- BTC is about to hit one other ATH.

- Extra merchants have taken brief positions regardless of this development.

Regardless of Bitcoin [BTC] buying and selling at $104,500 and sustaining a powerful upward development, the lengthy/brief ratio on Binance reveals practically 60% of merchants holding brief positions. With BTC buying and selling above key shifting averages, bulls stay in management, poised to push costs greater if resistance at $105,000 is breached.

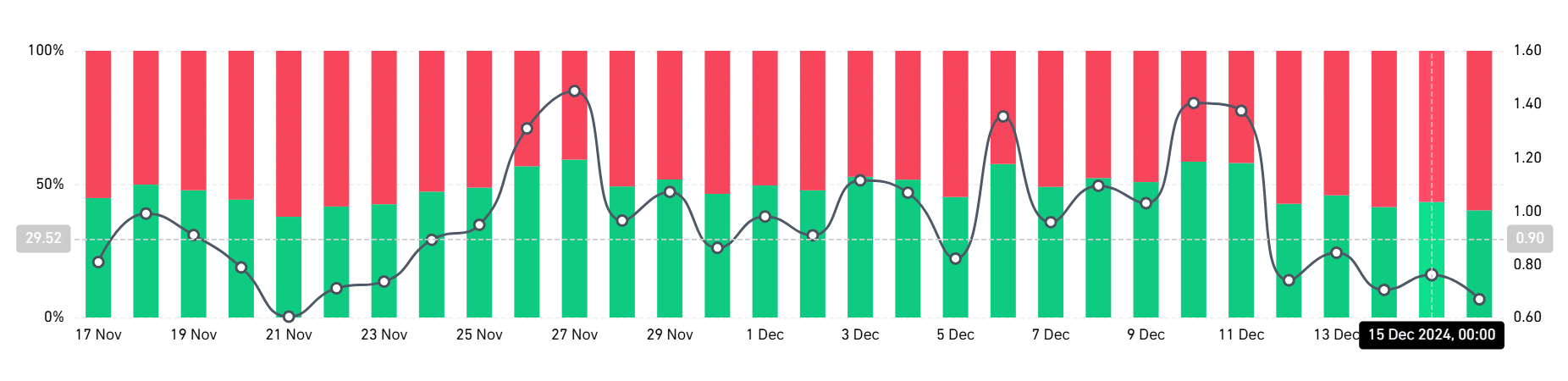

Lengthy/brief ratio alerts rising bearish bias

The newest lengthy/brief ratio knowledge evaluation on Coinglass highlights that just about 60% of merchants on Binance are holding brief positions in opposition to Bitcoin. This important skew towards bearish sentiment displays cautious sentiment amongst market individuals, whilst BTC continues its upward development.

The lengthy/brief ratio charts depict a constant dominance of brief positions over the past two buying and selling classes. The development means that many merchants are hedging in opposition to a doable correction or overbought situations.

Apparently, this bearish sentiment comes at a time when Bitcoin has maintained a powerful worth trajectory, buying and selling round $104,500.

Such a divergence between sentiment and worth efficiency could trace at underlying market power, with bears probably setting themselves up for liquidation within the occasion of additional upside momentum.

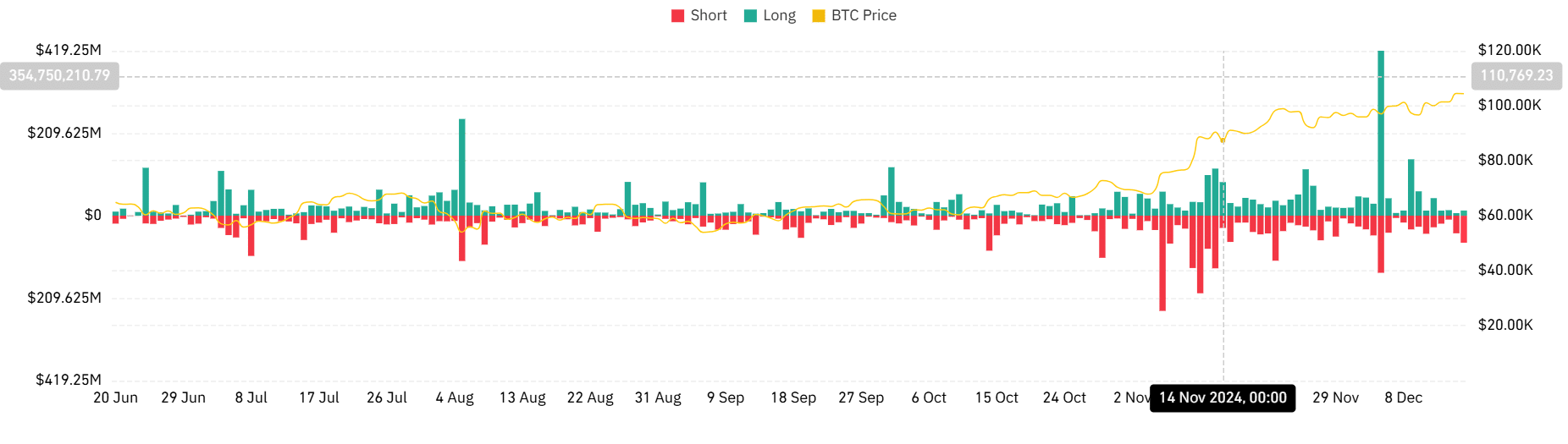

Liquidation traits: Shorts face growing danger

Over the previous two buying and selling classes, the liquidation knowledge reveals that brief positions have confronted heavier liquidations than longs. The latest buying and selling session noticed a notable spike in brief liquidations, with 68.78 million for shorts and $13 million for longs.

This surge signifies that bearish merchants, anticipating a pullback, have been caught off-guard by Bitcoin’s resilience above key psychological ranges.

When combining this liquidation development with the excessive share of brief positions, it turns into evident that BTC’s upward momentum has positioned important stress on leveraged bears.

Merchants might want to carefully watch the liquidation ranges, as additional worth will increase may set off further brief squeezes, probably propelling BTC greater.

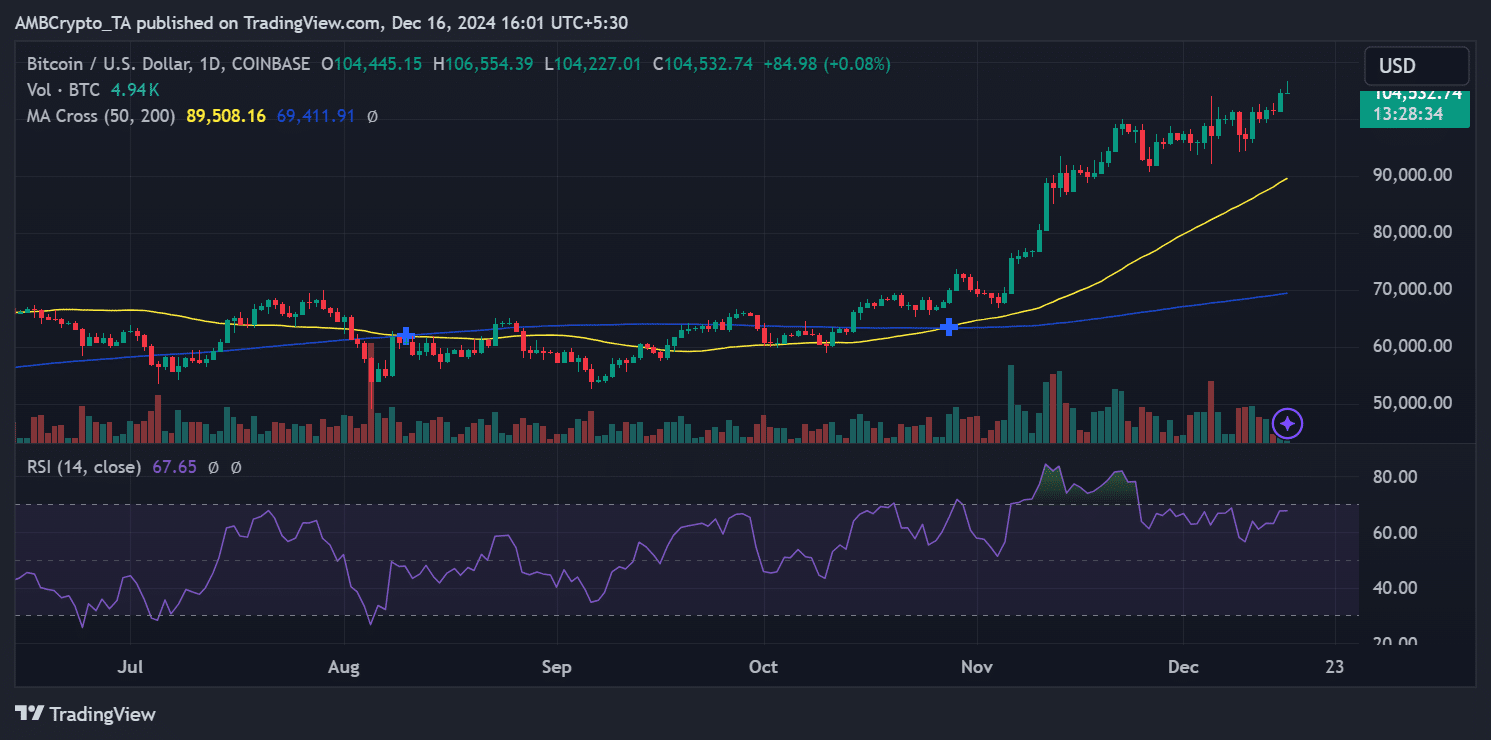

Bitcoin bulls in management amid RSI and shifting common alerts

Bitcoin’s worth motion stays bullish on the day by day timeframe, supported by technical indicators signaling sturdy upward momentum. The Relative Energy Index (RSI) at the moment sits at 67.65, indicating that BTC is approaching overbought territory however nonetheless has room for additional upside.

Traditionally, RSI ranges close to 70 have been accompanied by short-term corrections; nevertheless, Bitcoin’s potential to maintain present ranges may invalidate instant bearish considerations.

Moreover, BTC’s worth is buying and selling properly above its 50-day and 200-day shifting averages, additional reinforcing the bullish outlook. The Golden Cross continues to behave as a powerful assist for the continued rally.

An in depth above $105,000 may open the door to testing $110,000, whereas instant assist lies round $100,000.

Can bears face up to BTC’s momentum?

The present bearish positioning amongst merchants seems misaligned with Bitcoin’s sturdy upward momentum. With brief liquidations piling up and BTC sustaining key assist ranges, the market may very well be primed for additional positive factors if brief merchants capitulate.

Learn Bitcoin (BTC) Price Prediction 2024-25

The interaction between the lengthy/brief ratio, liquidations, and worth motion means that Bitcoin bulls stay firmly in management for now.

As merchants assess the dangers, the market’s potential to soak up promoting stress and maintain its upward trajectory might be essential. Traders ought to monitor Bitcoin’s resistance at $105,000 and assist at $100,000 for alerts of the following directional transfer.