Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The bond market, usually thought to be the bedrock of world monetary stability, is exhibiting indicators of extreme pressure, with market contributors on X sounding the alarm over what many are calling a “damaged” system. Jim Bianco of Bianco Analysis, a distinguished voice in monetary evaluation, printed a stark warning on X: “One thing has damaged tonight within the bond market. We’re seeing a disorderly liquidation. If I needed to GUESS, the idea commerce is in full unwind.”

Bianco highlighted the severity of the scenario, noting that the 30-year US Treasury yield spiked 56 foundation factors in simply three buying and selling days since Friday, a transfer he described as historic: “One thing has damaged tonight within the bond market. We’re seeing a disorderly liquidation. If I needed to GUESS, the idea commerce is in full unwind. […] The final time this yield rose this a lot in 3 days (shut to shut) was January 7, 1982, when the yield was 14%. This type of historic transfer is attributable to a pressured liquidation, not human managers make selections concerning the outlook for charges at midnight ET.

This sentiment was echoed throughout the platform, with Cathie Wooden of ARK Make investments stating, “this swap unfold is suggesting critical liquidity points within the US banking system. This disaster is asking out for some type of Mar-a-Lago Accord on free commerce, in tandem with critical assist from the Fed? No extra time to waste.”

Equally, Daniel Yan, the founder and CIO of Kryptanium Capital, a managing companion at Matrixport Ventures warned, “First, we now have a tariff pushed fairness meltdown. Then the bond foundation began to unwind and appears ugly now. The final straw is the credit score market – if we begins to see the HY index above 6%, then most likely an emergency Fed intervention is on the nook, or, an actual disaster.”

Associated Studying

Monetary journalist Charlie Gasparino added to the refrain, noting, “Now stuff is getting fascinating and scarily so; depraved spike in lengthy dated bond yields portends an unwind of an enormous commerce, probably a hedge fund dropping cash and imploding or a significant foreigner creditor dumping treasuries in retaliation to Trumps commerce battle, none of that are good. I’m certain Scott Bessent’s cellphone is ringing off the hook proper about now. Buckle up for the open”

Monetary commentator Peter Schiff added, “As I warned earlier, the Treasury market is crashing. The yield on the 10-year simply hit 4.5%, and the yield on the 30-year simply hit 5%. With out an emergency price minimize tomorrow morning and the announcement of an enormous QE program, tomorrow could possibly be a 1987-style inventory market crash.”

Macro analyst Alex Krueger agrees: “The lengthy bond is crashing. US lengthy rates of interest are actually significantly above Trump’s inauguration day. That’s how Trump & Bessent taking pictures themselves within the foot seems like. With a shotgun.”

What’s Occurring?

On the coronary heart of this turmoil supposedly lies the idea commerce, a leveraged technique employed by hedge funds to take advantage of worth discrepancies between Treasury futures and the underlying bonds. Bianco posits that this commerce, which ballooned in recognition throughout years of ultra-low rates of interest and quantitative easing, could now be in a full unwind.

Associated Studying

The fast deleveraging has precipitated bond costs to plummet as yields spike, eroding the safe-haven standing of US Treasuries. As yields soar to five.00% the implications for the broader monetary ecosystem, together with the Bitcoin and crypto markets, are profound.

This growth is especially alarming at a time when monetary markets are already reeling from President Donald Trump’s newly introduced global tariff regime. Trump’s tariffs have exacerbated fears of inflation and a recession.

Notably, the bond market’s dysfunction shouldn’t be occurring in isolation. Crude oil costs have collapsed by 21% since what Bianco refers to as “Liberation Day,” falling to $57 per barrel, the bottom degree since April 2021. This simultaneous crash in bond costs and crude oil is unprecedented, signaling broader systemic stress.

Implications For Bitcoin And Crypto

For the Bitcoin and crypto markets, this upheaval presents each dangers and alternatives. Bitcoin and different digital belongings have usually been touted as hedges against traditional financial instability, but their efficiency in latest months has proven a rising correlation with threat belongings like equities.

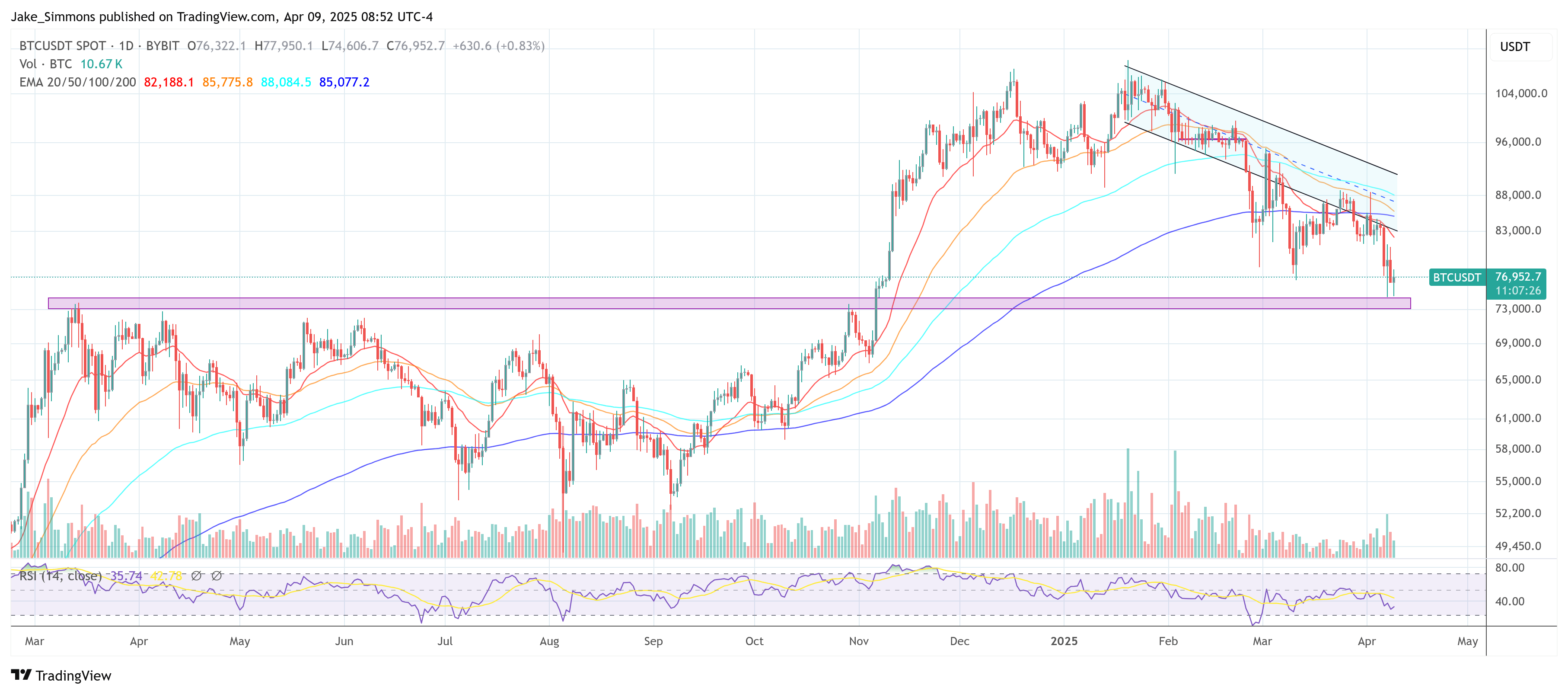

As S&P futures tumbled by -12% over the previous 4 buying and selling periods amid the bond market rout, BTC is down -8% because it faces a spillover impact. The US Dollar Index (DXY), which has risen since Thursday’s low, signifies web overseas shopping for into US markets, countering hypothesis that China is offloading Treasuries to “punish” the US over tariffs.

Bianco argues that if China had been certainly promoting Treasuries en masse, the greenback would doubtless be declining, not appreciating. This implies that the first driver of the bond market sell-off is home, doubtless tied to the pressured liquidation of leveraged positions relatively than overseas intervention.

Amid this turmoil, requires Federal Reserve intervention have grown louder. Some market contributors on X have speculated about the opportunity of an emergency price minimize to stem the bleeding, one thing which could possibly be extraordinarily bullish for Bitcoin.

“Is it foreigners dumping? The idea commerce blowing up? Inflation fears? Nobody is aware of for certain.

However look previous the “why,” and all of it results in the identical fork within the street: Fed intervention—or web curiosity expense blasts by means of $1 trillion,” Bitcoin skilled Sam Callahan writes through X.

As reported earlier today by Bitcoinist, Bitwise Chief Funding Officer (CIO) Matt Hougan argues that Bitcoin may gain advantage considerably from the Trump administration’s push towards a weaker greenback.

Bitcoin commentator Stack Hodler added through X: “This isn’t 2008. It’s worse. The World Sovereign Debt bubble is bursting proper in entrance of us. Two choices: Whole collapse… OR the Fed buys every part, institutional credibility hits new lows, impartial reserve belongings gold & Bitcoin take the treasury protected haven bid and full ship.”

At press time, Bitcoin traded at $76,952.

Featured picture created with DALL.E, chart from TradingView.com