- BTC has dropped by 6.54% over the previous 24 hours.

- Bitcoin’s market may very well be overheated, though different indicators counsel a possible rebound.

Over the previous 48 hours, as Trump commerce wars escalate in North America, the crypto market has been hit the toughest. Probably the most affected crypto property is Bitcoin [BTC].

Over this era, Bitcoin has dropped to a low of $91k for the primary time in 2025. The latest market crash has left key stakeholders speaking over Bitcoin’s future trajectory.

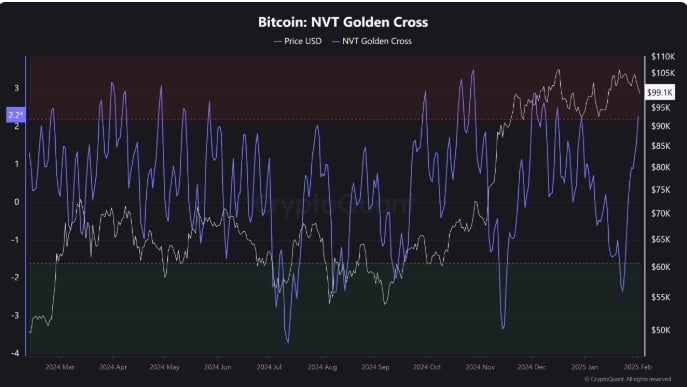

Bitcoin’s NVT Golden reaches a important degree

In keeping with CryptoQuant, NVT Golden Cross exhibits that the Bitcoin market is at present overheated and dangers a market bubble.

With the Golden Cross spiking to present ranges to settle at 2, it implies that bears are trying to take over the market.

When the Golden Cross reaches this degree, it alerts a possible sustained downward stress. This phenomenon has been witnessed over the previous two days as American traders flip bearish.

Surpassing the important threshold implies {that a} downward momentum is constructing and bears are actually rising.

What do different indicators counsel?

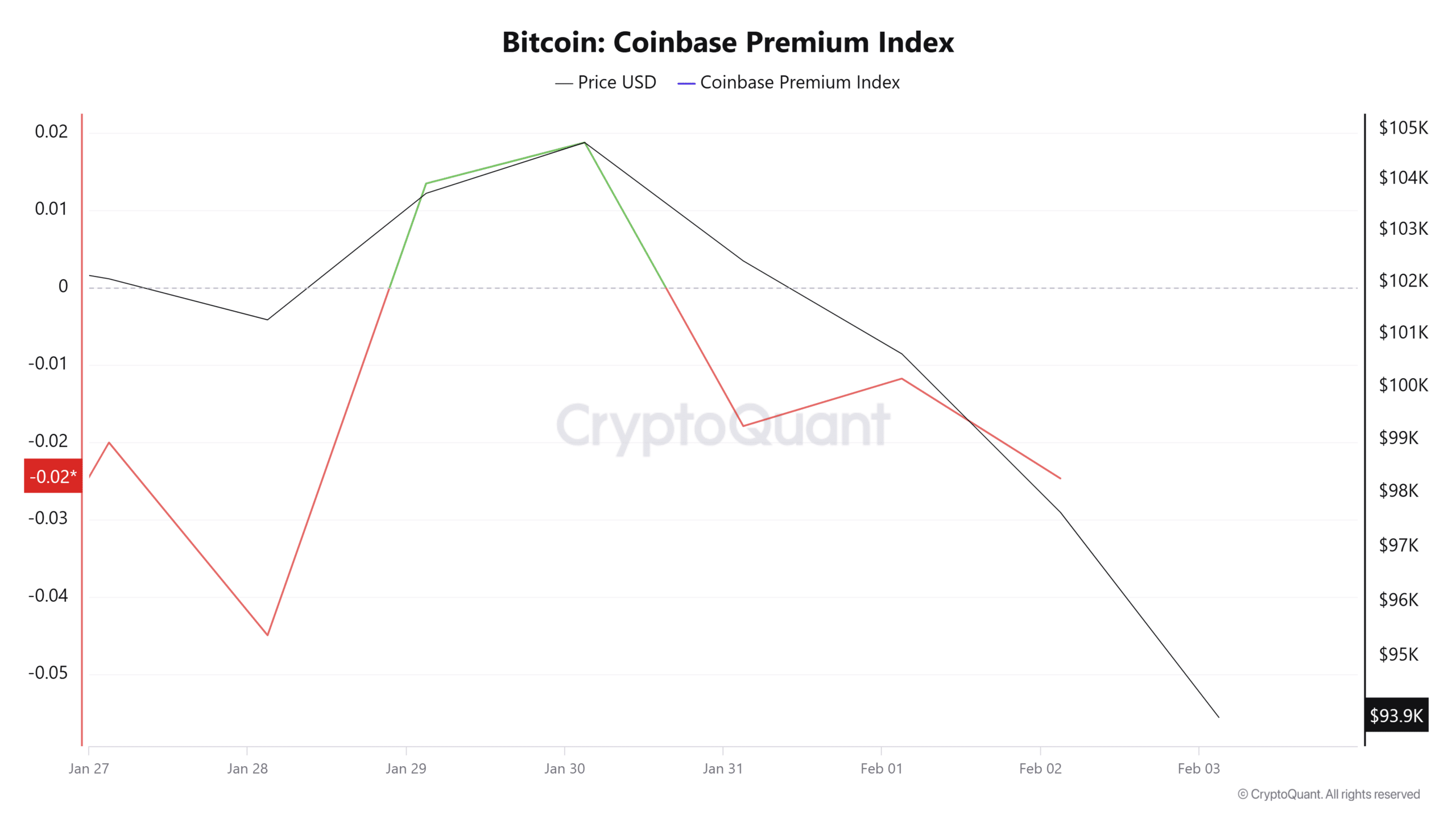

Whereas the latest worth motion is a trigger for alarm, key indicators counsel that different areas excluding the U.S. stay optimistic.

As such, the latest correction may very well be a short-term drop earlier than the market finds a method out of the present state of affairs.

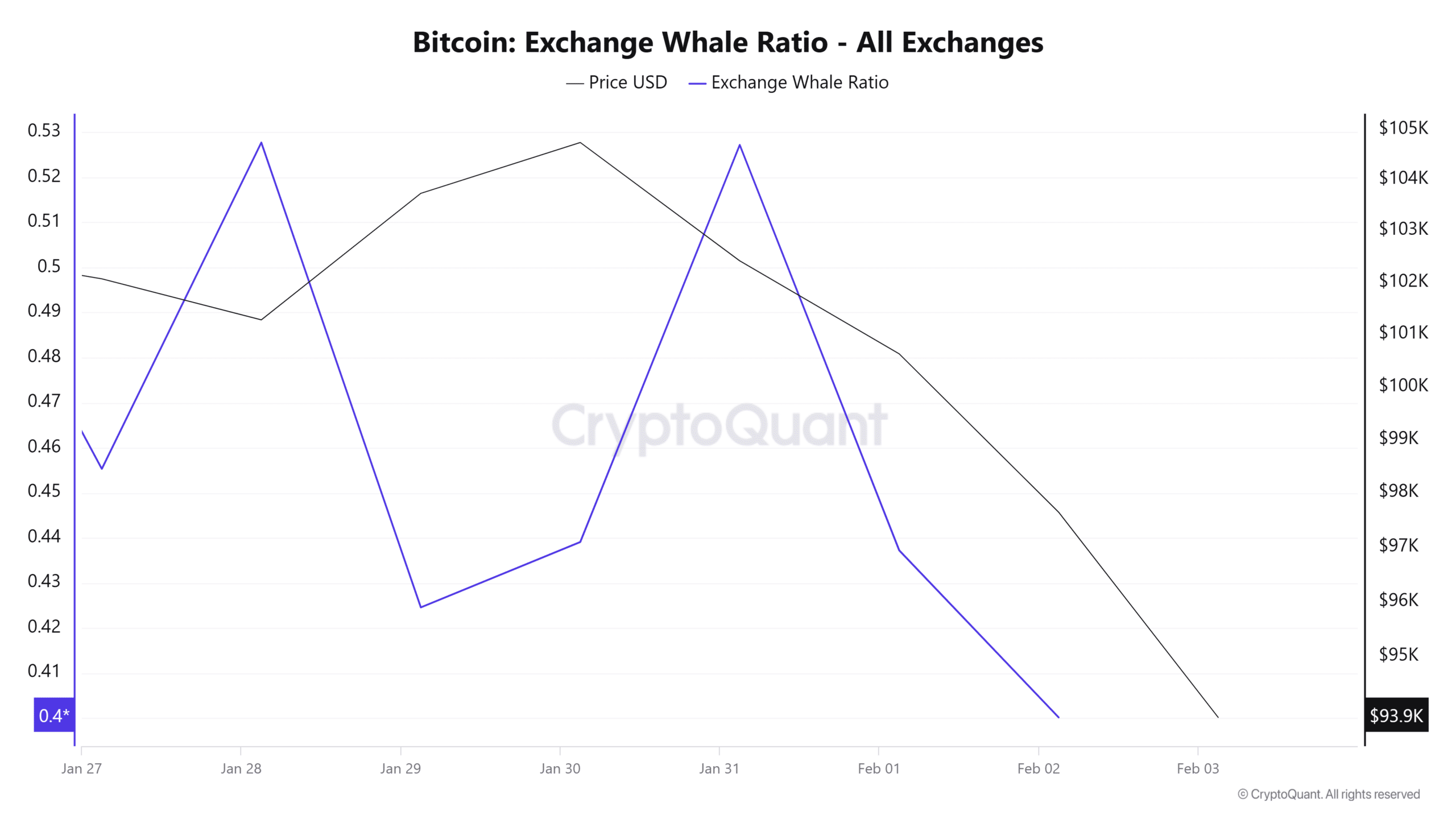

For instance, Bitcoin whales are nonetheless bullish and proceed to maintain their property off exchanges. As such, the Trade Whale Ratio has dropped to succeed in a 10-day low.

This decline implies that whales predict costs to rebound and will not be promoting their BTC.

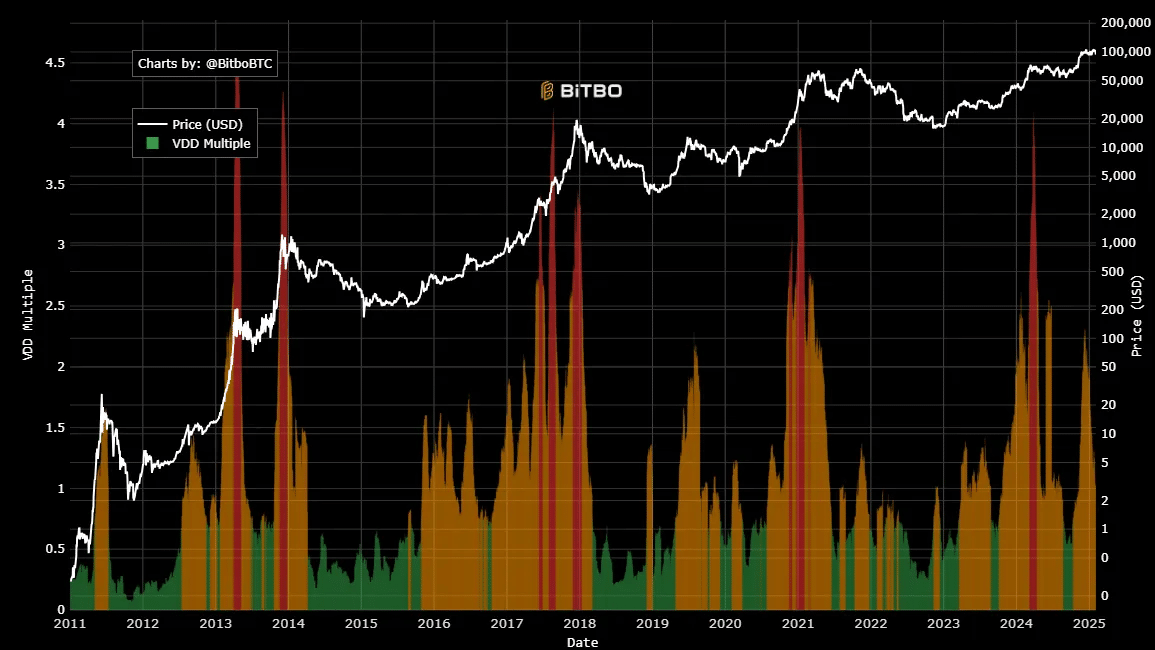

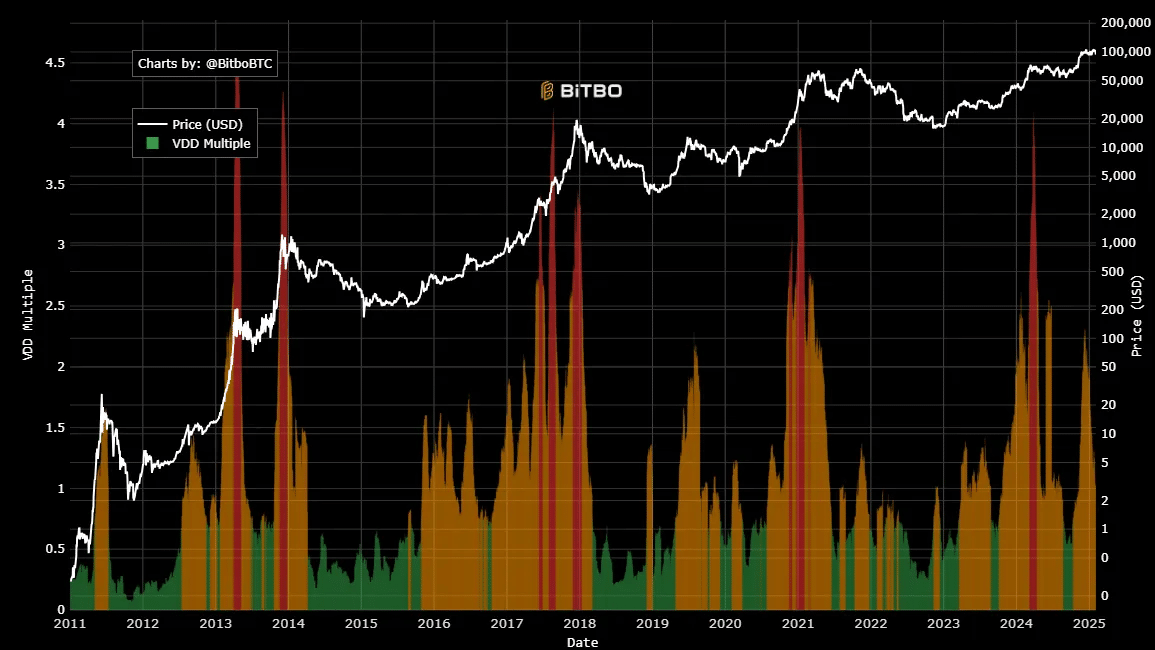

Supply: Bitbo

Moreover, Bitcoin’s VDD A number of has remained above 1, settling at 1.05 on the time of writing. When this stays above 1, it implies that long-term holders will not be panic promoting, indicating market stability.

There’s low promoting stress from long-term holders, and the present drop is basically led by short-term holders. With long-term holders nonetheless bullish, the market might get well quickly, and the drop is unlikely to proceed.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

Merely put, though Bitcoin has dropped over the previous few days because the North American market turns bearish, different indicators counsel the drop is led by short-term holders.

The market is more likely to rebound as long-term holders and whales stay bullish.

A rebound right here will see BTC reclaim $96,370 and try to succeed in $98,000. Nonetheless, additional correction might see a dip to $92,103.