- International liquidity is on the rise, hitting current highs as traders switch capital to overseas markets.

- Bitcoin is the largest winner as traders flip to BTC amidst market turmoil.

Regardless of the ravaging influence of Donald Trump’s insurance policies on international markets, international liquidity has surged to hit new ranges, in response to Alpha Extract.

The rise in market liquidity has seen Bitcoin [BTC] proceed to rise on its worth charts regardless of the market turmoil. The current spike means the markets are nearing September 2024 ranges, simply earlier than Bitcoin rallied to $100k.

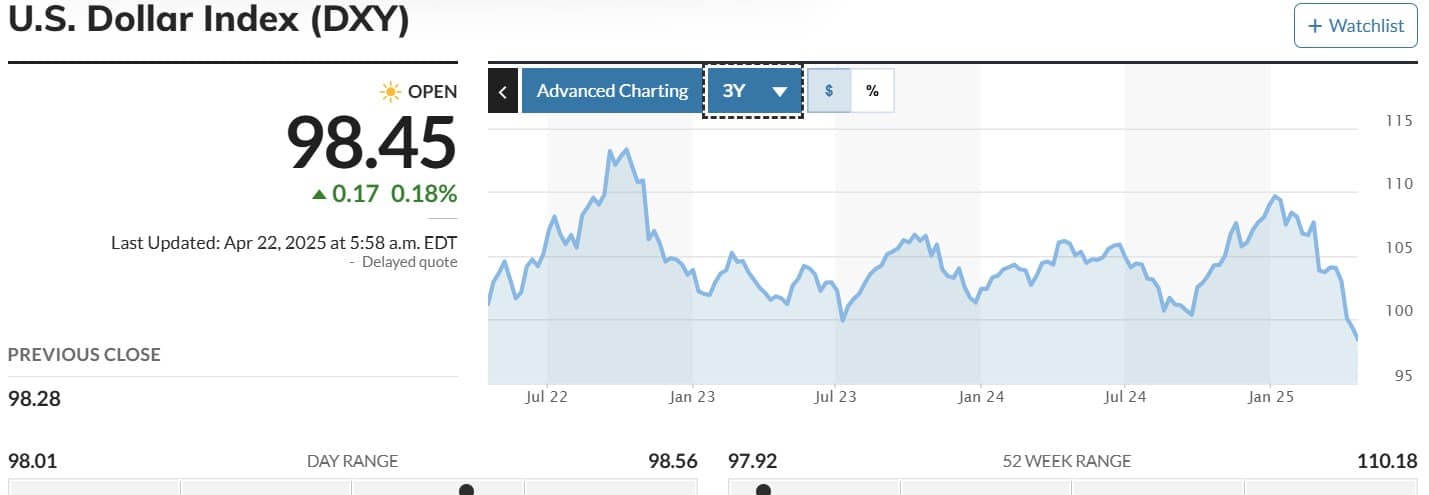

The U.S. Greenback Index (DXY) is in a robust downtrend, having breached a two-year vary and fallen to its lowest ranges since March 2022. This decline means that international markets are stabilizing and liquidity is rising.

As DXY drops, main capital seems to be flowing out of the U.S. into overseas markets, indicating a choice for higher funding circumstances.

Capital tends to maneuver the place it’s effectively handled, and presently, the U.S. market is struggling to retain it.

Is that this the golden second for BTC?

When international liquidity rises, Bitcoin tends to observe capital flows, usually main to cost will increase over time. This week, the International Liquidity Index surged by $4.175 trillion, marking a 3.31% improve.

Concurrently, Bitcoin’s worth jumped from $78K to $88K, displaying the optimistic influence of elevated capital influx into international markets.

Buyers are returning to build up BTC, with U.S. institutional patrons re-entering the market.

The Coinbase premium index turned optimistic after three days within the destructive, signaling institutional curiosity in Bitcoin amid market uncertainty.

The Korean Premium Index remained in optimistic territory, additional confirming sturdy investor curiosity in Bitcoin.

With each Korean and U.S. traders turning to BTC, it means that main gamers view Bitcoin as a haven amid excessive market volatility.

As uncertainty grows, Bitcoin is being perceived as a dependable retailer of worth, positioning it for important alternative within the present market panorama.

Amongst store-of-value property, solely Gold has outperformed Bitcoin. At the moment, BTC is holding above SPX, NDQ, and NLT, highlighting its rising energy towards equities.

Bitcoin’s comparative rolling efficiency suggests sturdy favorability, indicating additional development potential if market turmoil continues on account of U.S. coverage uncertainties.

Supply: Checkonchain

Merely put, as international liquidity will increase, Bitcoin stands to learn considerably, rising as a dependable retailer of worth alongside gold.

Amidst uncertainty in conventional finance, traders are more and more turning to BTC, setting the stage for additional development.

If BTC’s favorability persists, it may reclaim $90K and probably rally to $100K.

Nonetheless, if the FED intervenes to deal with the influence of Trump-era insurance policies, monetary markets might stabilize, resulting in a BTC pullback to $85K.