- Revenue-taking on Bitcoin has continued to shrink, as sellers out there waned

- Market liquidity flows revealed that Bitcoin buyers could possibly be gaining confidence as soon as once more

Because the cryptocurrency market features floor, Bitcoin [BTC] has adopted that sample, with a 3.22% rally throughout this era. This appeared to point that market confidence is rising. Nonetheless, that’s not all as several concurrent developments appeared to trace {that a} rally could also be brewing. Particularly as indicators of vendor fatigue start to floor.

Naturally, when evaluating the prevailing market efficiency to previous episodes of turbulence, the setup feels eerily acquainted.

Vendor exhaustion is nearing

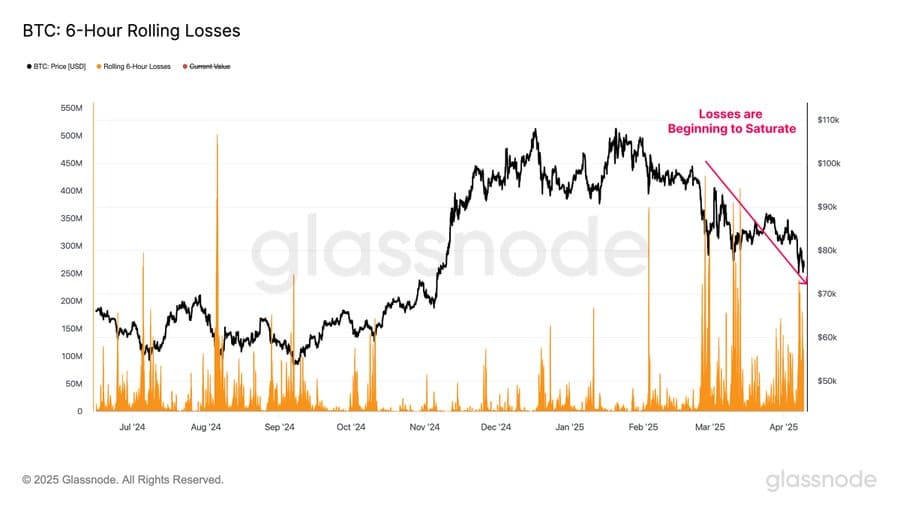

Through the newest market drawdown – one of many largest in crypto market historical past – buyers recorded main losses of upto $240 million. Such episodes sometimes invite aggressive promoting stress. On this specific case, the realized income have continued to shrink.

This contraction could possibly be an indication that sellers could also be evidently working low on ammunition.

In actual fact, it pointed to exhaustion setting in amongst market members – A situation that usually precedes a rebound.

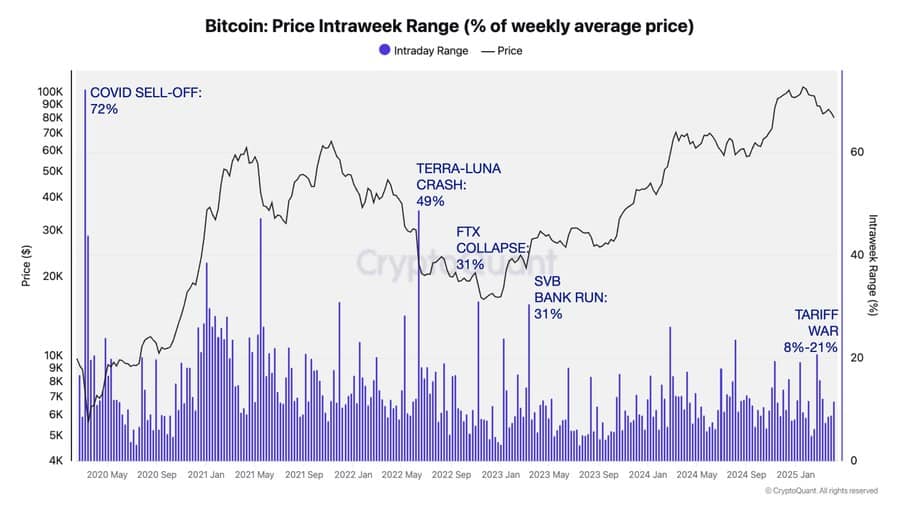

After we juxtapose the present setup with earlier capitulation phases, just like the U.S. tariff-triggered slide, the Covid-19 crash, the Terra-Luna and FTX meltdowns, and even the SVB banking scare, the resemblance is putting.

All of them have been adopted by durations of renewed shopping for power.

To supply clearer steering on potential market actions, AMBCrypto examined extra metrics to grasp the actions of main buyers. We found {that a} important rebound could quickly be approaching.

A serious rebound could possibly be nearer

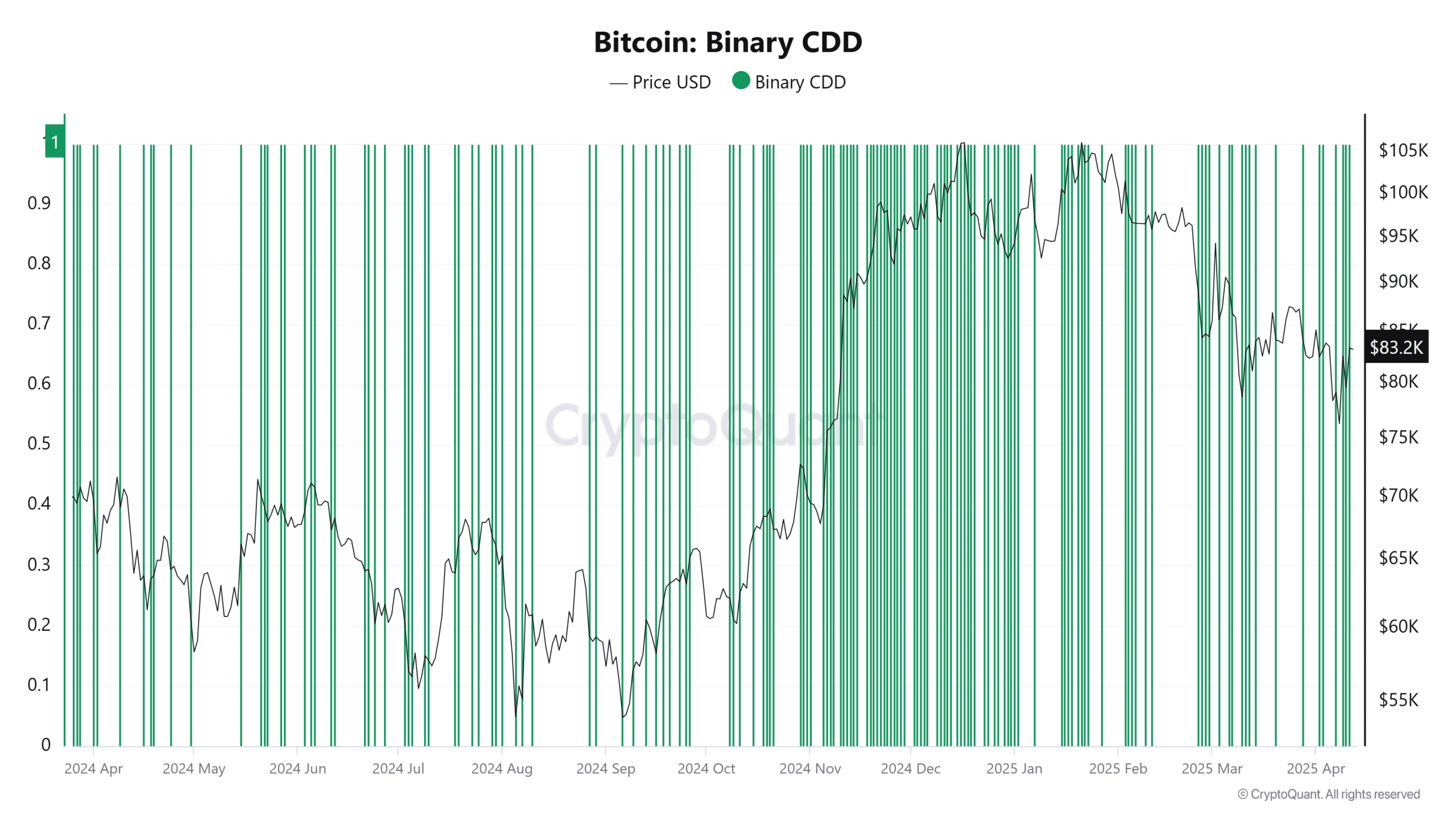

On prime of that, the Binary Coin Days Destroyed (CDD) metric tells us a narrative of its personal.

On the time of writing, it was flashing a studying of 1 – Indicative of the truth that long-term holders, typically the stoic believers in Bitcoin, have joined the promoting cohort.

That’s a potent sign. When long-term holders offload post-drop, it’s both to lock in features or minimize losses. These are each indicators of capitulation.

Now, although the market sentiment could also be skewed in direction of promoting, the tempo has been slowing down.

This mix of metrics—shrinking realized income, a Binary CDD studying of 1, and historic parallels—all converge in direction of a well-known narrative. It’s – Vendor fatigue is right here and a aid rally might very properly be the subsequent chapter.

In actual fact, constructing on indicators of vendor exhaustion, long-term holders could now be nearing their last section of promoting.

They might quickly maintain onto the remaining. That’s very true for establishments, who’re shifting gears too.

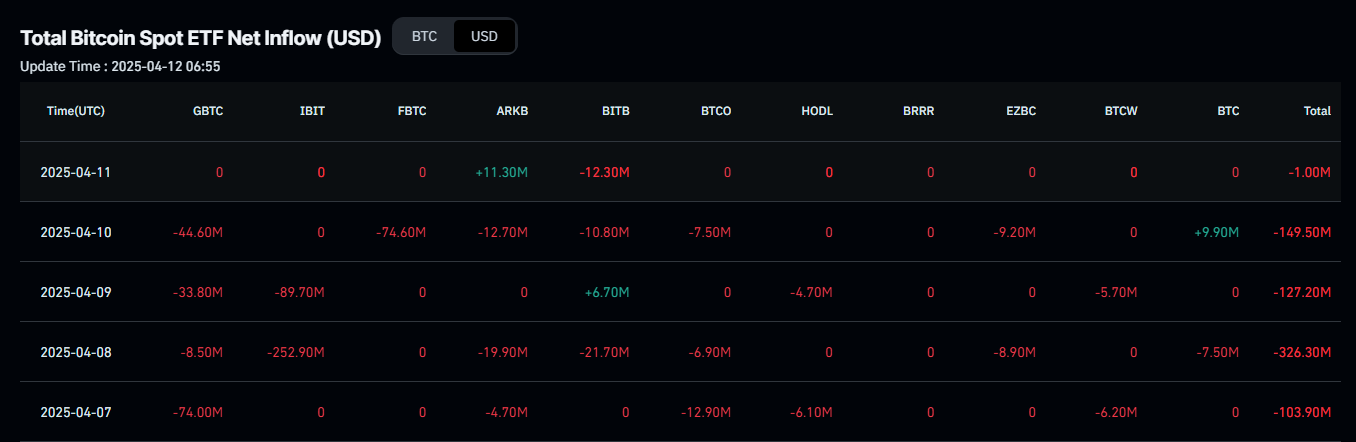

For instance – Institutional netflows have dried up. Solely $1 million in Bitcoin was bought not too long ago, down from a $176.72 million four-day common.

That’s an enormous drop. Naturally, this implies confidence is creeping again into the fingers of big-money gamers. These establishments don’t commerce frivolously. Their actions typically form Bitcoin’s subsequent main transfer.

Within the spot market, CryptoQuant’s information highlighted a brand new pattern. Netflows flipped unfavourable – All the time a bullish sign. That advised that accumulation is on and that Bitcoin is being moved into non-public wallets and away from exchanges.

On this section, 1,959 BTC have been scooped up – Value round $162 million. Common purchase worth? $83,000. If this tempo holds, Bitcoin might proceed absorbing the remaining promote stress. A breakout could also be nearer than anticipated.