- Bitcoin slipped under $84k after a sizzling U.S inflation print

- New Trump tariffs may decide the subsequent route for the cryptocurrency

Bitcoin [BTC] briefly retraced under $84k following a warmer PCE inflation print throughout early Friday’s U.S buying and selling session. BTC’s decline adopted Nasdaq’s 2% drop. Nevertheless, gold jumped to a brand new excessive, reiterating buyers’ risk-off mode and macro uncertainty, particularly forward of President Trump’s new tariffs.

Based on Coinbase analysts, the crypto’s worth may stay range-bound ($78k-$88k) till then. They stated,

“We anticipate range-bound buying and selling no less than till April 2nd, the deadline for President Trump’s tariffs.”

The analysts additional warned that April-June have been “robust months” for crypto on a seasonal foundation. They steered lowered publicity as an ideal technique.

Bitcoin – STH misery?

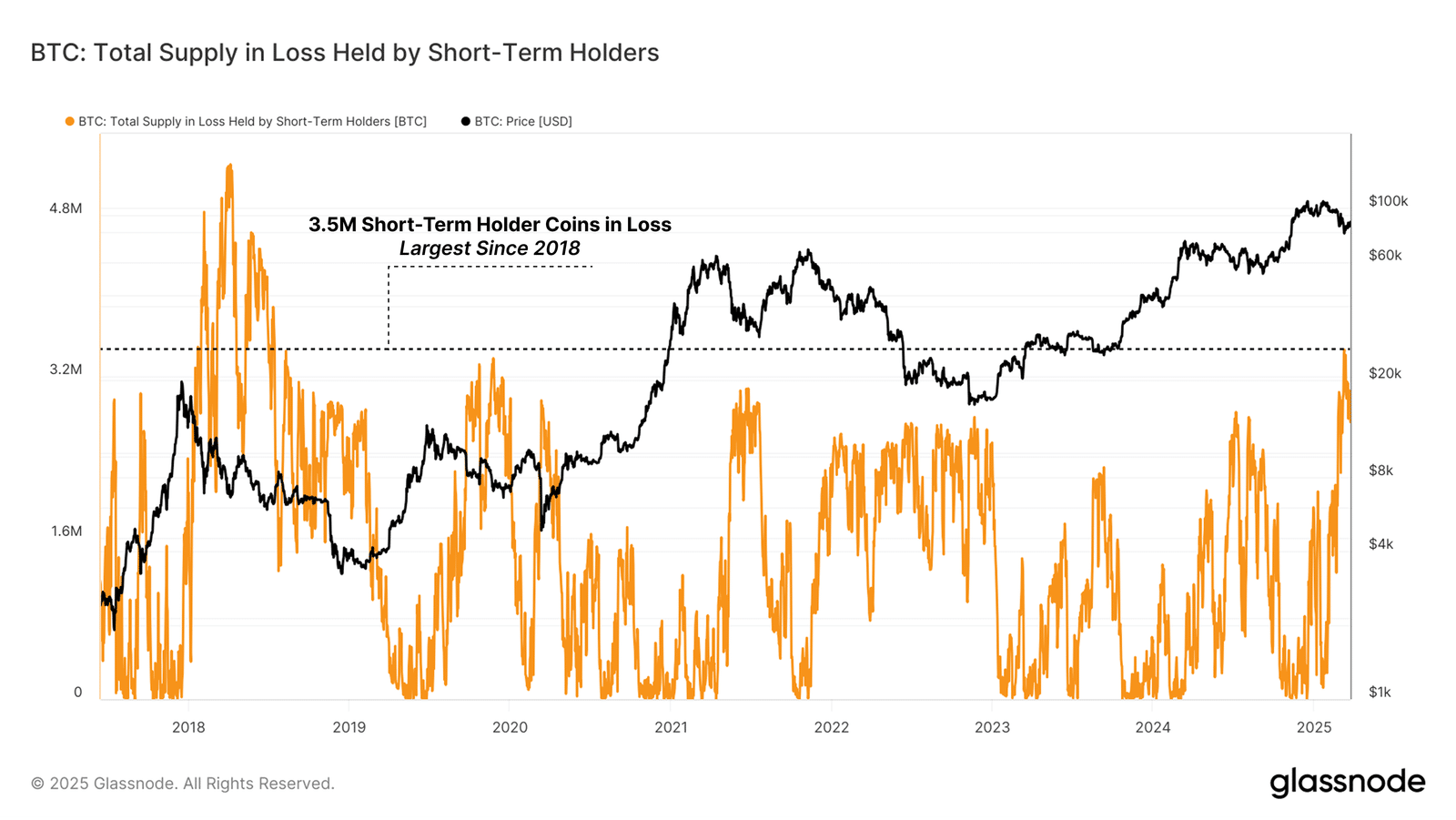

The cautious outlook was additionally evident on-chain, as per the monetary misery confronted by short-term holders (STH). These are new buyers (prime consumers) who’ve held BTC for lower than six months and sure purchased the asset above $90k or $100k.

Based on Glassnode, the provision held by STHs hit a 7-year excessive lack of 3.4 million BTC.

“Latest draw back volatility has created strenuous situations for brand new buyers, with the quantity of Quick-Time period Holder provide held in loss surging to an enormous 3.4M BTC. That is the biggest quantity of STH provide in loss since July 2018.”

The analytics agency added that the prevailing stress may heighten the “likelihood of a market-wide capitulation occasion.”

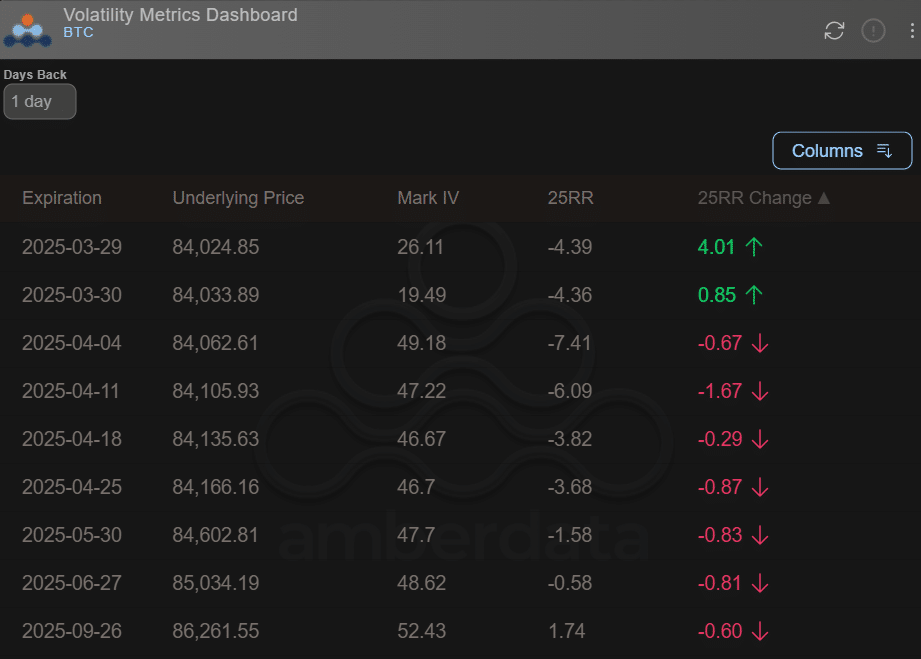

Even Choices merchants gave the impression to be positioned for additional draw back threat eventualities within the brief time period. Based on Amderdata’s 25-delta threat reversal (25RR) indicator, for example, Choices expiries for 04 April (-7.41) and 11 April (-6.0) have been unfavourable, on the time of writing.

Supply: Amberdata

This hinted at an uptick in hedging exercise and extra demand for put choices (bearish bets) for the subsequent two weeks. Merely put, speculators expect potential dips in early April.

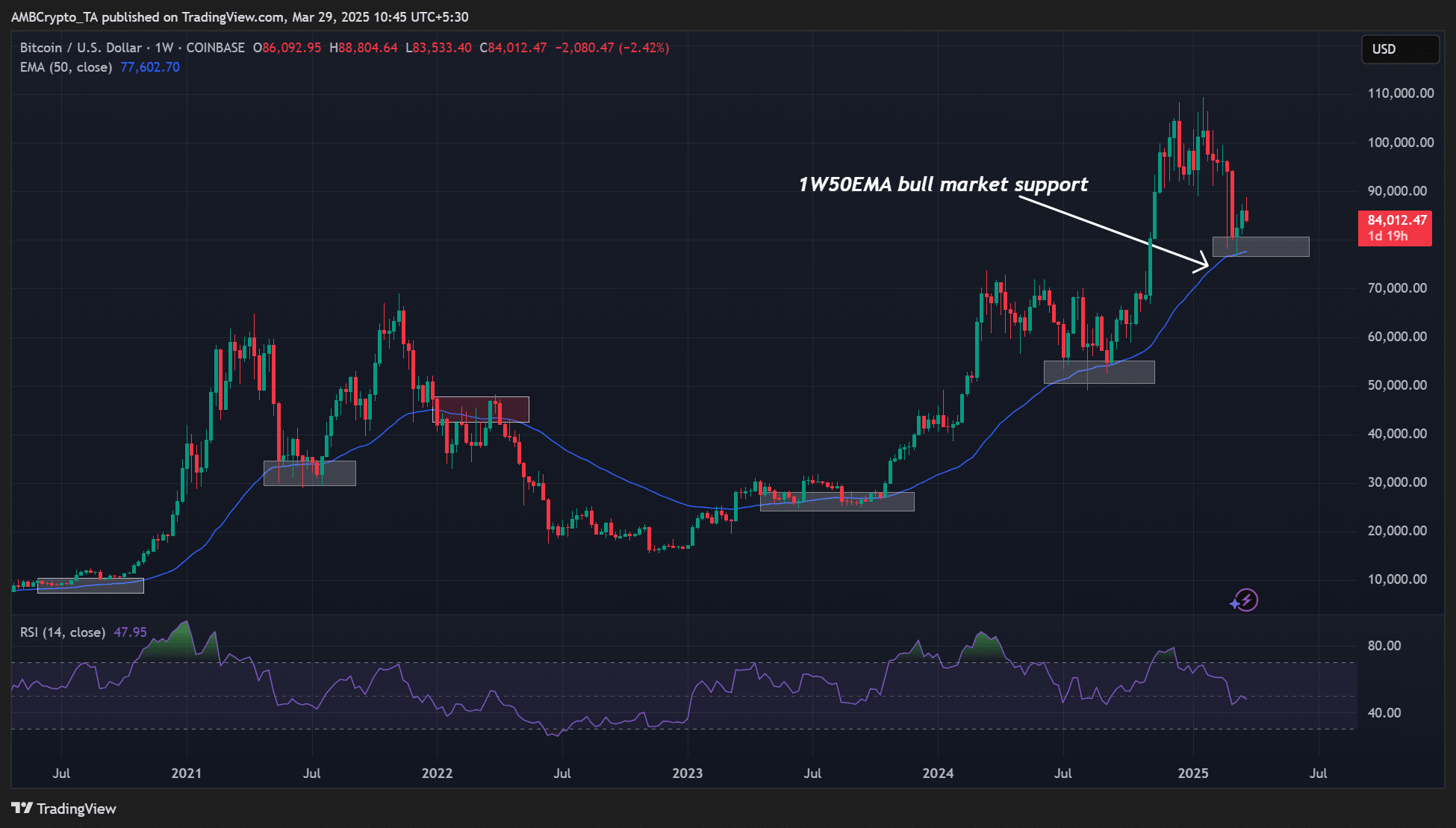

Price noting, nonetheless, that it will not be all gloomy. When zoomed out on the weekly worth charts, BTC defended the weekly 50-EMA (exponential transferring common, 1W50EMA). This dynamic degree was a key help up to now bull runs of 2021 and can also be one within the present 2023-2025 cycle.

Merely put, Bitcoin’s total market construction remains to be bullish. Nevertheless, if a sustained break under 1W50EMA happens, the asset might be deemed to be in a bearish pattern – A warning shot to bulls.

So, it’s a key degree to observe in Q2.