- Bitcoin traded into a serious help stage on the chart and will see a big rally from right here.

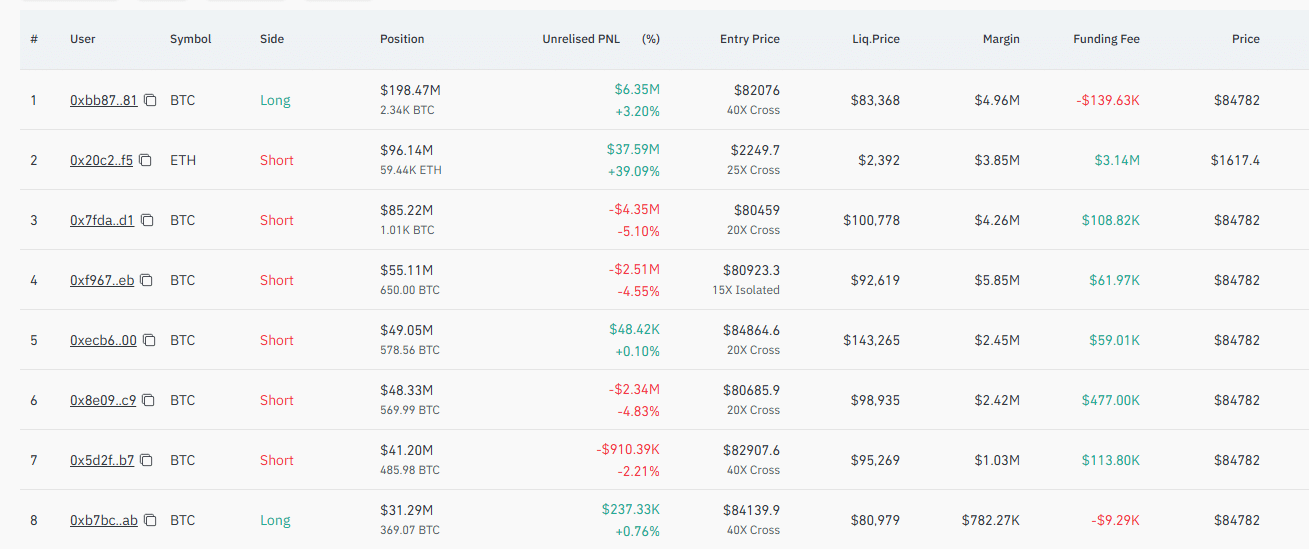

- A whale opened a $198.11 million lengthy place, however quick merchants available in the market are holding again and pushing towards the value.

Bitcoin’s [BTC] market motion has remained gradual regardless of buying and selling right into a key help stage, and regardless of the whale’s giant place, the asset had climbed just one.42% previously 24 hours.

Nonetheless, evaluation reveals that whereas the bulls’ presence is obvious, unfavourable market sentiment pushing towards a doable rally looms and will influence the value.

Bitcoin hits historic provide, eyes a bounce

Over the previous month, Bitcoin has entered a essential help zone on the chart, a stage that has traditionally triggered important rallies.

As indicated on the chart, this zone has constantly fueled main value surges. If Bitcoin efficiently holds this stage for the fifth time, it might spark a considerable upward motion, doubtlessly driving the asset’s value to $150,000 or past.

This bullish sentiment and the potential for a market rally have been intensified following a Hyperliquid whale opening a $198.11 million lengthy place, anticipating the asset to see a serious value run-up.

The gradual surge previously day has led to $5.99 million in unrealized revenue, with a funding price of $142,110.

The broader derivatives market helps this bullish narrative, suggesting the opportunity of a rally.

Shopping for quantity available in the market remained excessive, with a press time studying of 1.035, indicating extra patrons than sellers—which might push the asset increased.

How are merchants channeling liquidity?

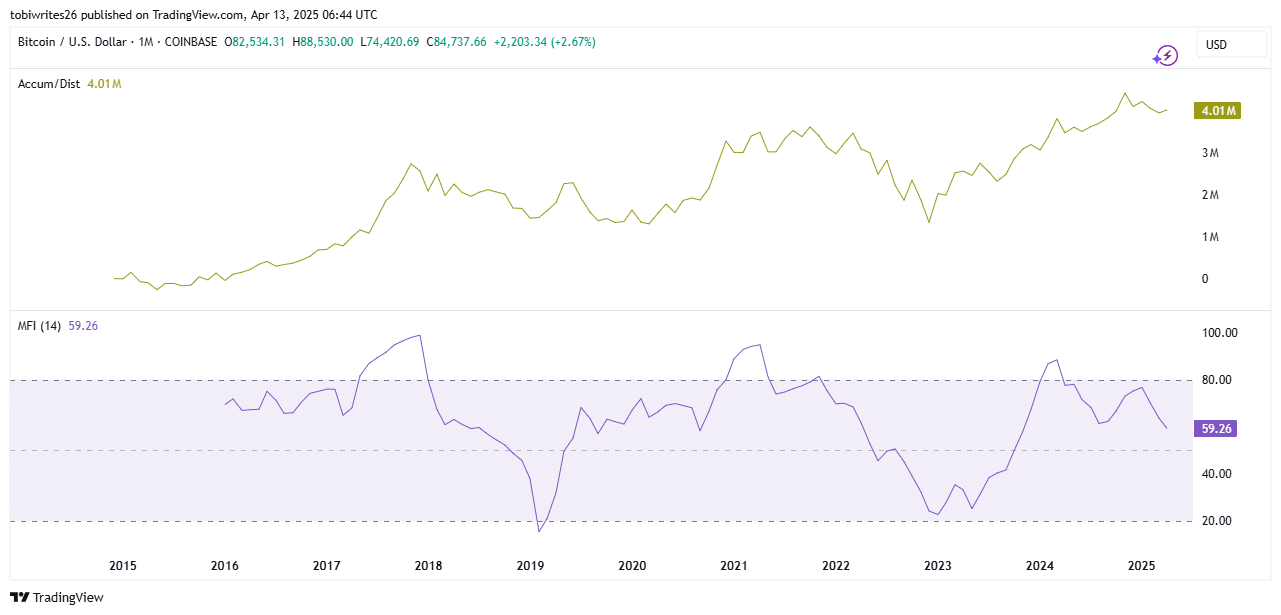

To know the depth and development of market motion, AMBCrypto studied the stream of liquidity into the market.

Utilizing the Accumulation/Distribution indicator, it reveals there was a gradual accumulation of Bitcoin, implying that merchants are shopping for the asset steadily.

Accumulation quantity reached $4 million value of Bitcoin.

Regardless of a decline in liquidity stream, the Cash Move Index (MFI) on the chart stays bullish at 59.26. This means that merchants are capitalizing on the dip, signaling optimism for the asset’s prospects.

If liquidity stream improves, Bitcoin might doubtlessly rise additional, extending its present positive factors.

Quick merchants are feeling the warmth

This gradual rise in Bitcoin’s value hasn’t favored quick merchants.

On the time of writing, $56.41 million value of quick contracts had been forcefully closed, in comparison with $13.25 million in lengthy positions—highlighting the opportunity of a market rally.

A examine of Bitcoin’s Funding Price confirms the tendency for a rally.

With a price of 0.0098%, a constructive Funding Price might suggest that lengthy merchants are paying charges to take care of their positions and keep away from value disparity between the spot and futures markets.

Bitcoin at present stays in a positive place for a rally, however this can solely materialize if broader market sentiment continues to align with present bullish indicators.