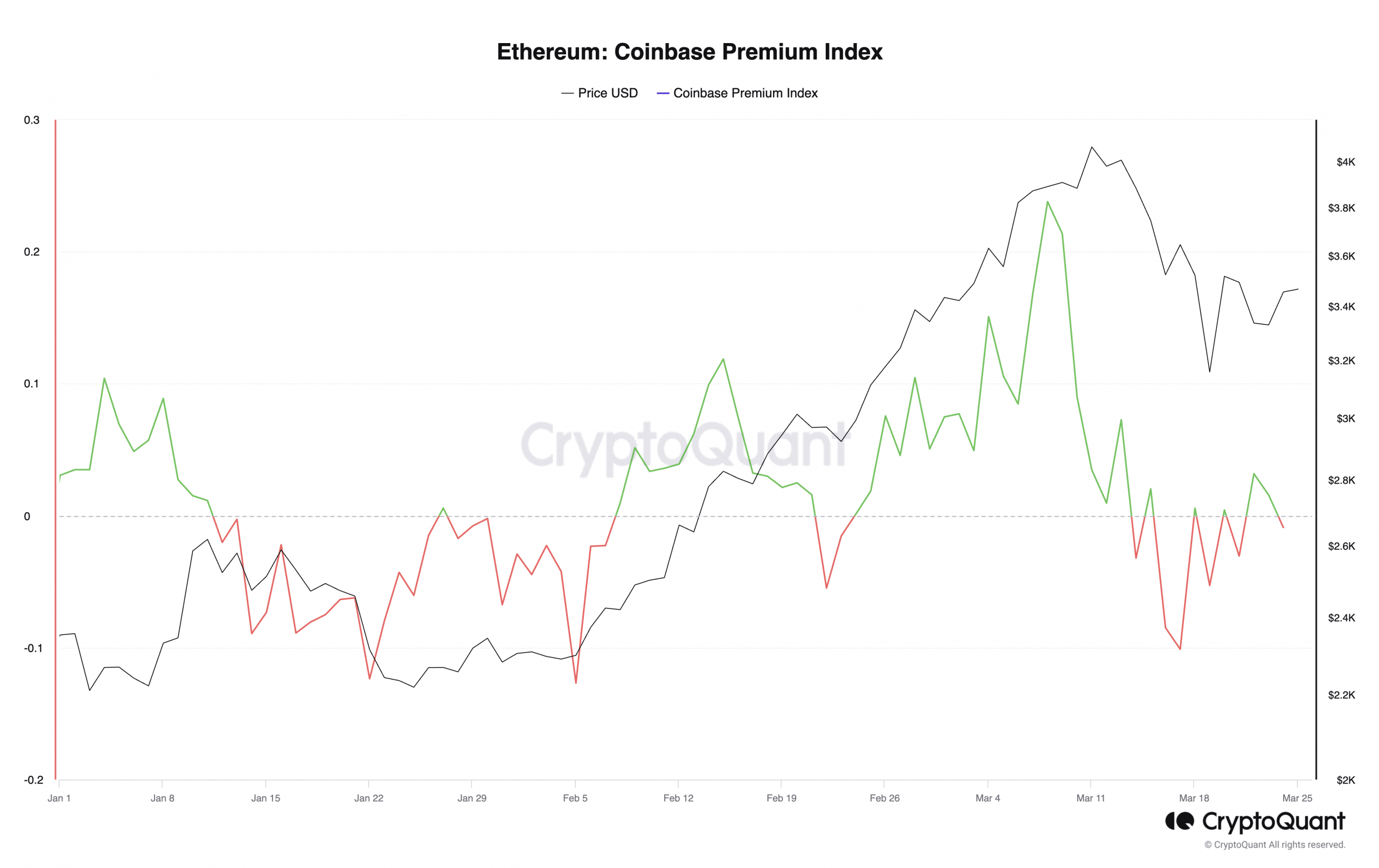

- ETH’s Coinbase Premium Index was adverse.

- This confirmed a decline within the coin’s shopping for exercise amongst U.S.-based traders on Coinbase.

Ethereum’s [ETH] worth decline since briefly buying and selling above $4000 on the eleventh of March has resulted in a drop in its Coinbase Premium Index (CPI), in line with CryptoQuant’s information.

This metric measures the distinction between an asset’s costs on Coinbase and Binance. When its worth grows, it suggests vital shopping for exercise by US-based traders on Coinbase.

Conversely, when it declines and dips into the adverse territory, it alerts much less buying and selling exercise on the US-based trade.

At press time, ETH’s CPI was -0.008. CryptoQuant’s information confirmed that when the altcoin’s worth fell under $3200 on the 18th of March, its CPI cratered to a 30-day low of -0.1.

The coin’s CPI has declined in the previous couple of weeks after rallying to a 12-month excessive at the start of March.

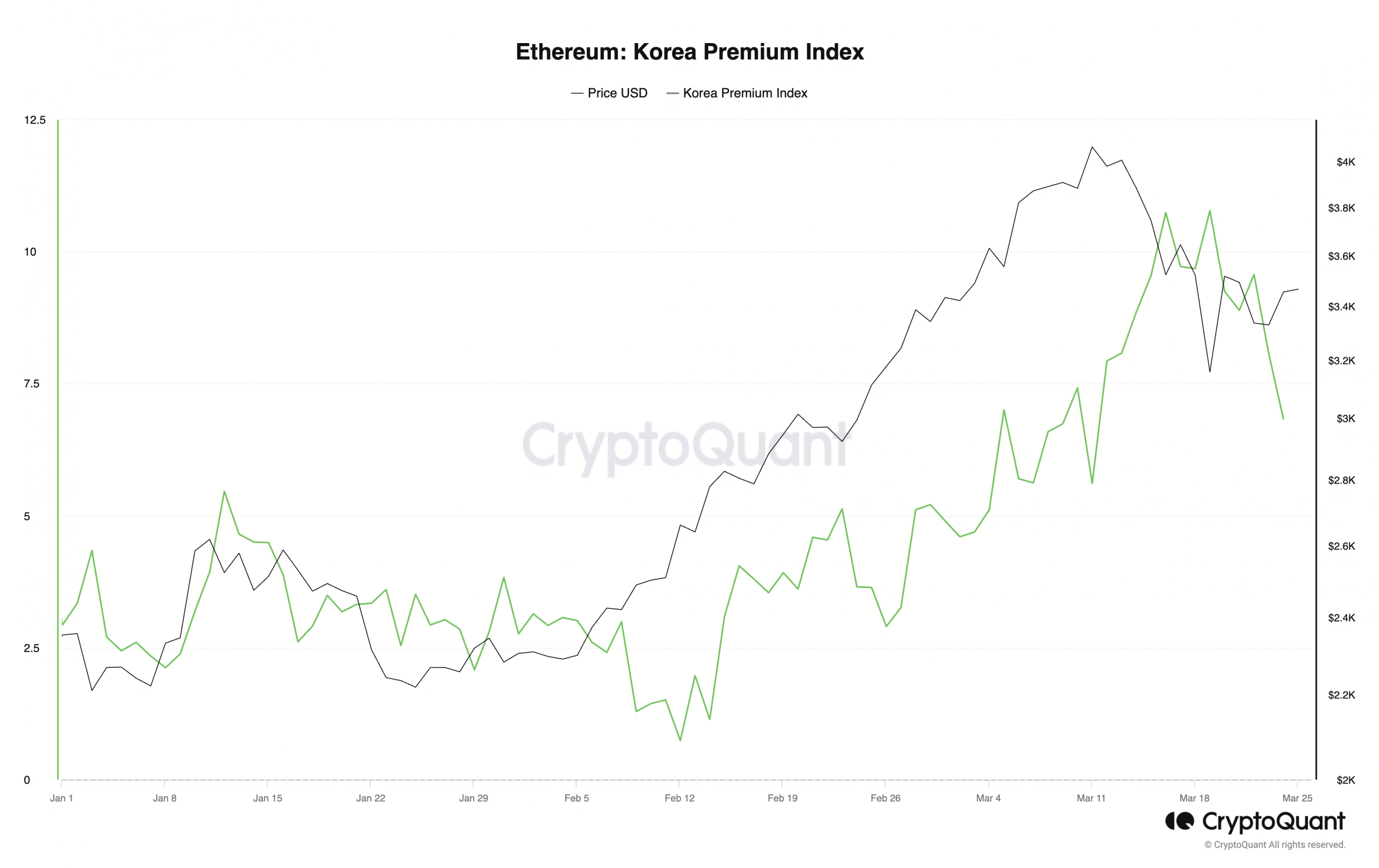

Though the Asian markets observe the same pattern, an evaluation of ETH’s Korean Premium Index (KPI) confirmed that it stays constructive regardless of the value pullback previously few weeks.

At press time, ETH’s KPI was 6.83.

The bears purpose to increase ETH’s losses

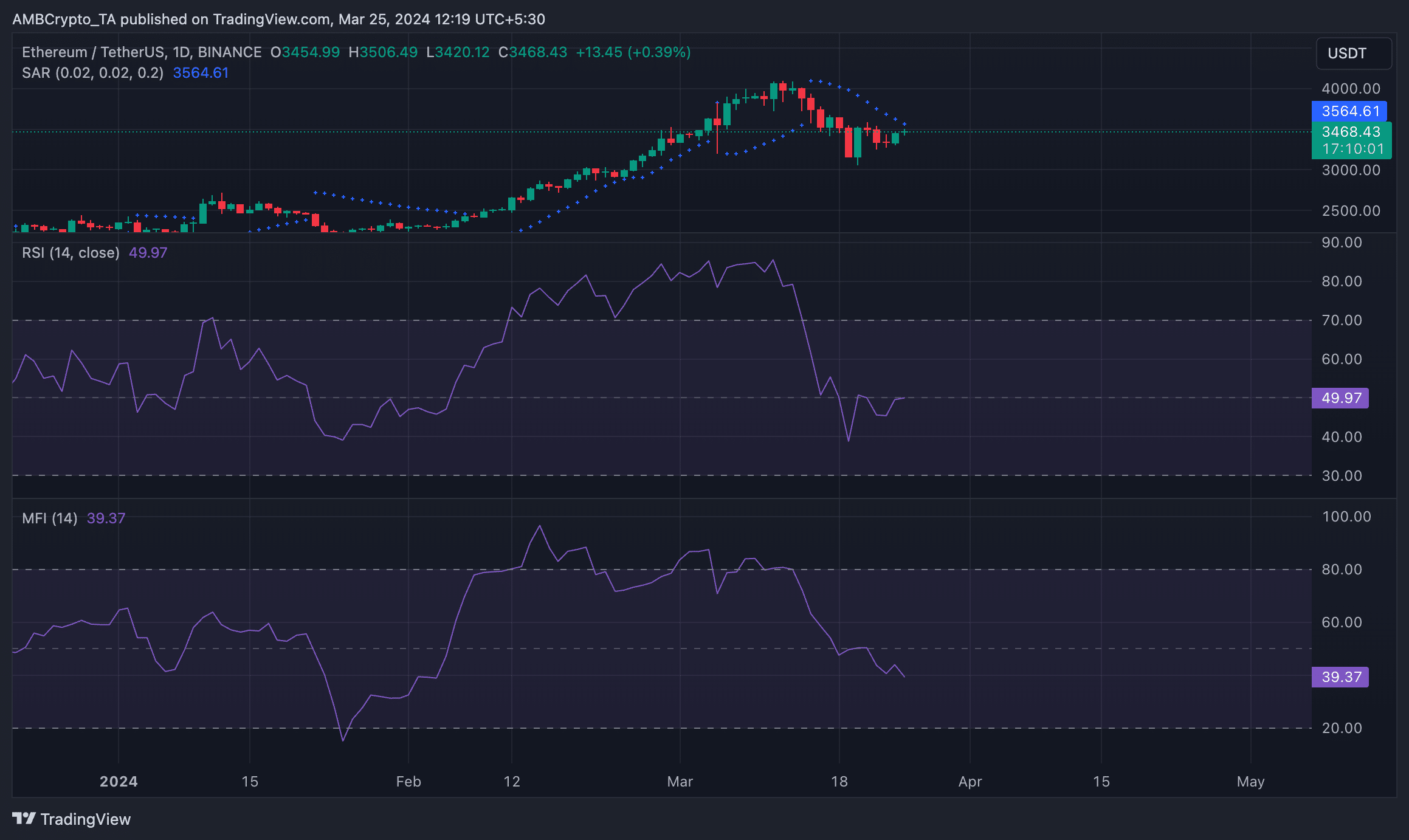

AMBCrypto’s evaluation of ETH’s worth efficiency on a each day chart hinted at the potential for a decline within the coin’s worth this week.

As of this writing, the altcoin exchanged arms at $3,474, witnessing a 4% worth decline within the final week.

The coin’s Cash Move Index (MFI) was noticed at a low of 39.34. This indicator measures the energy of cash flowing out and in of an asset.

At a price of 39.34, ETH’s MFI advised that the coin was witnessing a decline in shopping for stress.

Confirming the lower in demand for the coin, its Relative Power Index (RSI) trended downward to return a price of 49.

This additionally confirmed that promoting exercise outpaced coin accumulation amongst spot market contributors.

Additional, ETH’s Parabolic SAR revealed that the bearish sentiment has been vital for the reason that fifteenth of March.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

It has been positioned above ETH’s worth previously 10 days, throughout which the coin’s worth has dropped by 6%.

The Parabolic SAR indicator tracks potential pattern route and reversals. When its dotted strains relaxation above an asset’s worth, the market is deemed to be in a downtrend.