Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amid the Trump-Musk on-line feud, Bitcoin (BTC) has hovered inside the mid-and-low areas of its native worth vary, hitting a one-month low close to the $100,000 assist. Nonetheless, some analysts counsel that the cryptocurrency is getting ready for the “actual” worth bounce towards a brand new all-time excessive (ATH)

Associated Studying

Bitcoin Prepares For ‘Actual Breakout’

Over the previous 24 hours, Bitcoin skilled vital volatility fueled by the web feud between US President Donald Trump and Tesla and X proprietor Elon Musk. The flagship crypto’s worth took a beating on Thursday afternoon after dropping by over 5% from the $105,000 stage to the $100,000 assist.

Earlier than the pullback, BTC had been making an attempt to reclaim its native mid-range space after its current efficiency. Notably, the cryptocurrency traded sideways following its ATH rally to $111,980, hovering between the $106,800 and $109,700 worth vary.

Nonetheless, the cryptocurrency misplaced the important thing $106,800 assist amid final week’s market retracement, which noticed Bitcoin drop to $102,000 over the weekend. Since then, BTC has been making an attempt to reclaim the present levels.

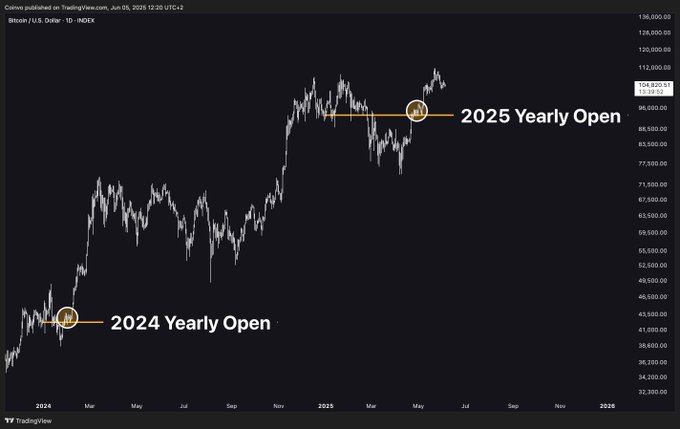

After yesterday’s drop, the biggest cryptocurrency by market capitalization has surged 4.5%, climbing above the $104,000 stage. Crypto dealer Coinvo highlighted BTC’s one-year chart, pointing to the equally wanting worth motion between 2024 and 2025.

In response to the chart, Bitcoin recorded its first main pump after reclaiming its yearly opening stage, consolidating inside its new vary for weeks earlier than climbing to its Q1 2024 ATH.

This yr, the cryptocurrency has had an identical efficiency, though delayed, having reclaimed the yearly opening vary and surging to the primary main worth surge in Could.

Equally, analyst Alex Clay suggested that Bitcoin is getting ready for the “actual breakout” following its retests of the vary’s mid-zone resistance in Q1 2025 and a “false” breakout final month.

To the analyst, “We grabbed the liquidity beneath the Damaged Provide Zone. Now on the lookout for a Actual Breakout” towards the $120,000 mark.

BTC Value To Vary For Two Weeks?

The Cryptonomist noted that Bitcoin shows a 3-week bullish falling wedge formation, with the decrease boundary sitting across the $101,000 stage. Following the current worth drop, BTC bounced from that space, and will get away of the sample if it reclaims the $105,000 barrier as assist, concentrating on the $118,000-$120,000 ranges.

In the meantime, market watcher Daan Crypto Trades highlighted that its worth now trades on the mid-range once more, close to the Month-to-month opening worth. To the dealer, “it’s fairly protected to imagine that these vary excessive/lows are good triggers for no matter bigger pattern follows,” as BTC has been having a “comparatively massive transfer early within the month.”

As he beforehand explained, Bitcoin tends to set its month-to-month excessive or low through the first week of the month, adopted by a reversal in the wrong way and a pattern continuation till a brand new month begins.

Based mostly on this, he warned that if the value drops beneath yesterday’s lows, it would proceed to pattern down for an additional week or two, displaying “weak spot and confirming a bigger correction is due.”

Associated Studying

Nonetheless, if worth surges above the month-to-month highs, across the $106,700 mark, “the correction is extra prone to be over and there’s a very good probability that we head to all-time highs and past.”

“Good likelihood we vary round this space for some time, although, with none of those ranges breaking,” he concluded.

As of this writing, Bitcoin trades at $104,224, a 2.6% enhance within the every day timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com