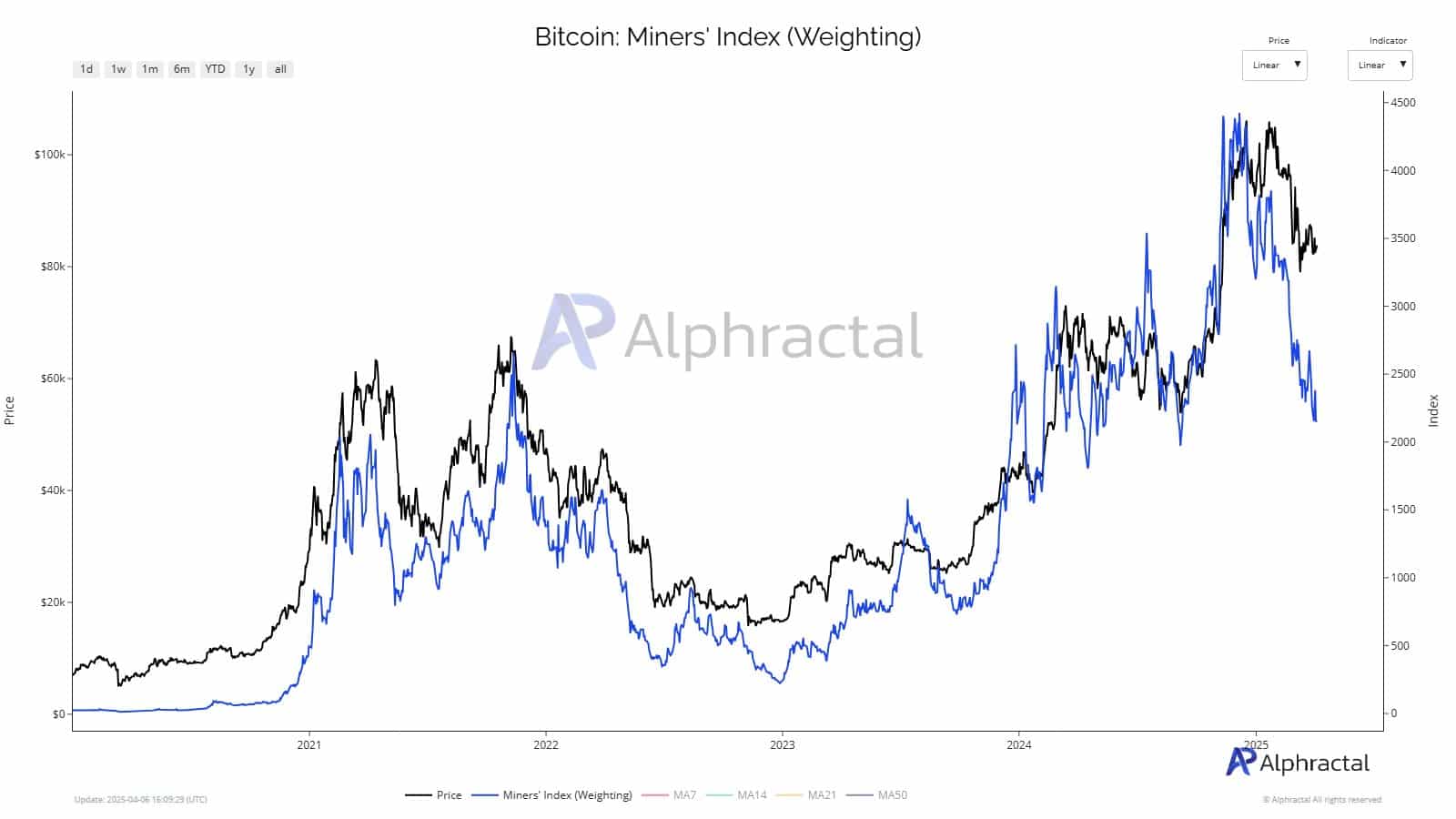

Miners are breaking away from Bitcoin – and never in a great way. Regardless of BTC holding above its $65k help, miner fairness valuations have tumbled, triggering a steep decline in correlation.

The truth is, knowledge underlined that the correlation between Bitcoin’s worth and miners’ market cap dipped sharply, nearing unfavorable territory for the primary time since mid-2022.

Supply: Alphractal

Traditionally, such decouplings have preceded volatility spikes or directional shifts in BTC.

Whether or not this alerts a market re-evaluation of miners, structural stress forward of the halving, or broader sentiment cracks – This time feels totally different.

Miners’ profitability and sentiment beneath strain

Put up-halving economics, rising vitality prices, and trade-related uncertainty – particularly round President Trump’s April tariff hints – are squeezing Bitcoin miners. The miners’ index highlighted a pointy decoupling from Bitcoin’s worth, reflecting deep stress throughout the sector.

On the identical time, investor urge for food seems to be shifting too.

Supply: Alphractal

Based on Galaxy Digital, as an example, Spot Bitcoin ETFs are gaining favor, providing publicity with out the operational and regulatory dangers tied to mining companies.

CEO Mike Novogratz has additionally emphasised ETF-driven inflows as a serious bullish power for BTC in 2025. With capital rotating out of miner shares, miners might face a sentiment winter at the same time as Bitcoin rallies.

What this implies for the broader market

The decoupling between Bitcoin miners’ shares and BTC’s worth could also be a warning sign. Related divergences in early 2022 preceded broader corrections, suggesting miners may once more be a number one indicator of market stress. Establishments are taking notice – Underperformance in mining equities level to deeper operational and regulatory challenges, prompting a attainable shift in the direction of direct BTC publicity or ETFs.

Tech shares provide a parallel – Current U.S. tariffs have triggered steep losses, with analysts warning of decade-long setbacks. As with tech, exterior shocks may reshape crypto dynamics, turning this divergence right into a sign and never a blip.

Source link