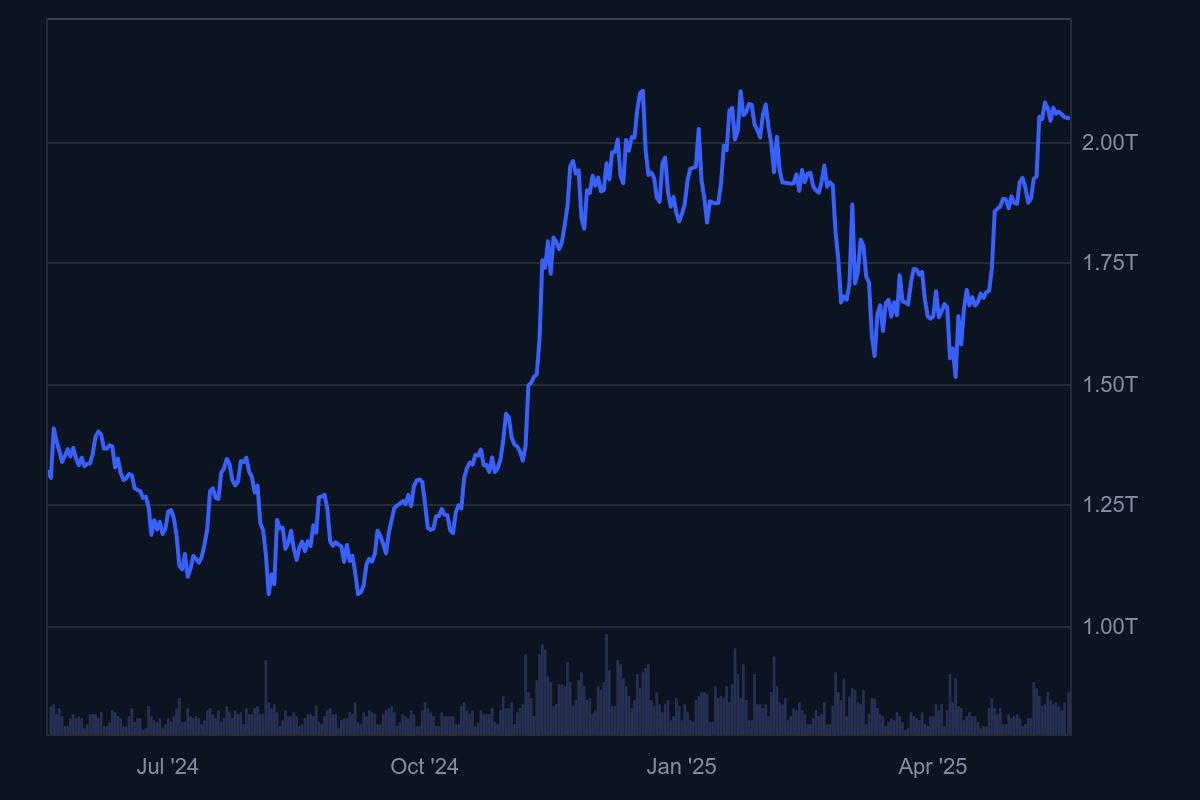

- BTC surged above $100K, permitting the asset to reclaim the $2 trillion market cap stage.

- Now, BTC is extra invaluable than Meta, Google, and should flip Amazon quickly.

Bitcoin’s [BTC] rebound above $100K in Q2 2025 tipped it to reclaim the $2 trillion market measurement, making it extra invaluable than Google and Meta.

The world’s largest digital asset first hit the milestone late final yr, however Q1 2025 headwinds contracted its market measurement to almost $1.5 trillion.

Given the renewed risk-on sentiment after the China-U.S. commerce deal, the asset reclaimed the $2 trillion market cap once more, making it the sixth most respected commodity globally.

BTC to turn out to be a prime 5 world asset

At press time, the asset traded at $102K, and the market cap was $2.046 trillion.

There have been solely seven belongings with a market measurement of over two trillion. Google ranks seventh whereas Amazon was within the prime 5 with $2.182 trillion.

Supply: Companies Marketcap

Assuming the market sizes of the highest 5 stay fixed, BTC would want to hit $110K to flip Amazon because the fifth-largest asset.

To switch Apple from the fourth place at a market cap of $3.155 trillion, the BTC value should surge above $158K.

For the reason that $110K-$200K range has been cited as a possible BTC goal by December 2025, the asset might turn out to be the fourth most respected asset on the earth this yr.

So what’s driving BTC’s explosive market progress?

Based on CryptoQuant, the U.S. spot BTC ETF inflows had been the principle catalyst for the expansion, per realized capital (realized cap).

Between April lows and BTC’s present stage above $100K, the realized cap surged from $869 billion to $906 billion. In brief, over $36 billion in new capital flowed into the market prior to now six weeks.

CryptoQuant noted that the expansion development in realized cap might push BTC to a brand new ATH (all-time excessive).

“If the development of accelerating realized capitalization continues, suggesting ongoing investor confidence in Bitcoin, it is rather probably that Bitcoin will surpass its ATH within the close to future.”

If the projection is validated, BTC might at the very least knock out Amazon from the highest 5 world asset place.