- Capital inflows into Bitcoin surged to new ATH.

- Exit of weaker arms might have strengthened BTC’s market basis.

Bitcoin [BTC] value actions are underneath shut watch as latest knowledge reveals a notable rise in web capital inflows, pointing to doubtlessly larger costs forward.

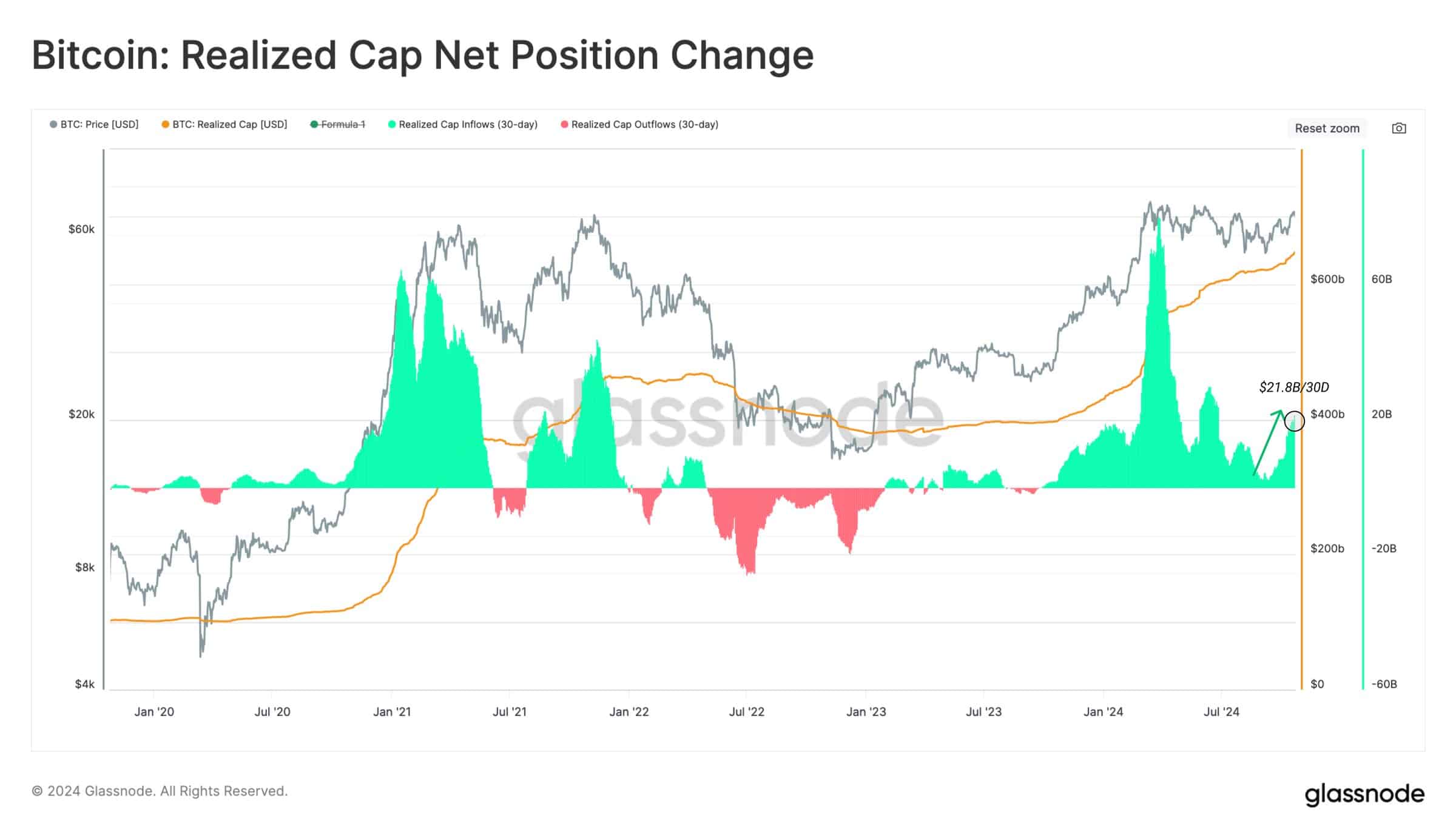

Over the past 30 days, capital inflows into Bitcoin have surged by $21.8 billion, a 3.3% enhance, pushing Bitcoin’s realized cap to an all-time excessive of over $646 billion.

This development means that liquidity throughout Bitcoin is rising, and with elevated capital backing the asset, Bitcoin may very well be positioned for a big value rally.

Weak arms out as BTC retests breakout degree

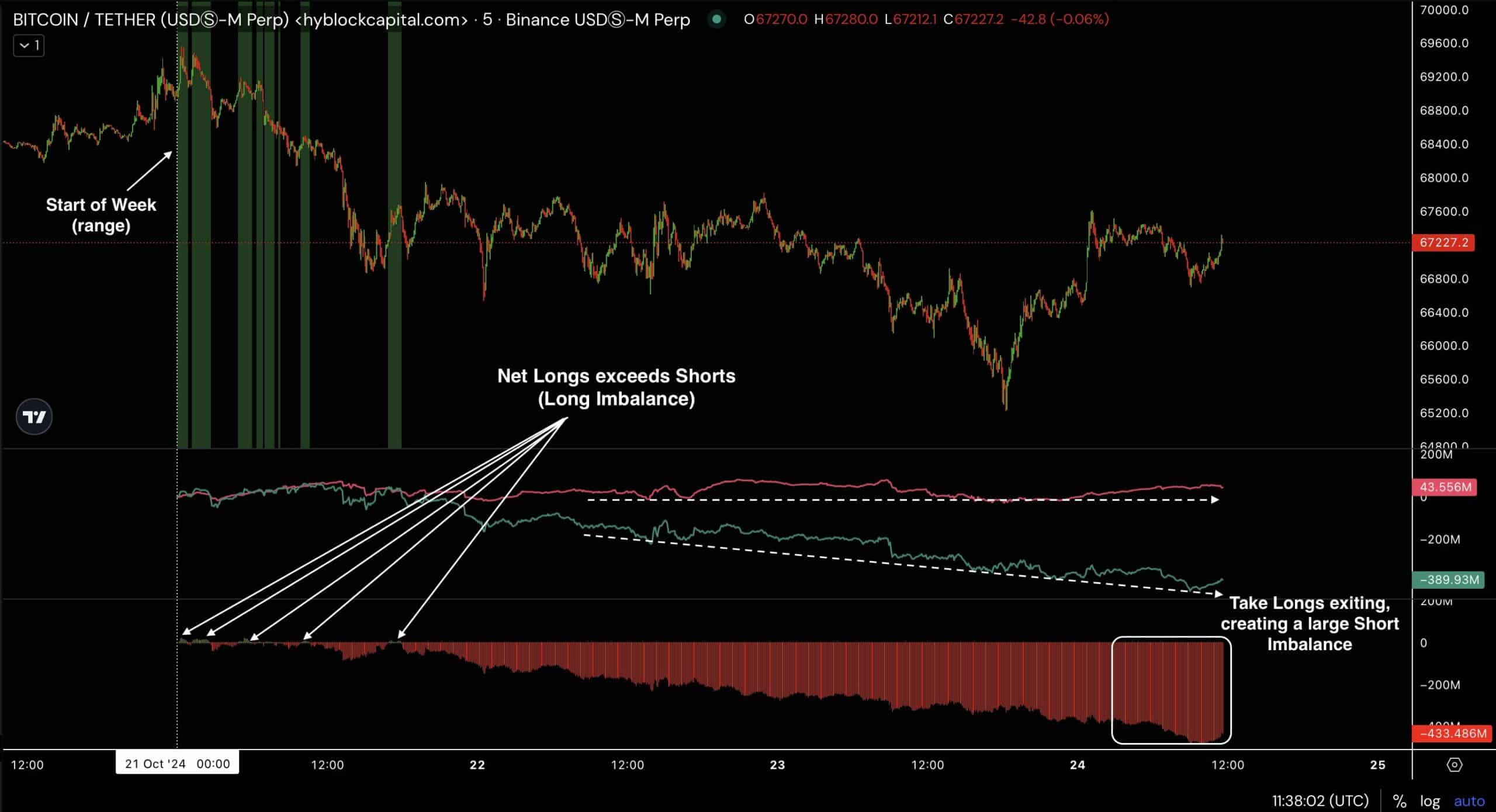

The worth dynamics of Bitcoin this week point out weak arms might have exited the market, creating an surroundings for brand spanking new capital to drive the subsequent main transfer.

Initially of the week, BTC noticed a decline, main some merchants to pursue aggressive lengthy positions in hopes of catching a rebound.

This created a state of affairs the place BTC trapped a few of these longs, resulting in additional promoting strain.

Nevertheless, following this shakeout, Bitcoin’s value rapidly recovered, signaling that the exit of weaker arms might have strengthened the market’s basis.

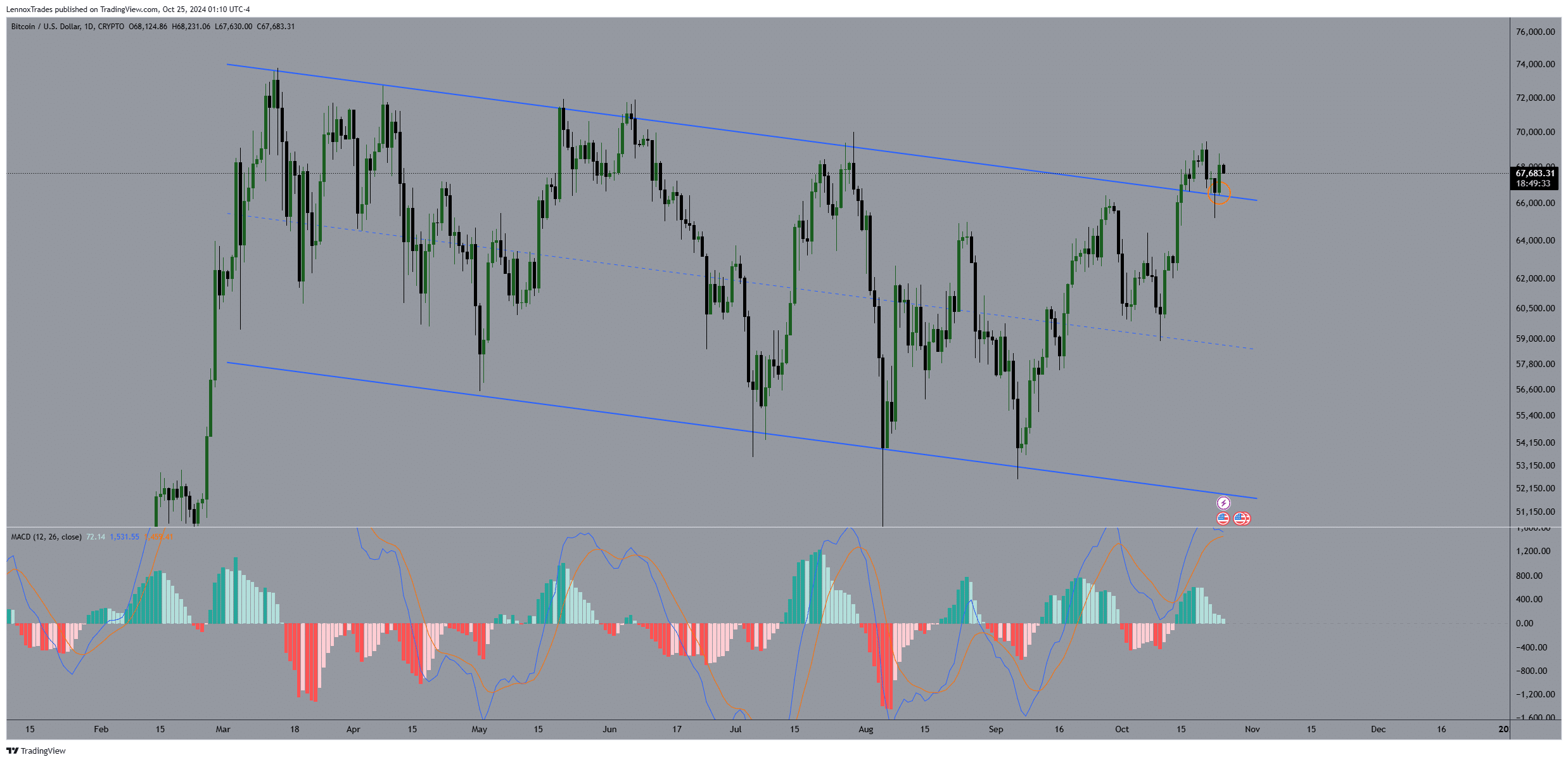

When it comes to technical indicators, BTC has lately retested its descending development channel, which has been a vital resistance for greater than eight months.

A breakout from this channel with a profitable retest suggests Bitcoin might proceed its upward trajectory.

BTC reached this development channel’s higher restrict earlier, testing the $69.5K zone however in the end pulled again.

Regardless of this rejection, Bitcoin has since rebounded strongly off the breakout degree, with yesterday’s each day shut as at press time, coming in bullish.

This transfer may very well be the affirmation merchants have been searching for, doubtlessly setting the stage for a rally that would problem earlier highs.

New holders to find out subsequent transfer

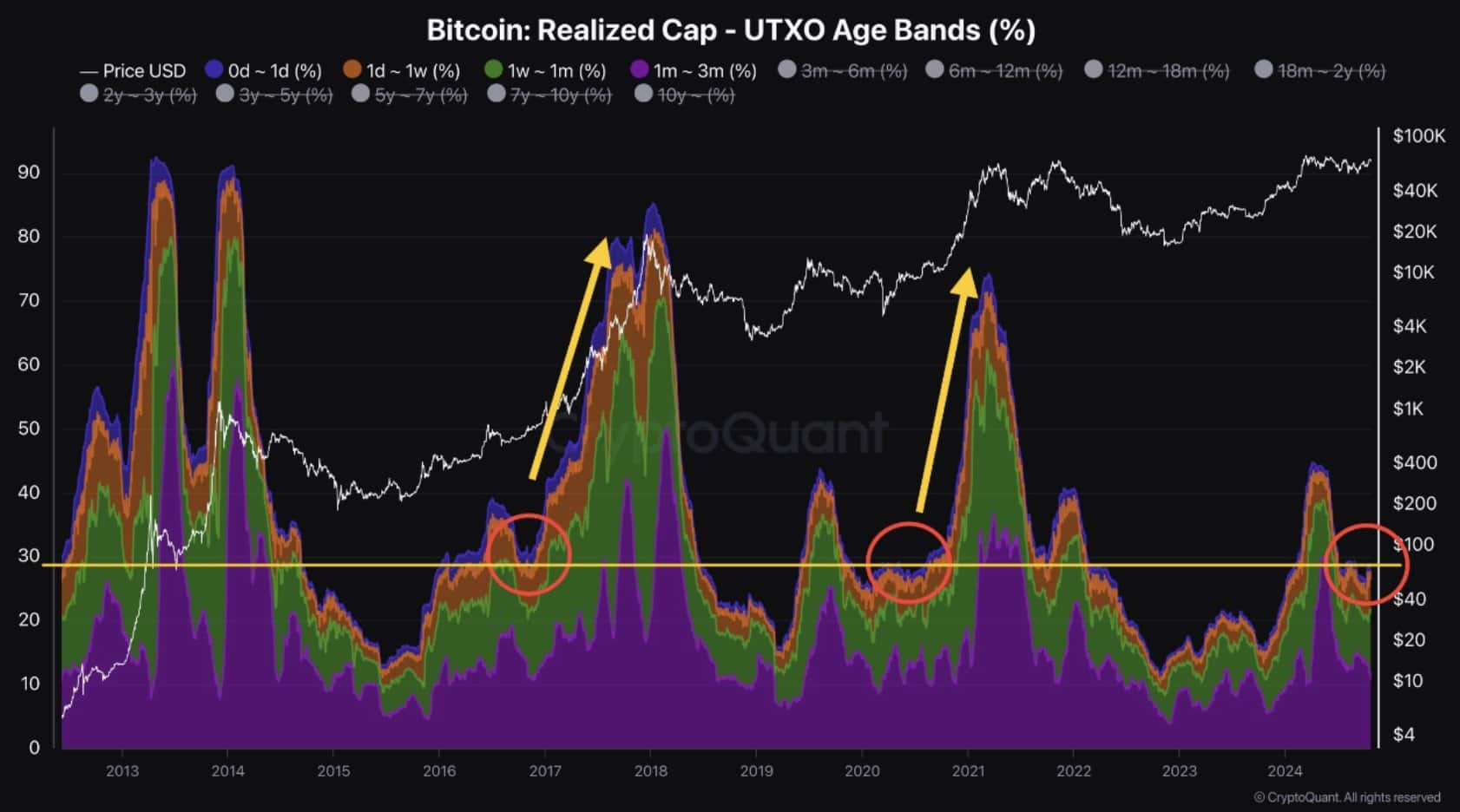

Lastly, the actions of latest traders seem like crucial in figuring out Bitcoin’s subsequent main value path.

Historic knowledge means that when unspent transaction outputs (UTXOs) — a measure of Bitcoin held for lower than six months — present a pointy enhance following a pause, Bitcoin sometimes sees vital value development.

Is your portfolio inexperienced? Test the Bitcoin Profit Calculator

Current knowledge highlights a transparent development, indicating BTC’s value could also be set for an upward transfer. Report-level capital inflows and aligned technical indicators make a BTC breakout look more and more seemingly.

As Bitcoin’s liquidity and capital ranges climb, and with weak arms largely out, BTC might poised for additional upward trajectory. The approaching weeks will likely be telling, and merchants will likely be anticipating indicators that BTC is able to attain new highs.