Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

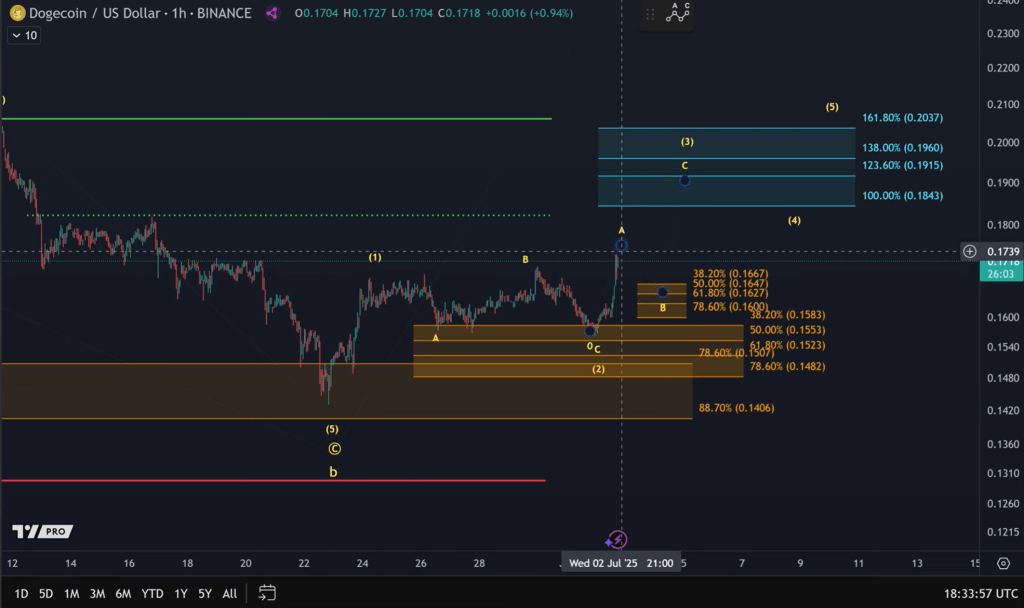

Dogecoin was altering arms close to $0.174 in European buying and selling on Thursday, extending a two-day rebound that started when patrons twice defended the mid-June flooring round $0.16. The 11% restoration for the reason that Tuesday low has put the biggest memecoin again on merchants’ radars, however technical analyst Extra Crypto On-line cautions that what appears like an impulsive burst is in truth “all corrective in nature,” with the market nonetheless trapped inside a posh diagonal wave sample that might simply as simply fail.

Dogecoin Is Quietly Coiling For A Potential Breakout

In a video replace recorded on 2 June, the analyst dissected the one-hour chart and concluded that the advance from the 22 June low is greatest counted as a three-wave transfer. “As a result of wave 1 … was solely a three-wave transfer, the third wave ought to unfold as an ABC construction,” he stated, underscoring that the rally lacks the five-wave DNA of a development reversal. Even so, so long as Dogecoin defends what he known as a “micro-support space between $0.16 and $0.166,” the diagonal stays legitimate and a measured goal at $0.196—the 138 p.c Fibonacci extension of wave 1—“stays believable.”

The roadmap is conditional. First, the present A-wave has to complete; then a corrective B-wave ought to comply with, “and within the C-wave we might then rally to spherical about $0.196.” A probe towards $0.182 earlier than that pullback can’t be dominated out, however the analyst warned viewers to not assume a straight shot greater. “Please bear in mind that we might be coping with very uneven and messy buildings,” he stated.

Associated Studying

If bulls do drive a full five-wave climb from the July swing low, that sequence would mark the primary leg of a bigger five-wave advance—a textbook sign that the broader down-trend from Dogecoin’s March peak could lastly be exhausted. Failure to carry $0.16, nonetheless, would invalidate the diagonal depend and expose the June lows close to $0.151, the place on-chain information present a skinny layer of spot bids and little by-product assist.

Market context is combined. CoinGecko information present Dogecoin’s 24-hour turnover has topped $1.5 billion, roughly according to final week’s common, whereas the memecoin’s correlation with Bitcoin has weakened to 0.62, its lowest studying since early Could.

Associated Studying

Within the quick time period, although, all eyes are on the $0.16 band. As Extra Crypto On-line summed up, “The diagonal sample mainly stays believable so long as we’re holding that $0.16 stage.” Ought to that flooring survive the inevitable B-wave turbulence, Dogecoin’s “quiet setup” would possibly certainly detonate shortly—propelling the token towards $0.196 and probably signalling a extra sturdy development change.

Notably, the higher boundary of Dogecoin’s long-running descending channel within the every day chart, now located close to $0.20, traces up virtually precisely with Extra Crypto On-line’s bullish goal. A decisive breakout via this confluence wouldn’t solely pierce the ceiling that has capped costs for the reason that December 8 excessive at $0.4843 however might additionally validate the analyst’s name for a trend reversal.

At press time, DOGE traded at $0.174.

Featured picture created with DALL.E, chart from TradingView.com