- Aave outperforms Bitcoin however faces key resistance.

- The protocol’s fundamentals are wanting good.

Aave [AAVE] continues to guide within the crypto house regardless of doubts surrounding the income fashions of Decentralized Finance (DeFi) blue chips.

Some trade voices counsel a reevaluation of what qualifies as earnings and bills in decentralized programs since these protocols usually are not conventional companies.

However, the AAVE/USDT pair broke a big 800-day vary, inflicting the pair to development larger for the previous two months, outperforming Bitcoin [BTC] throughout this era.

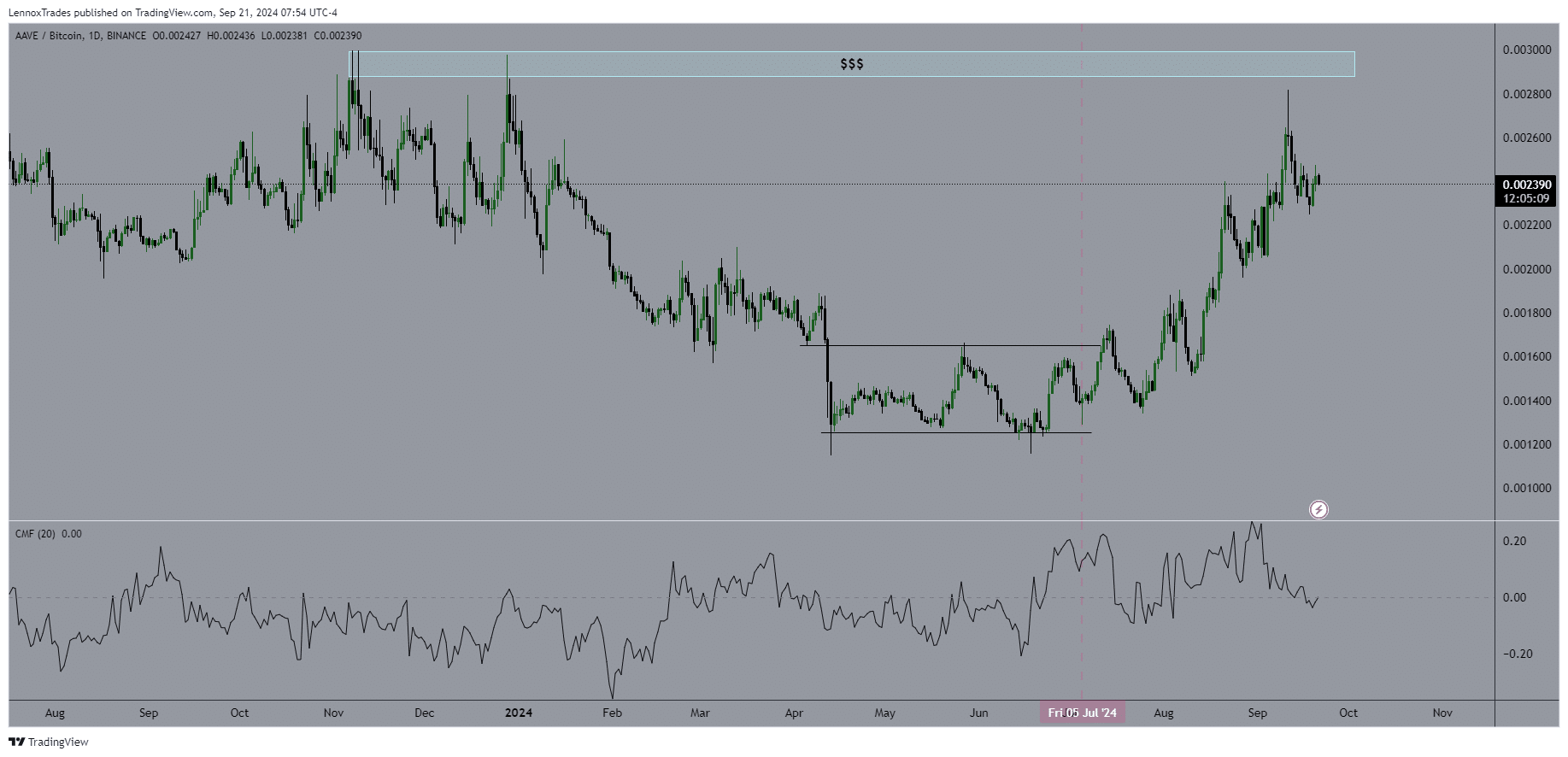

From 18th June, AAVE/BTC has proven larger highs and better lows, nevertheless it lately confronted sturdy resistance close to 0.003 BTC zone. This rejection, mixed with Bitcoin’s current efficiency, has slowed the pair’s rise.

Whereas Aave is predicted to proceed its upward development resulting from sturdy fundamentals, its pairing with Bitcoin could battle within the close to time period.

Moreover, the Chaikin Cash Circulate (CMF) indicator additionally reveals merchants taking income, with cash flowing out of AAVE/BTC pair.

Nonetheless, it’s total trajectory stays optimistic, particularly when traded towards stablecoins, which it’s anticipated to outperform as each AAVE and Bitcoin may surge in This fall.

This could possibly be the beginning of a reversal of Aave’s BTC pair however is but to be confirmed since…

Aave’s stablecoin surpassed $150 million

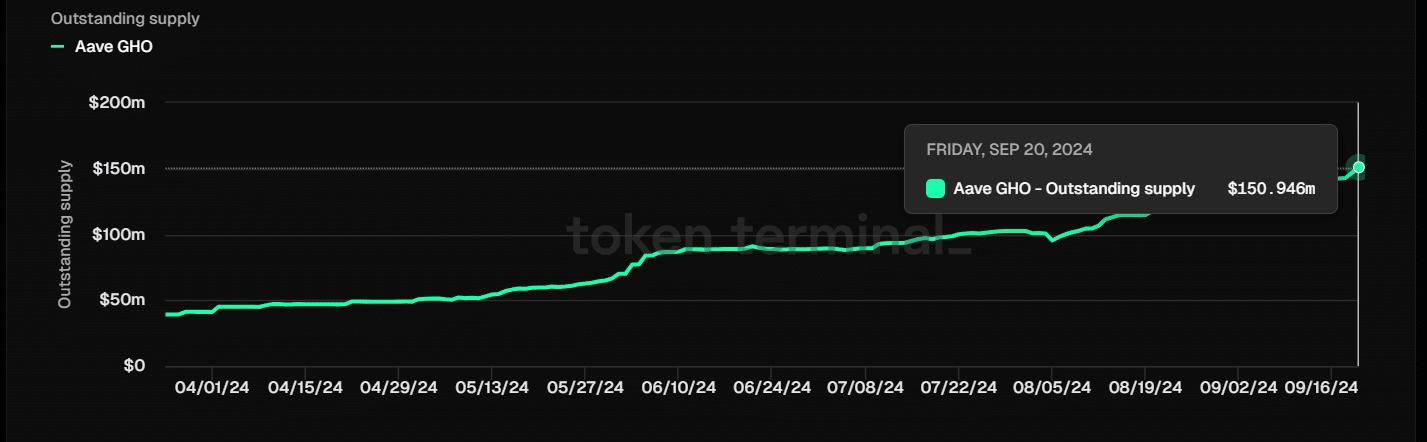

One necessary issue driving Aave’s bullish momentum is its stablecoin, GHO. GHO has seen regular development since its launch throughout a bear market, alongside Curve’s stablecoin (CRV).

In early September 2024, GHO’s provide elevated by greater than 6.7%, and now has reached a milestone of greater than $150 million in excellent provide.

Regardless of CRV having a bigger provide than GHO, each stablecoins have potential for important development.

As GHO continues to develop, it strengthens the broader Aave protocol and its potential for long-term development.

Constructive OI-weighted funding charges

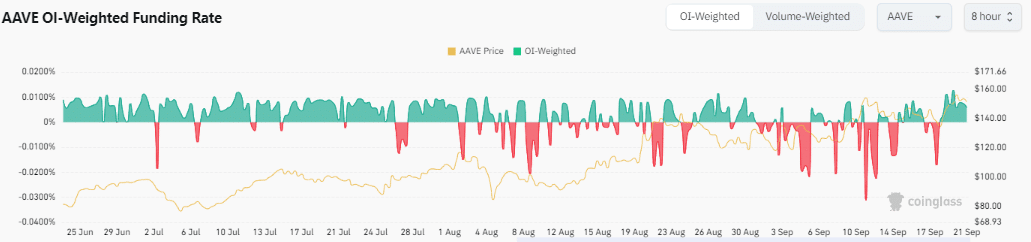

Moreover, the OI-weighted funding charges mirror bullish sentiment. As of the most recent information, the speed stood at 0.0058%, indicating that lengthy positions are paying shorts.

This implies a robust shopping for demand for Aave and aligns with its optimistic worth outlook. The rising demand highlights that merchants stay optimistic about Aave’s worth shifting larger within the close to future.

Sentiment & mindshare on the rise

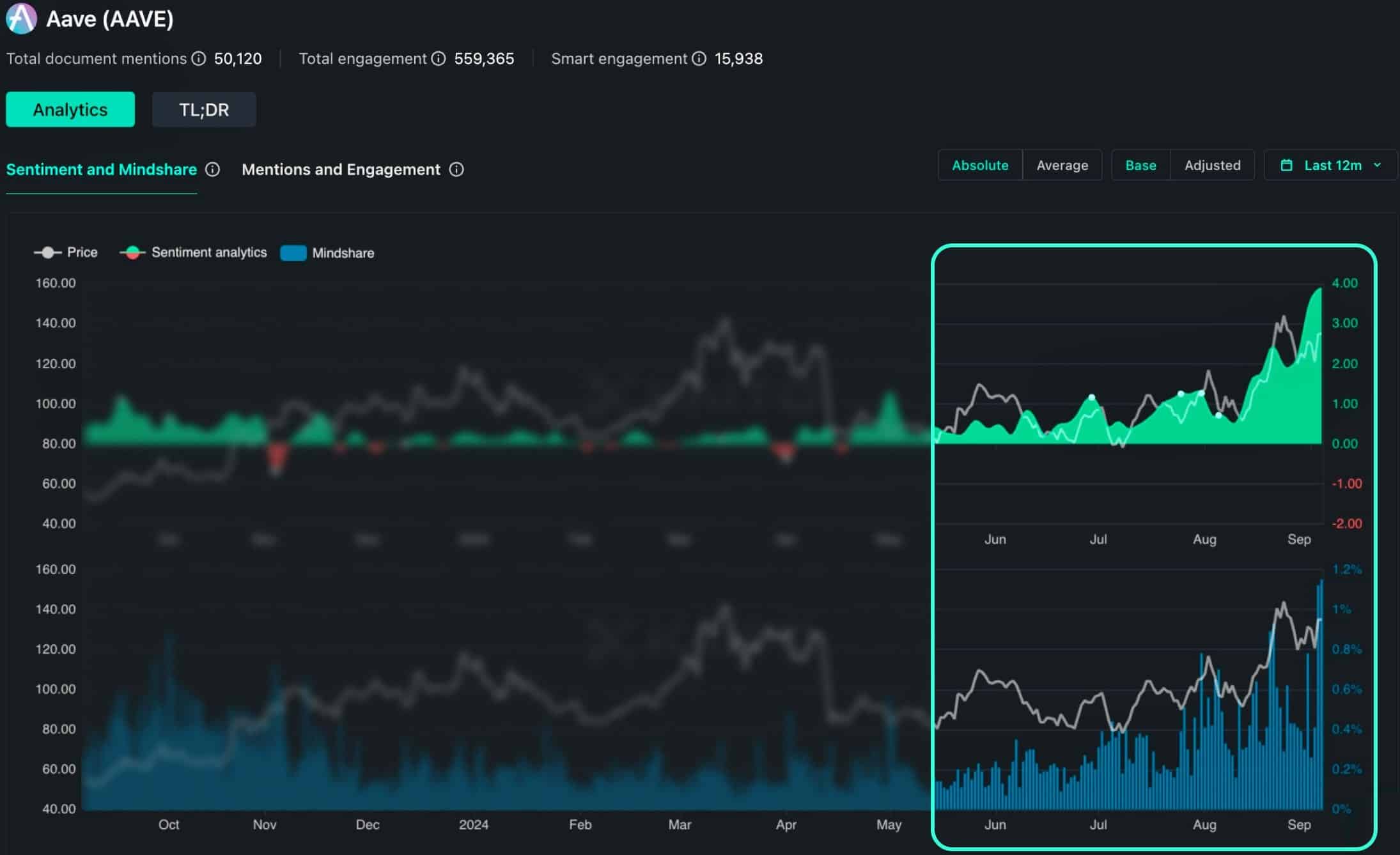

Lastly, Aave’s social sentiment and mindshare are additionally bullish. Information from Kaito AI platform reveals record-high ranges of positivity surrounding Aave.

Learn Aave’s [AAVE] Price Prediction 2024–2025

With potential elements like Trump integration, buybacks, and the Sky partnership, Aave is poised for additional development.

Aave’s total outlook is robust, particularly towards stablecoins, signaling a possible rise in its worth. It’ll proceed to carry out effectively within the DeFi house, with larger costs forward.