- Bitcoin was buying and selling at round $98,000 at press time.

- Sentiment round it remained optimistic.

As Bitcoin [BTC] inches nearer to the psychological $100,000 milestone, market individuals are intently monitoring on-chain metrics to decipher the dynamics at play.

Whereas profit-taking actions by long-term holders (LTHs) are evident, the surge in demand from spot Bitcoin ETFs is balancing the equation.

The interaction between these components might decide the trajectory of BTC’s value within the brief to medium time period.

Bitcoin’s long-term holder exercise and profit-taking

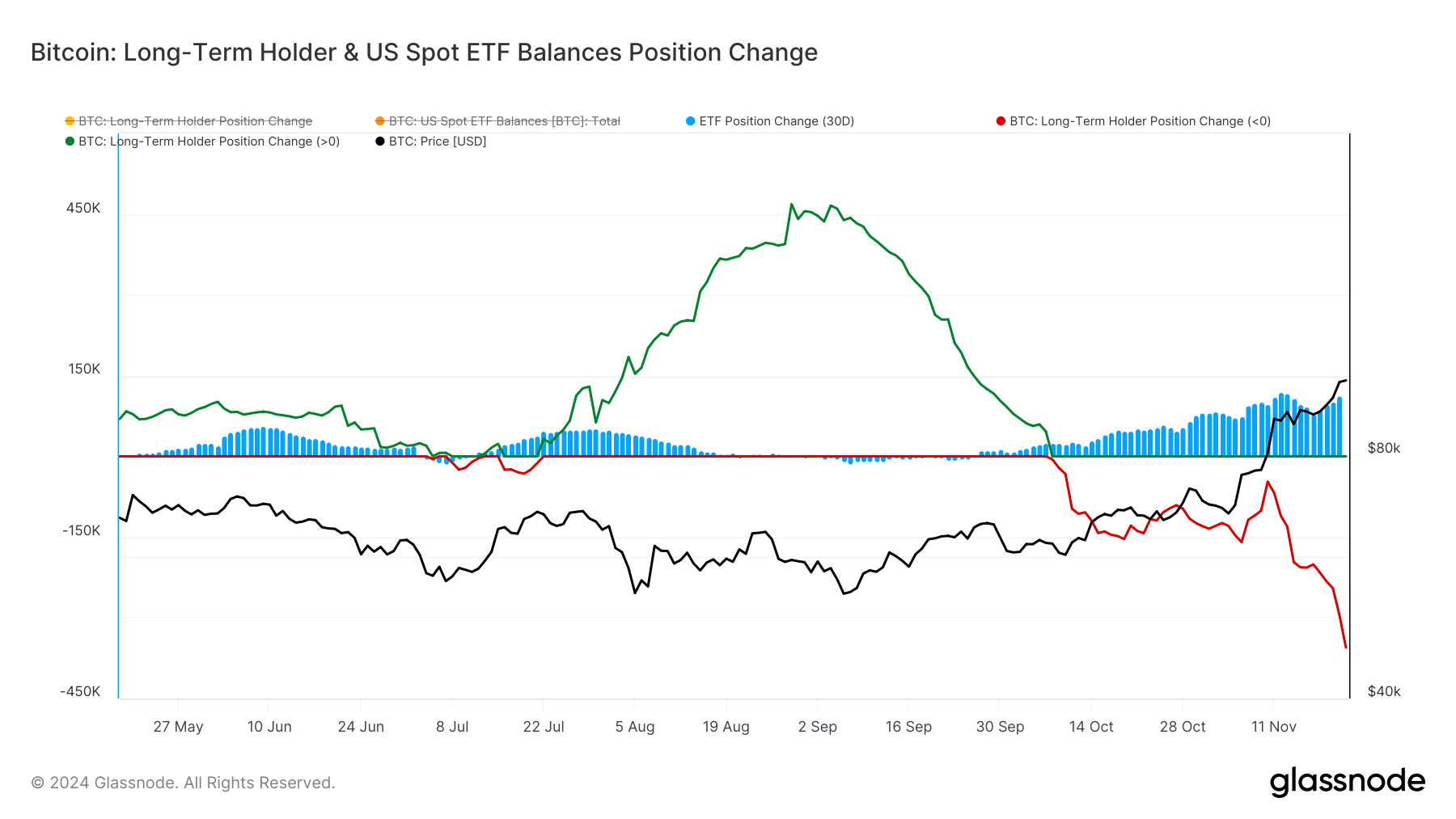

The conduct of LTHs is essential in understanding Bitcoin’s market stability. Evaluation of information from the Lengthy-Time period Holder Place Change chart indicated a notable uptick in distribution.

Over the previous few weeks, there was a pointy decline in LTH internet positions. The Glassnode chart confirmed important profit-taking actions marking this part.

The shift from accumulation to distribution is widespread throughout bull markets, as LTHs capitalize on their long-term holdings.

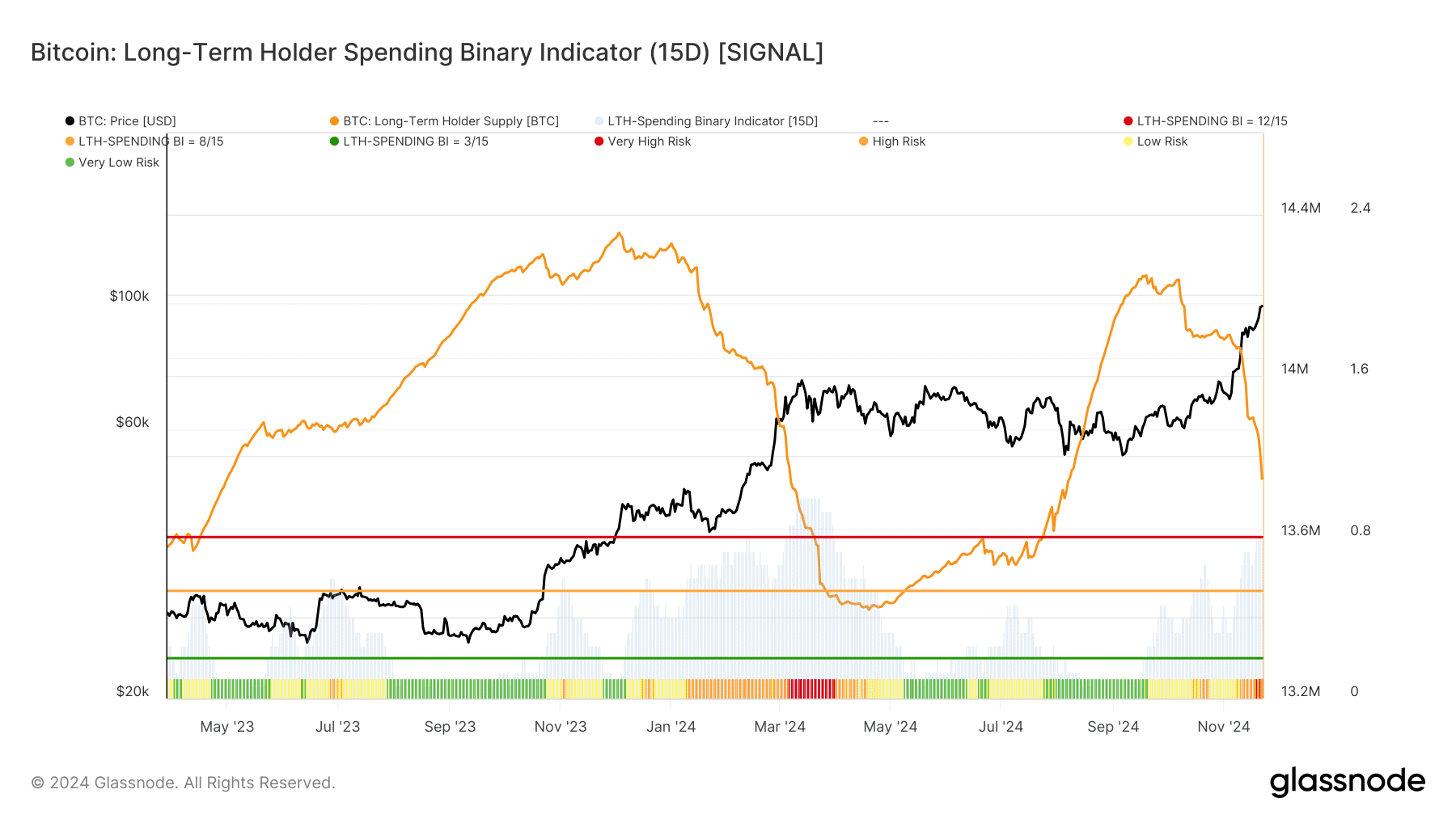

Including context to this pattern is the Lengthy-Time period Holder Spending Binary Indicator. The metric, which indicators LTHs’ threat ranges by way of revenue realization, at present displays a “Excessive Threat” zone at round 0.8.

Traditionally, comparable threat ranges have coincided with native value peaks, suggesting warning for buyers banking on a sustained rally past $100,000.

Bitcoin ETF demand balances sell-offs

Counterbalancing the sell-off by LTHs is the sturdy demand for Bitcoin ETFs. The Spot ETF Place Change chart highlights constant inflows, with over 450,000 BTC allotted to ETFs over the previous month.

This inflow underscored the urge for food of institutional buyers, who view ETFs as a simplified entry level into the crypto market.

The ETF flows are enjoying a pivotal function in absorbing the promoting strain.

In October, when LTH distribution intensified, ETF holdings noticed their sharpest rise in months, indicating that demand from new individuals and establishments may maintain Bitcoin’s value momentum.

BTC indicators sign bullish continuation

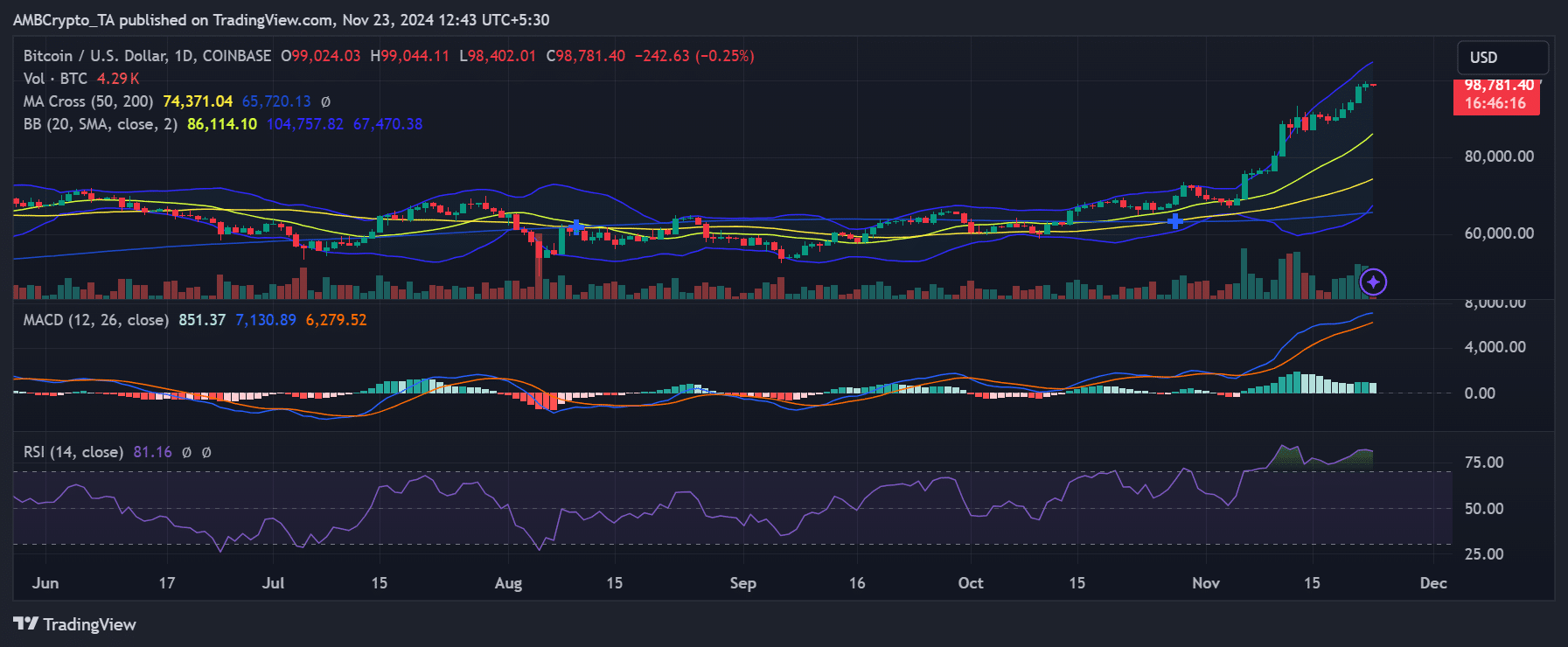

Bitcoin’s every day chart painted a promising technical outlook.

The value remained effectively above key transferring averages, with the 50-day and 200-day Shifting Averages, offering sturdy assist ranges at $74,000 and $65,000, respectively.

Moreover, the Bollinger Bands instructed heightened volatility, with BTC buying and selling close to the higher band—an indication of bullish momentum.

Momentum indicators just like the MACD and RSI additional verify the optimistic sentiment.

The MACD was in bullish territory, with the histogram exhibiting rising momentum, whereas the RSI sat at 81, indicating overbought circumstances.

Regardless of the overbought studying, historic value tendencies recommend Bitcoin can maintain rallies underneath such circumstances throughout bull runs.

The interaction between profit-taking by long-term holders and demand from spot Bitcoin ETFs highlights a market balancing act.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Whereas the chance of a correction looms resulting from elevated LTH exercise, the inflow of institutional capital through ETFs might assist Bitcoin’s bullish momentum.

As BTC approaches $100,000, these metrics can be essential in shaping its path ahead.