- BTC has crossed right into a historic “buying space,” indicating {that a} bounce-back is imminent.

- U.S. traders have began buying BTC on this area, whereas by-product merchants are promoting as an alternative.

Bitcoin [BTC] has but to totally recuperate following the market-wide sell-off.

The occasion noticed its worth drop from $90,000, which it had held because the fifteenth of November, buying and selling beneath it on the twenty fourth of February, placing it at a lack of 17.47% prior to now month.

Per AMBCrypto’s evaluation, BTC might see a serious bounce increased as sure sentiment aligns with a bullish narrative.

Nevertheless, with the present promoting stress from the by-product market, the rally could not materialize. Right here’s why.

U.S. traders accumulate Bitcoin as costs hit new stage

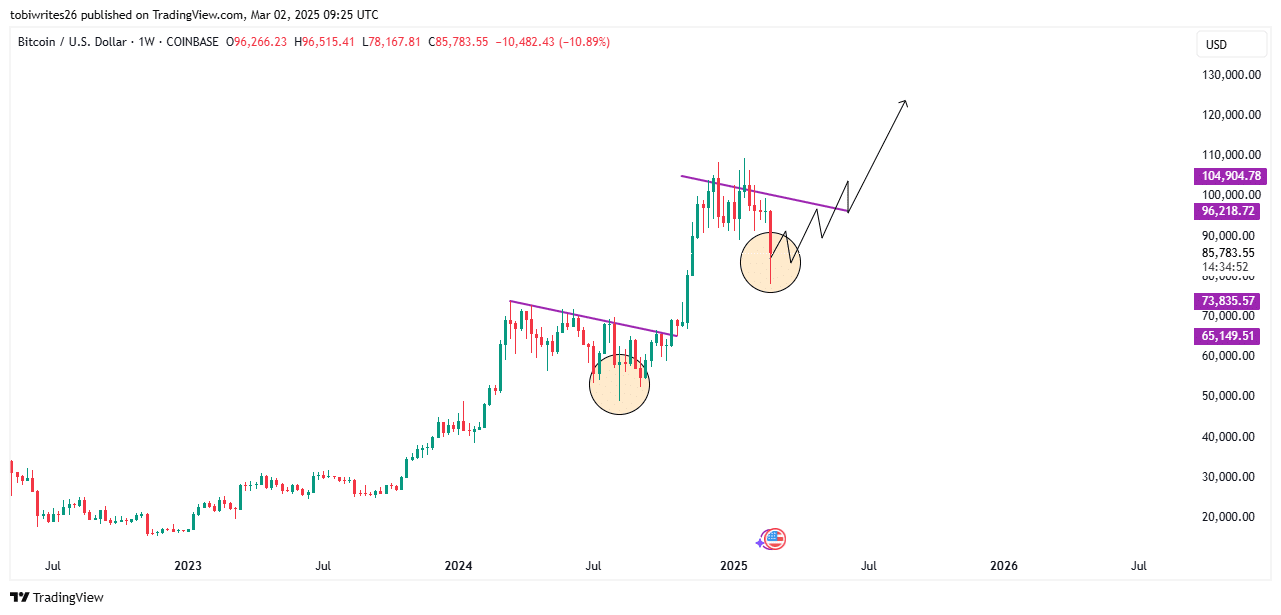

Latest evaluation from CryptoQuant reveals that Bitcoin has entered a zone known as a historic buying space 1 & 2 on the chart.

To commerce on this space, Bitcoin must see a worth drop of 15 to twenty%—a decline it has lately recorded.

These ranges, as seen on the chart, are characterised as buying areas as a result of two main actions happen: the historic accumulation of BTC by market individuals and traders capitalizing on the overreaction that led to a worth drop.

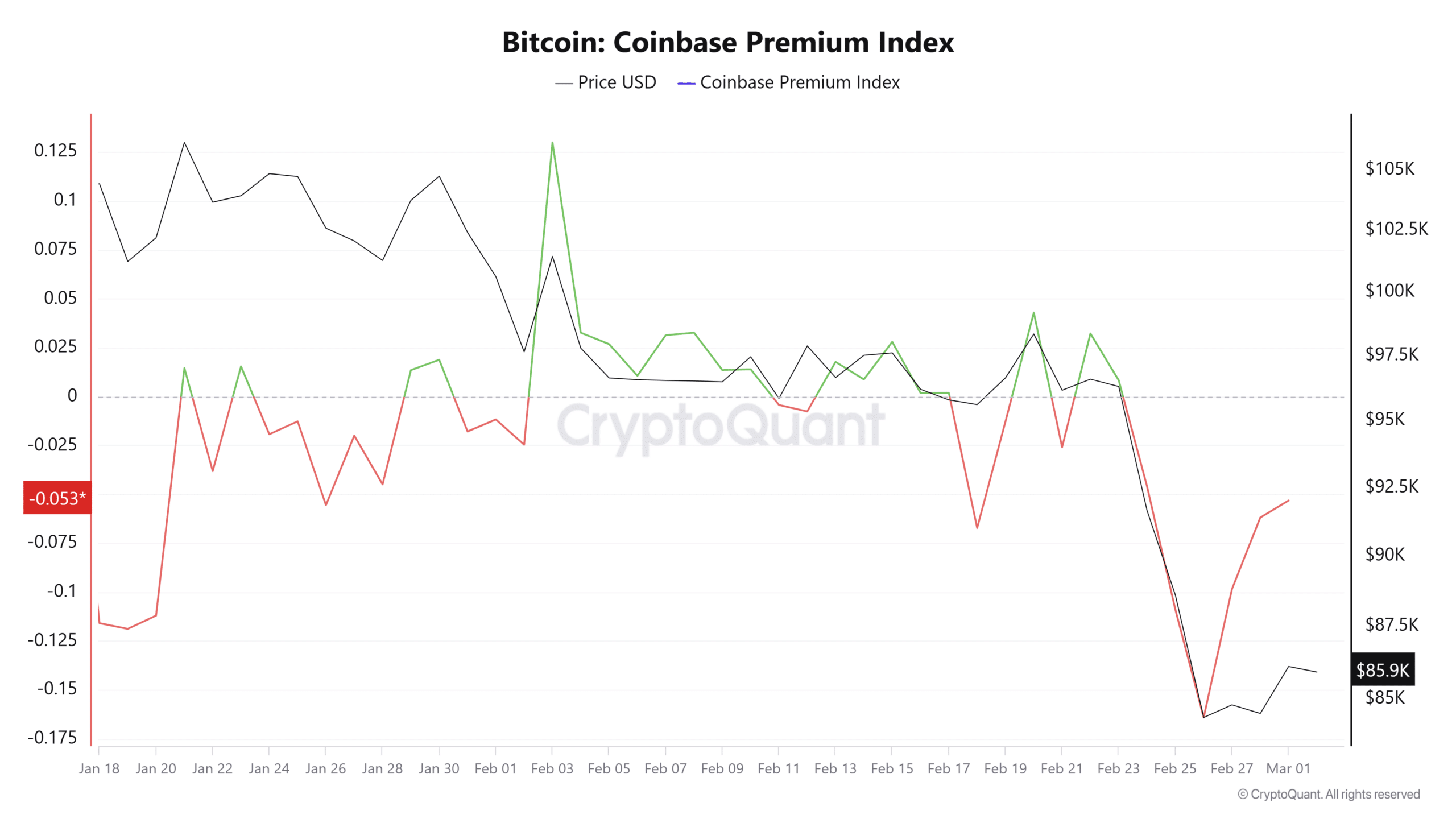

On the time of writing, U.S. traders available in the market had been profiting from this drop and have begun accumulating the asset because the Coinbase Premium Index spikes to -0.053, trending up.

Usually, when this index is within the adverse area, it signifies promoting from U.S. traders. Nevertheless, when the asset tendencies increased and heads towards crossing above 0, it indicators that purchasing sentiment is step by step build up.

If the index crosses above 0, one other wave of BTC shopping for might happen, as traders at this stage achieve confidence that the asset is more likely to rally primarily based on its efficiency and different market sentiment.

On the chart, BTC could possibly be on the sting of replicating the transfer that led to its worth surge after a pointy decline in August, highlighted within the orange circle. Presently, the same drop has occurred.

Following this sample, the bullish transfer for BTC could be confirmed as soon as the asset breaches the purple resistance line above it, probably resulting in a brand new all-time excessive.

Whereas exercise on-chain and the chart counsel a possible rally for Bitcoin, by-product merchants are promoting, which might hinder the anticipated upswing.

Spinoff merchants wager towards BTC

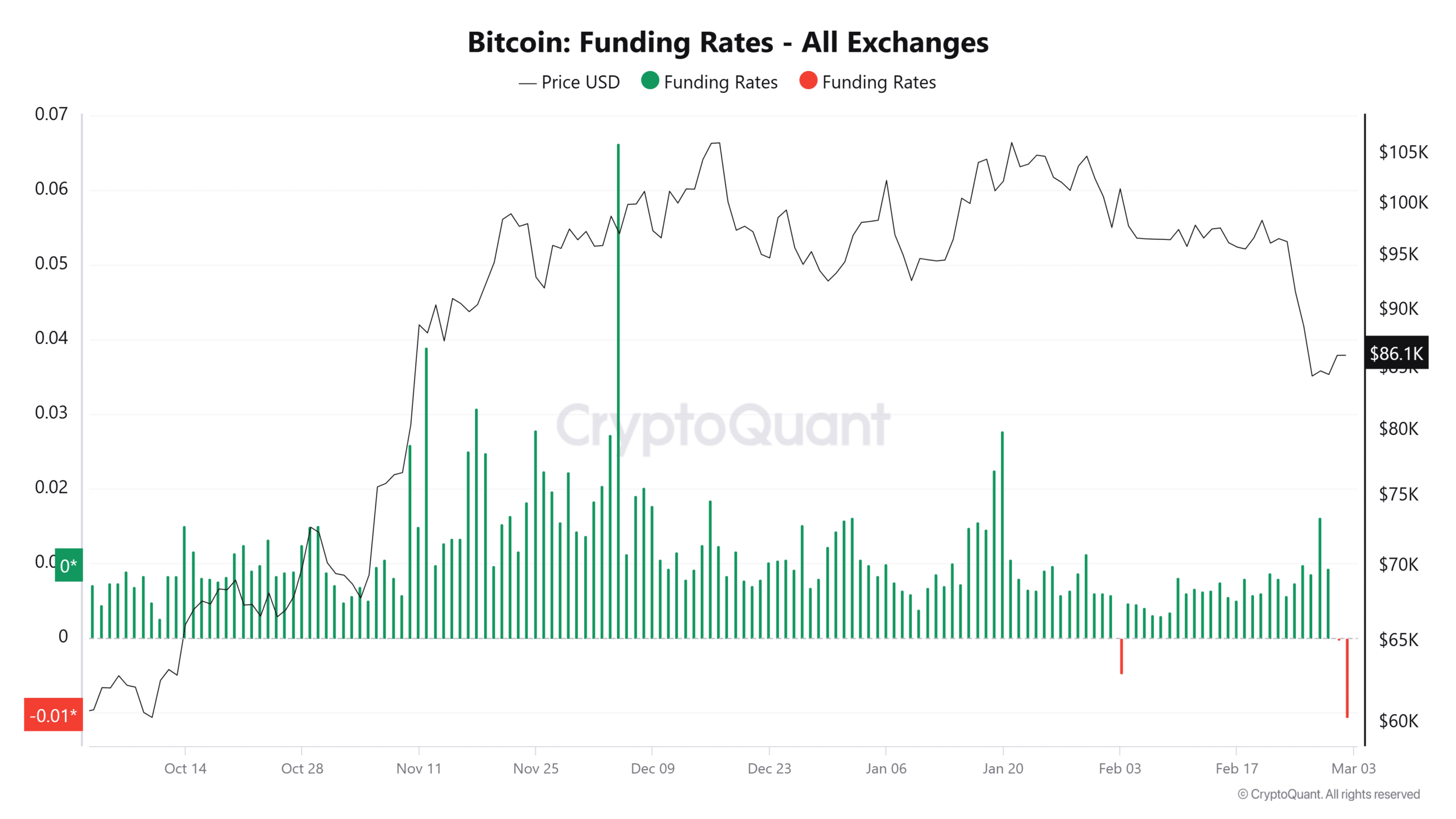

Conviction within the by-product market is low, with funding charges dropping and promoting quantity seeing a serious hike, suggesting these merchants have impeded BTC’s main worth transfer.

The present Bitcoin Funding Price throughout cryptocurrency exchanges has seen a serious drop because the third of February decline, with a press time studying of -0.01.

A adverse Funding Price implies that sellers available in the market are paying a premium to take care of their positions in anticipation of additional worth declines.

With the Taker Purchase/Promote Ratio, used to find out whether or not shopping for or promoting quantity is dominating, evaluation reveals that sellers available in the market are in management, as their promote stress outweighs purchase stress.

With key basic indicators turning bearish, BTC’s rally might face a minor setback. Nevertheless, if different key indicators flip bullish, sellers within the by-product market might get liquidated because the asset strikes increased.