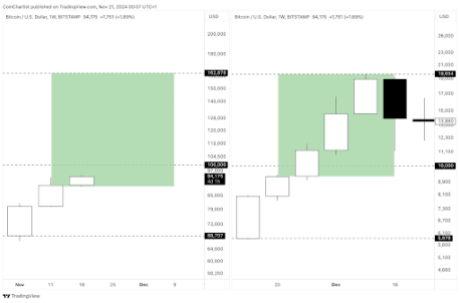

- Bitcoin has reclaimed the STH value foundation, a pivotal stage usually defining near-term pattern route.

- A bullish continuation above $93k stays possible.

Bitcoin’s [BTC] 13% Q1 decline was primarily pushed by a pointy 18% drawdown in February, initiating a major market correction.

Consequently, in March, the short-term holder (STH) capitulation part dominated, resulting in a spike in realized losses, which pushed BTC to its lowest level at $77,000.

Regardless of this, whale accumulation continued, pushed by macroeconomic turbulence and a shift in threat urge for food.

This strategic influx of capital catalyzed a bullish rally, breaking by way of two key provide zones and triggering a liquidation cascade of leveraged positions.

Bitcoin now trades at $93,700, representing a 14% rebound from its March shut.

Notably, BTC has surpassed its STH value foundation for the primary time since mid-February, marking a pivotal shift in market construction and sentiment.

Bitcoin flips above STH realized value: Key reversal sign

Bitcoin posted a 6.82% single-day achieve on the twenty second of April, closing at $93,489, successfully reclaiming a key overhead resistance stage that has remained untested for over a month.

Its affect? Brief-term holders (STHs) flipped into revenue territory after over a month of their realized value sitting under BTC’s market valuation, holding them in an underwater place.

This resurgence indicators a robust bullish continuation. Why? It serves as a essential FOMO set off.

If Bitcoin maintains its momentum, short-term buyers are more likely to HODL for outsized returns. Therefore, viewing the transfer as a “reward” for his or her resilience in the course of the March sell-offs.

Actually, at $93,986, 11.72k BTC have been purchased— the best within the month. This marks a major shift with sturdy outflows into wallets, reinforcing AMBCrypto’s thesis of bullish continuation.

With elevated whale participation and the reversal of STHs into revenue, Bitcoin’s market construction has shifted decisively.

The trail of least resistance now factors towards additional bullish value discovery, with a possible for continuation into increased resistance zones.