- Whale exercise and technical breakout sign a possible Bitcoin value surge.

- Institutional help and optimistic sentiment strengthen Bitcoin’s market outlook.

Bitcoin [BTC] continues to draw heavy institutional curiosity, and its value motion displays this rising consideration.

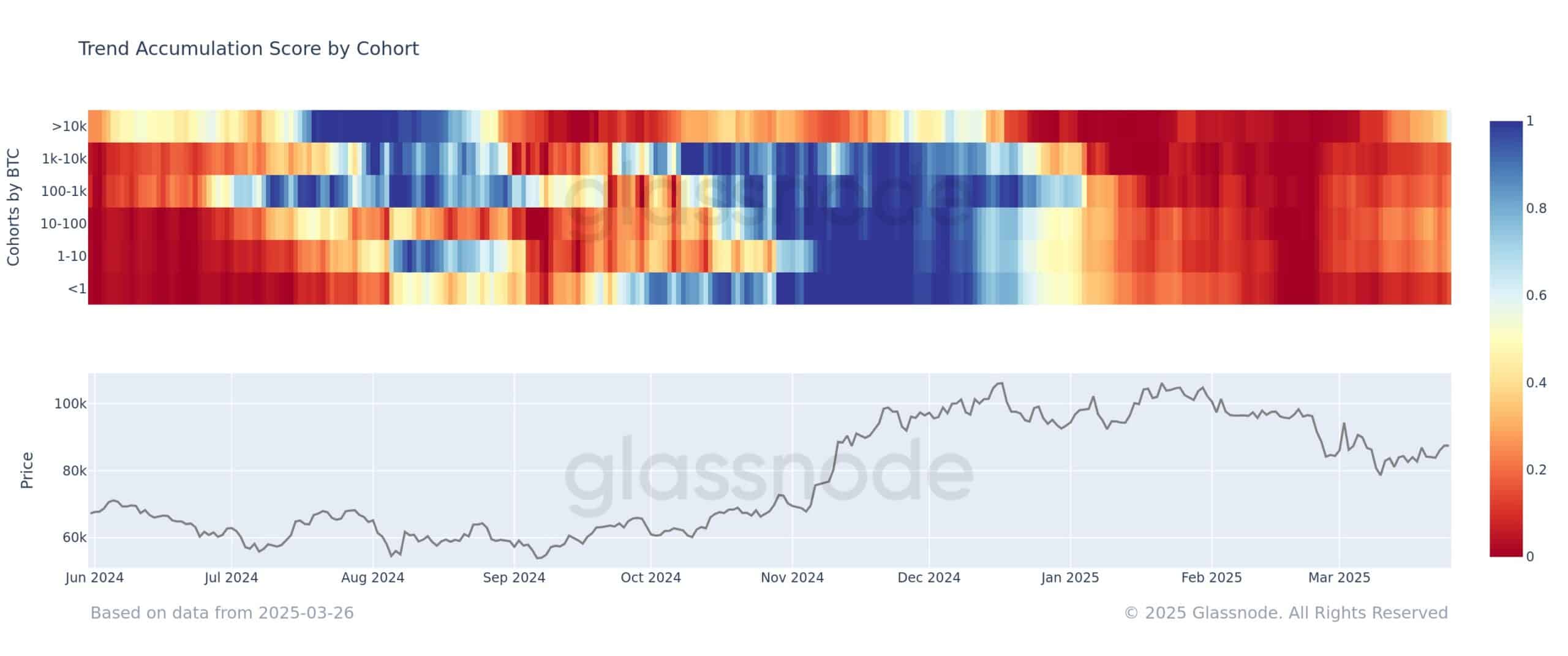

Whales holding over 10,000 BTC have elevated their Accumulation Development Rating above 0.5, a transparent indication of regular shopping for.

The pattern signifies that giant traders are persevering with to build up BTC whereas smaller holders are nonetheless internet sellers, as seen within the cohort-level chart.

Bitcoin’s current surge in exercise aligns with these developments, and market analysts are eagerly watching the subsequent transfer.

What’s fueling Bitcoin’s upward momentum?

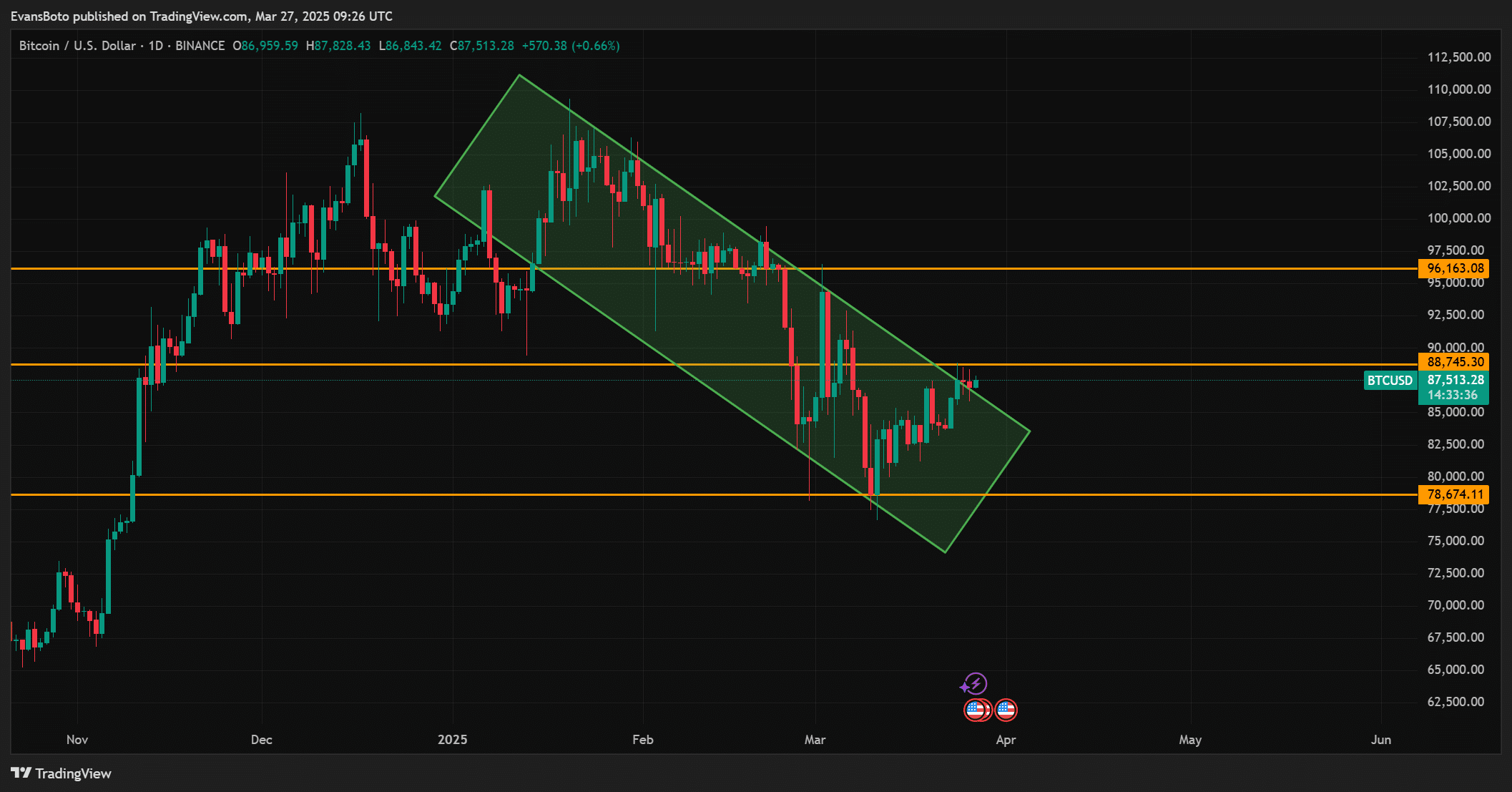

Bitcoin’s value just lately broke out of a descending wedge sample, signaling a possible bullish pattern.

The chart clearly reveals that BTC has been pushing upward, trying to beat important resistance ranges at $96,163.08 and $95,000.

At press time, Bitcoin trades at $87,521.46, marking a 0.48% lower within the final 24 hours.

The breakout from the wedge sample presents a chance for BTC to succeed in new highs, and if it efficiently surpasses these resistance ranges, an extra upward transfer might be in retailer.

Market contributors are keenly centered on whether or not BTC can consolidate above key help zones.

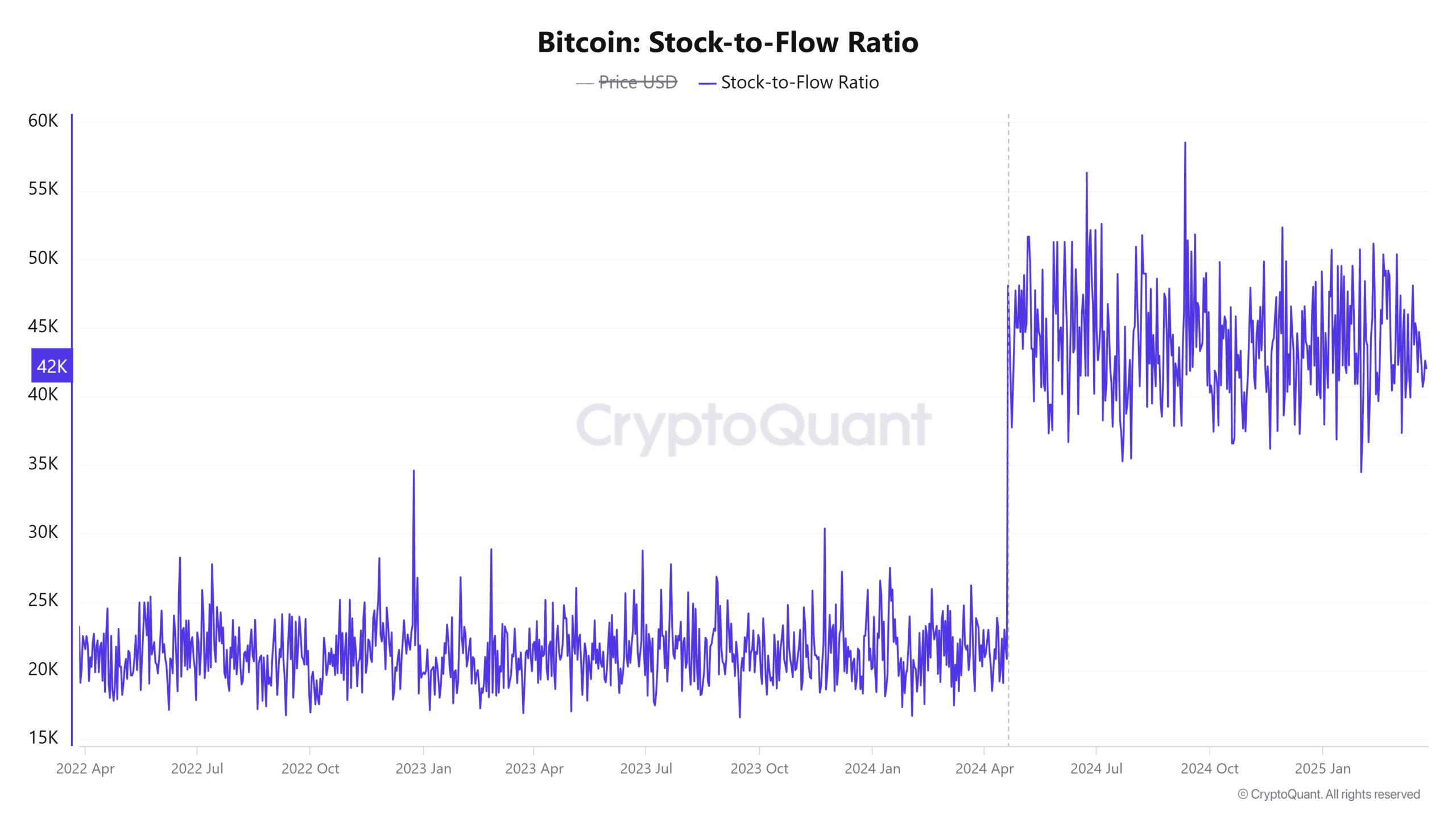

Moreover, Bitcoin’s stock-to-flow ratio at the moment sits at 907.0911K, which represents a 42.86% decline. This metric helps measure Bitcoin’s shortage by evaluating the circulating provide to newly mined cash.

The decline within the stock-to-flow ratio signifies that the shortage of BTC is rising, probably making it extra helpful sooner or later.

The diminished ratio is an indication that fewer cash are being made out there available on the market, suggesting that BTC’s worth might rise as its shortage grows.

That is notably related as institutional traders and whales proceed to carry massive quantities of BTC, additional driving the narrative of accelerating shortage.

How are whales and establishments shaping BTC’s future?

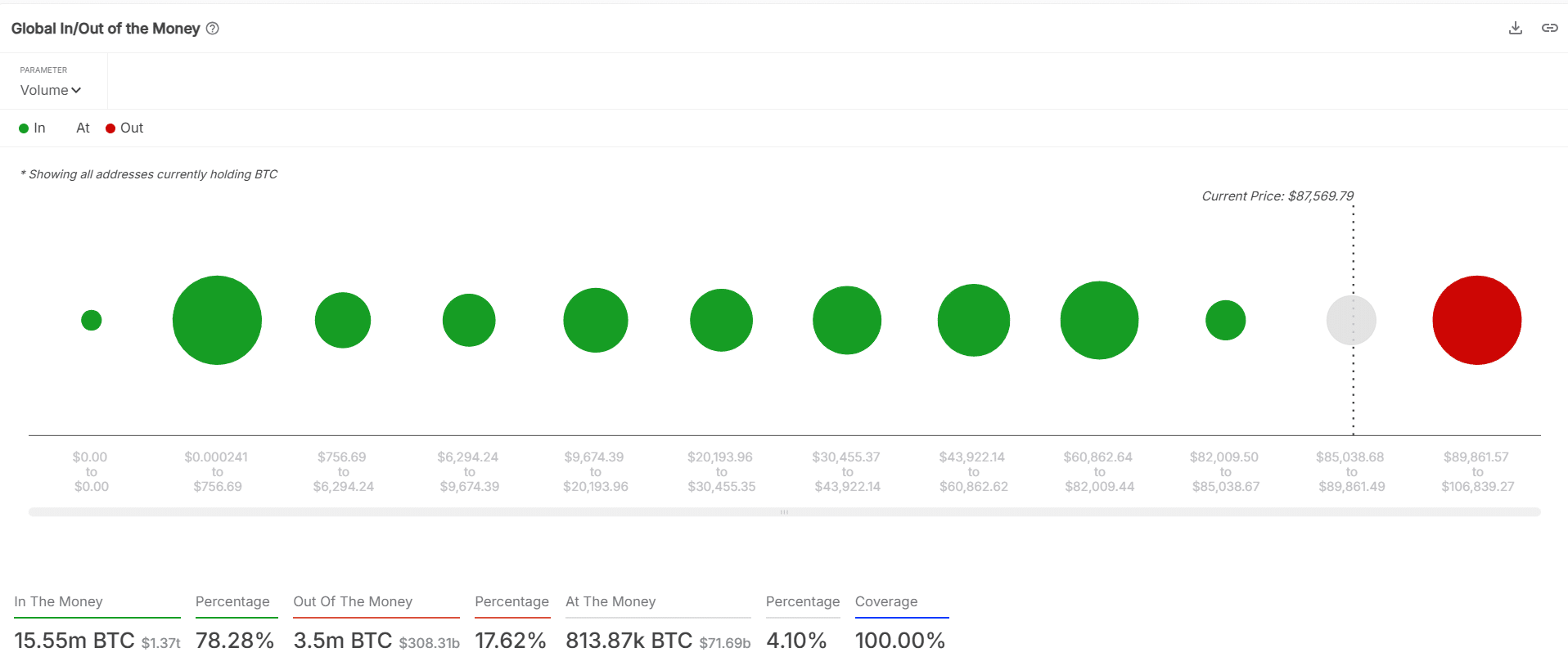

The in/out of the cash chart for BTC reveals that 77.59% of Bitcoin holders are at the moment in revenue, supporting the notion that almost all traders are holding robust.

This means a optimistic sentiment among the many majority of holders, which may assist stabilize the market.

Moreover, BTC’s social sentiment is strongly bullish. On the DC Blockchain Summit 2025, Senator Cynthia Lummis emphasised Bitcoin’s function in lowering nationwide debt if held for 20 years.

In the meantime, Michael Saylor highlighted the significance of BTC on the worldwide stage, calling it the “fashionable digital gold rush.”

Such statements from influential figures contribute to the rising institutional help for Bitcoin.

Conclusion

Bitcoin’s rising whale exercise, optimistic technical patterns, and powerful institutional backing recommend that it’s certainly poised for a possible value surge.

The buildup pattern amongst whales, coupled with favorable technical indicators and the continuing help from institutional figures, signifies that BTC may see additional development.

Due to this fact, the proof strongly factors towards BTC persevering with its upward trajectory within the coming months.