- BTC, ETH, and SOL have adopted practically similar worth patterns, suggesting macroeconomic elements are driving the market.

- Key assist and resistance ranges indicated {that a} breakout or deeper correction may form the following main transfer.

Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] have exhibited a powerful worth correlation over the previous two weeks, shifting virtually in unison.

This sample raises key questions on whether or not macroeconomic elements, investor sentiment, or structural market tendencies are driving this alignment.

A better take a look at their worth motion reveals how a lot every asset has declined and what this correlation means for merchants shifting ahead.

BTC, ETH, and SOL present a powerful correlation

Latest market information highlights that BTC, ETH, and SOL have been shifting in shut sync, with every asset experiencing related peaks and troughs.

The correlation chart illustrated how their costs have mirrored one another, suggesting that broader market forces are influencing all three belongings equally.

Supply: X

This alignment can typically be attributed to market-wide sentiment shifts, liquidity tendencies, and institutional buying and selling methods that influence a number of main belongings concurrently.

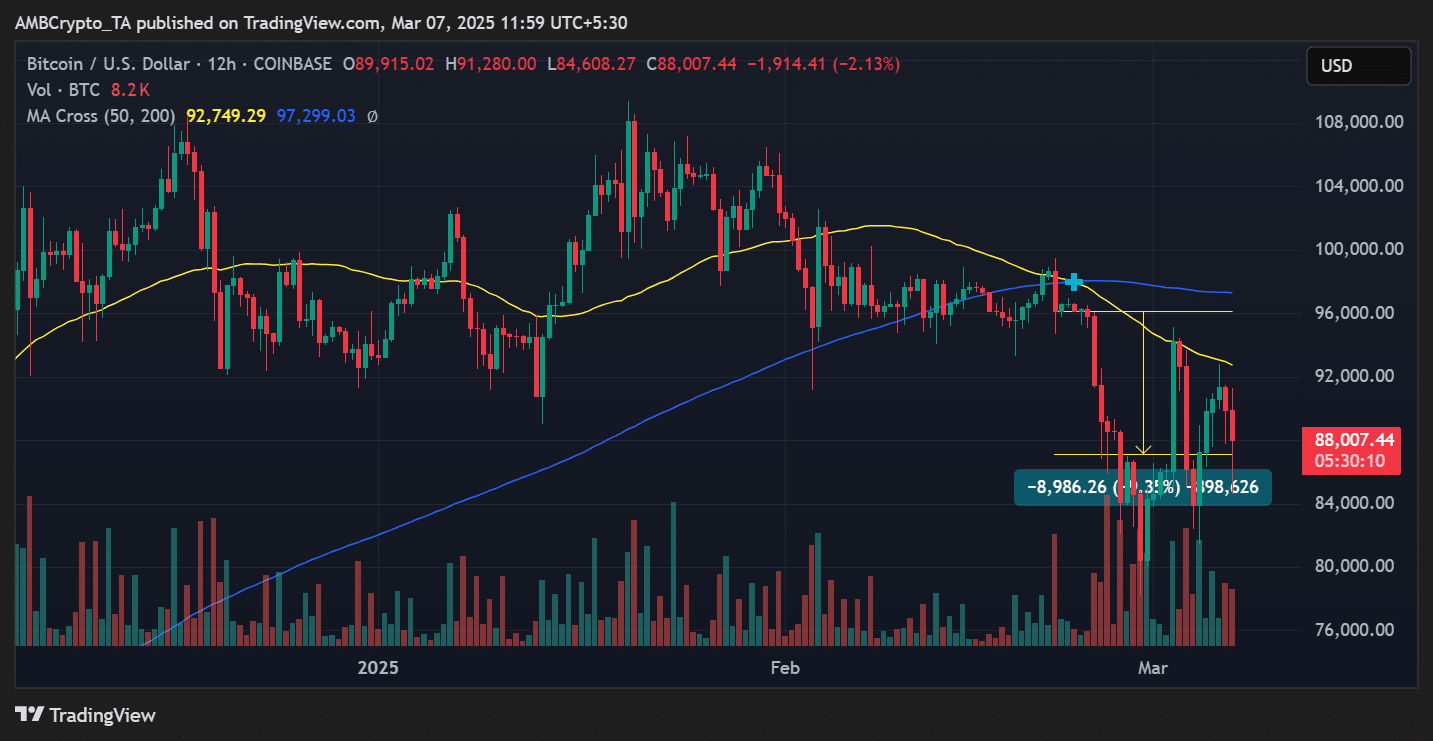

Bitcoin worth evaluation: Struggling to carry assist?

Bitcoin has seen a pointy decline in current weeks, with BTC buying and selling at $88,007, at press time. Additionally, the evaluation confirmed a 9.3% drop in worth from two weeks in the past.

The 50-day Transferring Common (MA) was at $92,749, appearing as resistance. If BTC fails to reclaim this stage, additional draw back stress may push the worth towards the $84,000 assist zone.

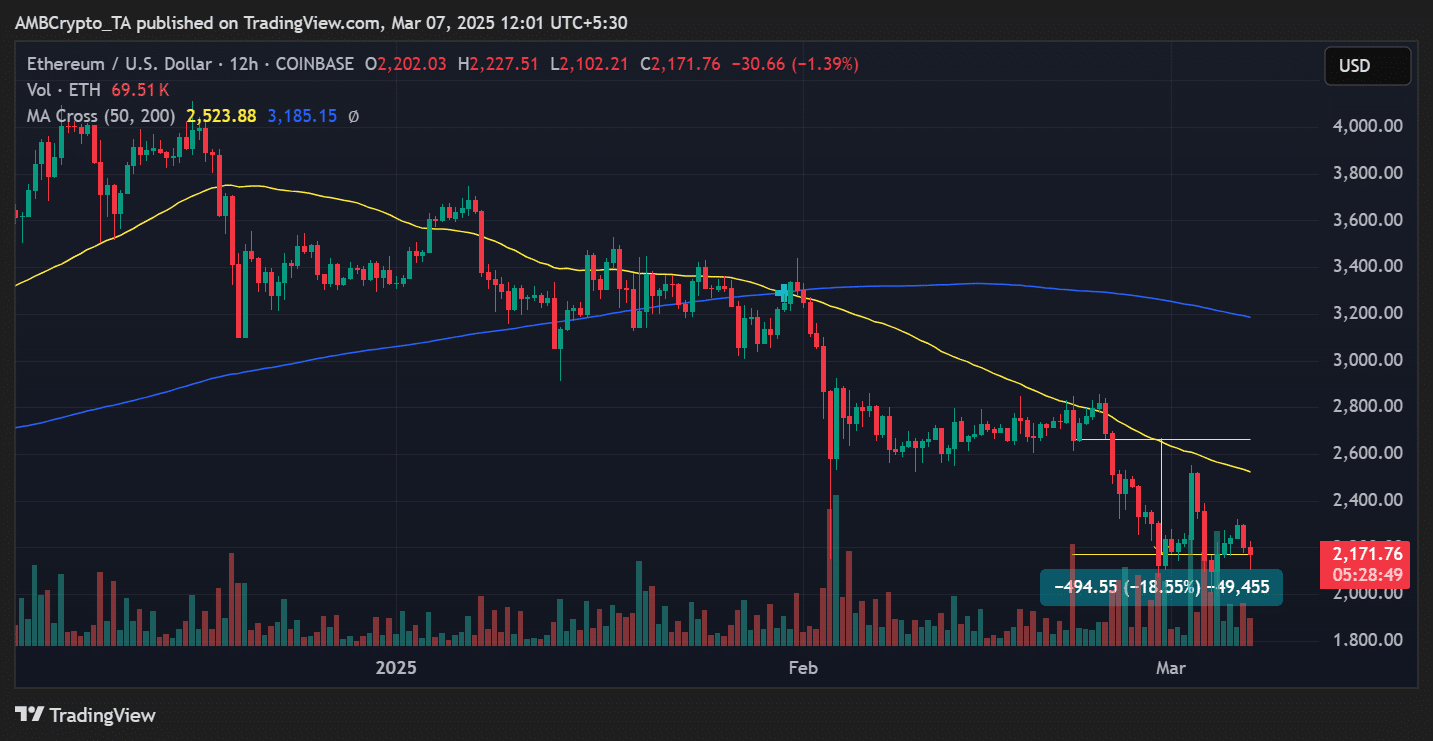

Ethereum worth evaluation: A steeper fall

Ethereum has additionally suffered vital losses, with its worth at $2,171, on the time of writing. The Value Vary instrument confirmed an 18.55% decline from earlier ranges.

ETH stays beneath its 50-day MA of $2,523, which is now appearing as a serious resistance stage. An additional decline may see ETH testing assist round $2,100.

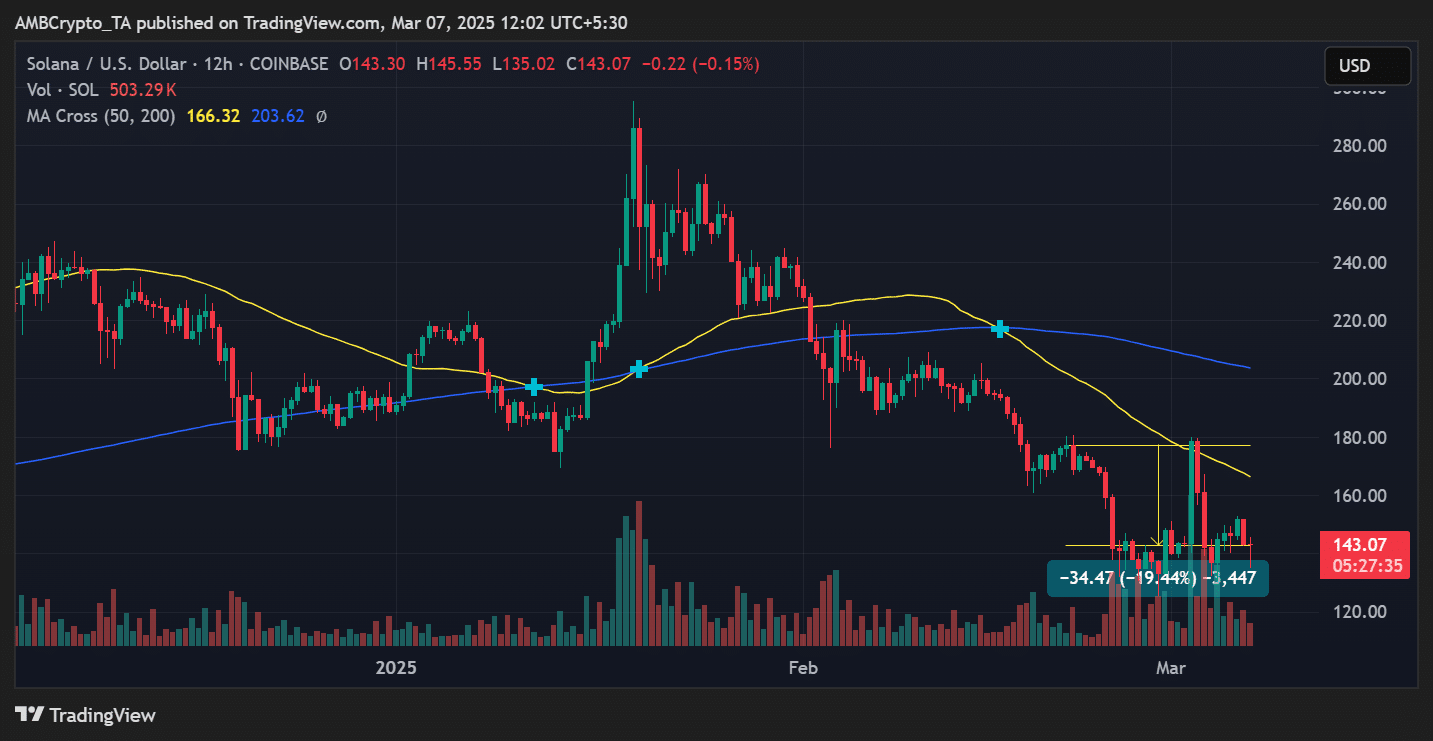

Solana worth evaluation: Can it get well?

Solana has mirrored the downtrend of Bitcoin and Ethereum however has seen extra declines within the final two weeks. The instrument confirmed a 19.44% decline from its worth vary two weeks in the past. As of this writing, SOL was buying and selling at $143.

The 50-day MA at $166 stays a powerful resistance stage. If bulls fail to push SOL above this mark, it may see additional draw back towards $135.

What’s fueling this correlation?

A number of elements drive the synchronized motion of Bitcoin, Ethereum, and Solana, together with macroeconomic circumstances, regulatory adjustments, and investor sentiment shifts.

Inflation issues and rate of interest changes considerably affect danger urge for food throughout monetary markets, impacting these belongings collectively.

Institutional buying and selling patterns additionally play a job, as giant buyers typically implement methods involving a number of belongings, creating synchronized worth shifts.

Moreover, liquidity tendencies inside the crypto market amplify this correlation. Excessive liquidity ranges allow speedy worth swings, affecting a number of belongings without delay.

What’s subsequent for BTC, ETH, and SOL?

The robust correlation amongst Bitcoin, Ethereum, and Solana highlights the significance of monitoring general market sentiment over particular person asset tendencies.

If Bitcoin holds above key assist ranges, ETH and SOL are more likely to observe. Nevertheless, failing to regain crucial Transferring Averages may lead to elevated downward stress.

Merchants ought to keep watch over resistance breakouts, as these could sign whether or not the market is primed for restoration or one other spherical of sell-offs.

Given the excessive correlation, the motion of 1 asset may point out the potential route of the whole market.