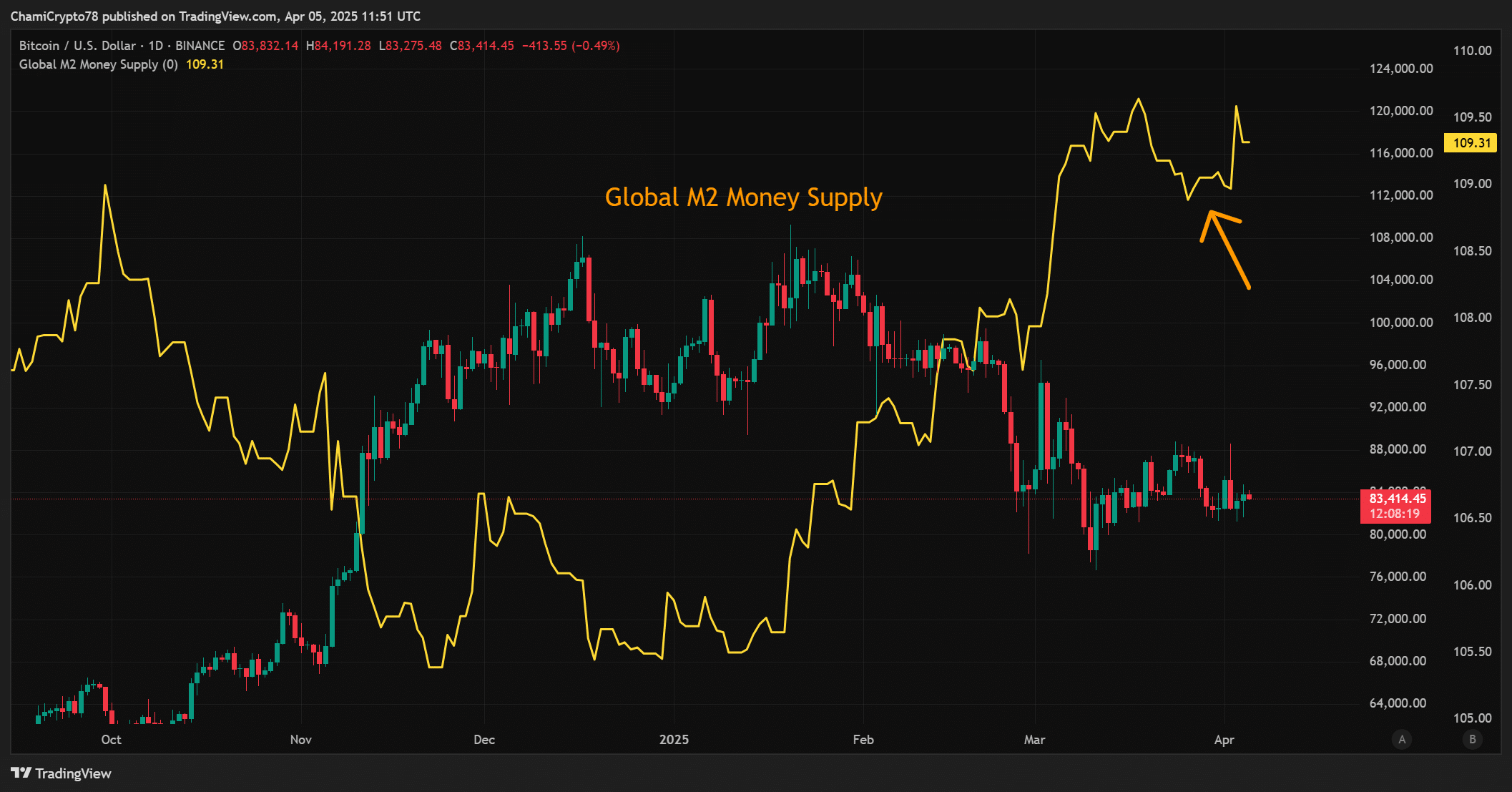

- Bitcoin traditionally lags M2 spikes, and the present setup hints at a coming breakout.

- Community power and tightening technical sign that Bitcoin is making ready for a serious transfer.

Bitcoin [BTC] is consolidating whereas international M2 goes parabolic, creating an ideal storm of liquidity that might set off the asset’s subsequent explosive transfer.

This growth consists of rising money, checking deposits, and liquid near-money property circulating throughout international economies.

As liquidity will increase, fiat currencies weaken, and buyers search alternate options that retain worth.

Due to this fact, Bitcoin—with its restricted provide and decentralized construction—emerges as a most popular asset. Regardless of M2’s sharp rise, BTC stays in consolidation.

Nevertheless, historical past reveals that such divergences don’t final lengthy. Bitcoin has usually responded to liquidity surges with delayed however explosive upside strikes, and that window could also be closing quick.

How does rising liquidity gas BTC?

Increasing liquidity instantly impacts investor conduct, usually shifting capital into property that resist inflation and preserve long-term buying energy. Bitcoin thrives on this surroundings as a result of it’s programmed to be scarce.

With solely 21 million cash to ever exist, its provide stays fastened, not like fiat currencies that inflate endlessly. Due to this fact, rising M2 strengthens the long-term bullish case for BTC.

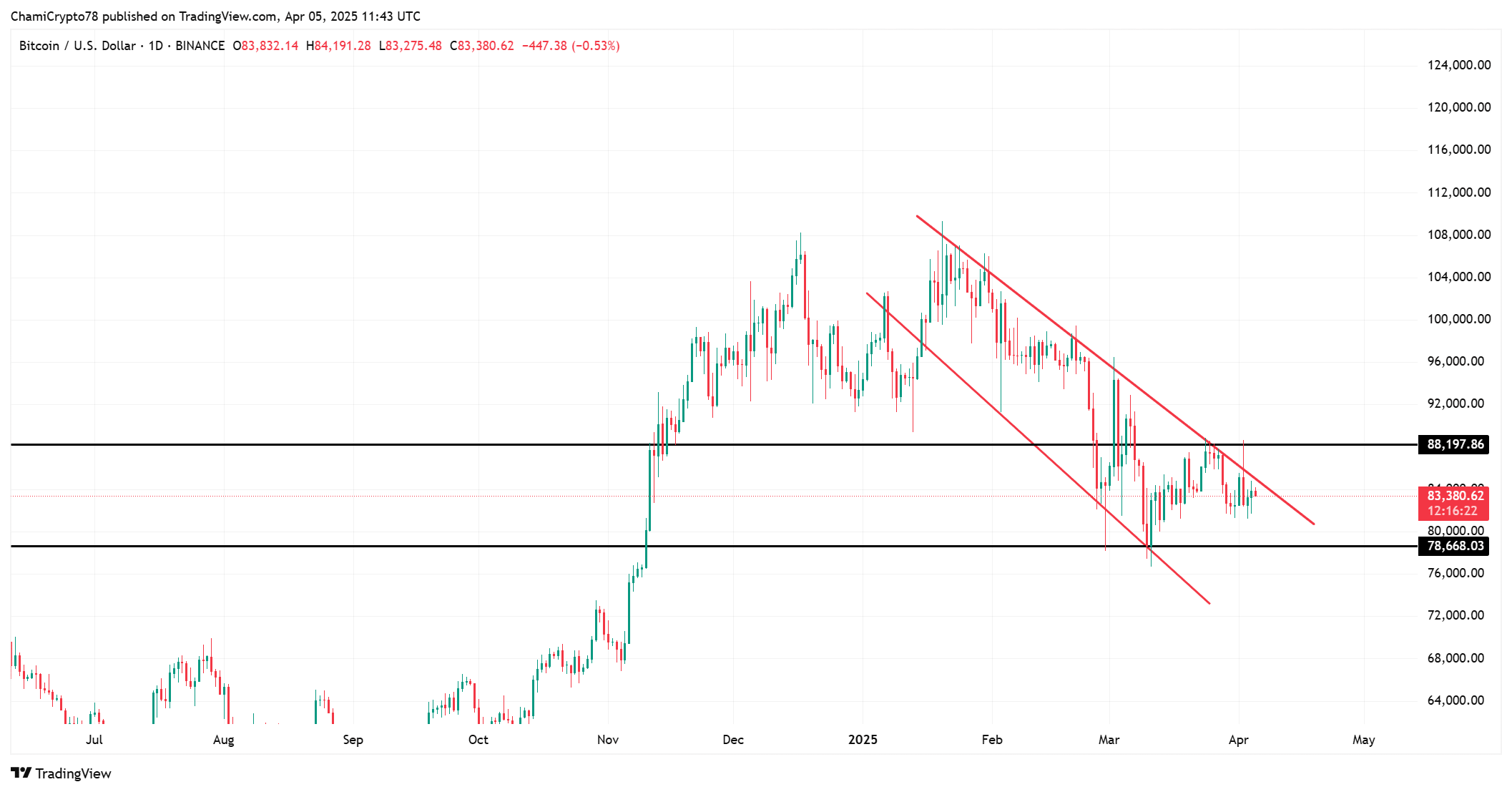

On the time of writing, BTC trades at $83,640, up 1.21% prior to now 24 hours. Worth continues to compress inside a descending channel, going through resistance at $88,197 and holding assist at $78,668.

This tightening construction, mixed with aggressive financial growth, creates the right backdrop for a breakout. A transfer above resistance might align value motion with the worldwide liquidity curve.

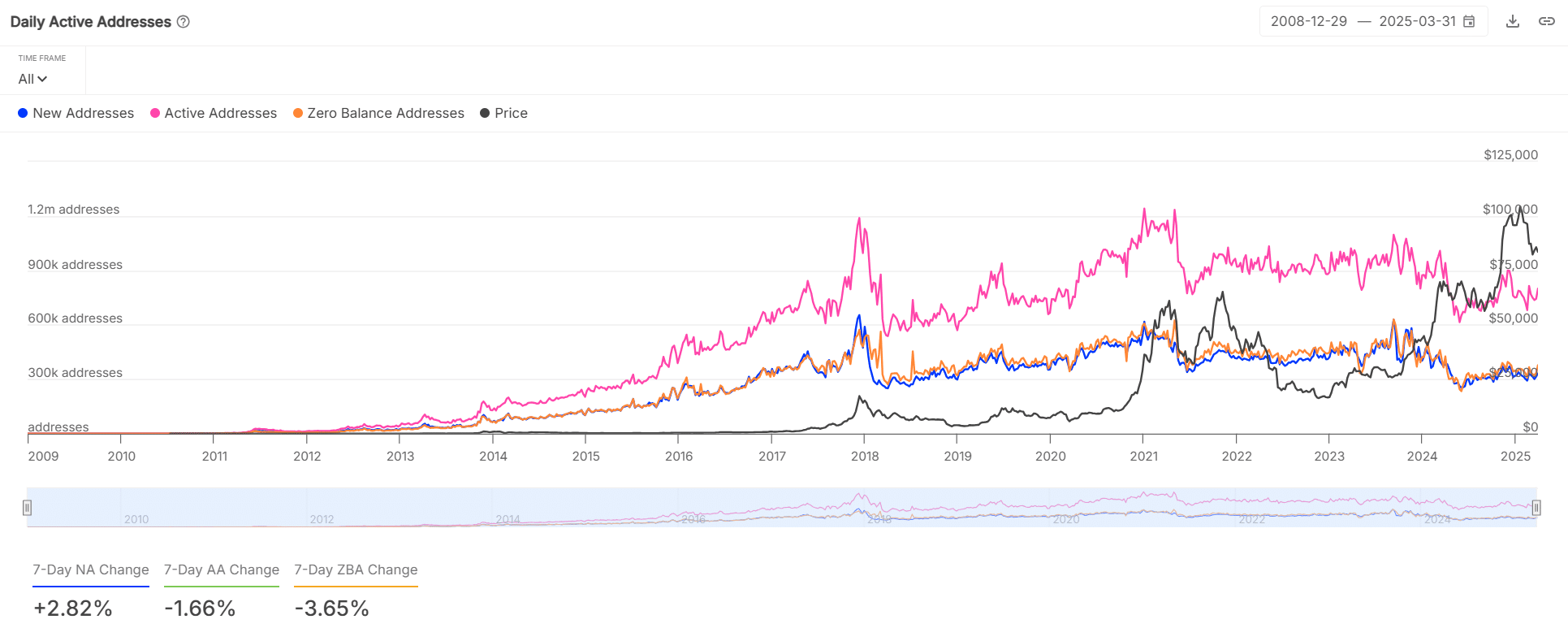

Is the Bitcoin community displaying power?

Bitcoin’s community exercise stays sturdy, supporting the macro and technical thesis. New pockets addresses have elevated by +2.82% over the previous week, reflecting recent participation.

On the similar time, zero-balance addresses declined by -3.65%, suggesting fewer customers are exiting. Though energetic addresses dipped barely by -1.66%, the rely stays close to 800,000 every day, displaying sustained utilization.

These on-chain indicators replicate resilience. BTC’s base stays stable, even throughout value consolidation—a typical setup earlier than bigger strikes.

Will Bitcoin wait for much longer?

Bitcoin is consolidating whereas international liquidity goes vertical, creating an more and more unstable equilibrium. On-chain metrics proceed to point out power, and person participation stays regular.

Technical patterns are tightening, suggesting that value is making ready for a decisive transfer. Due to this fact, BTC received’t wait for much longer—it’s primed to reply sharply to the overwhelming financial growth.