- Brief-term Bitcoin holders are sitting on the highest income since August after BTC broke above $63,000.

- The widespread profitability has seen market sentiment shift to constructive, which may stir an prolonged rally.

Bitcoin [BTC] traded at $63,790 at press time, its highest worth this month. Constructive macro components have seen BTC defy the everyday September drop, and with “Uptober” in sight, bulls look like making their transfer.

Nevertheless, provided that this month’s constructive macro narratives look like exhausted, merchants who’ve held Bitcoin for lower than 155 days maintain the important thing to the subsequent short-term worth strikes.

Surge in Bitcoin short-term holder features

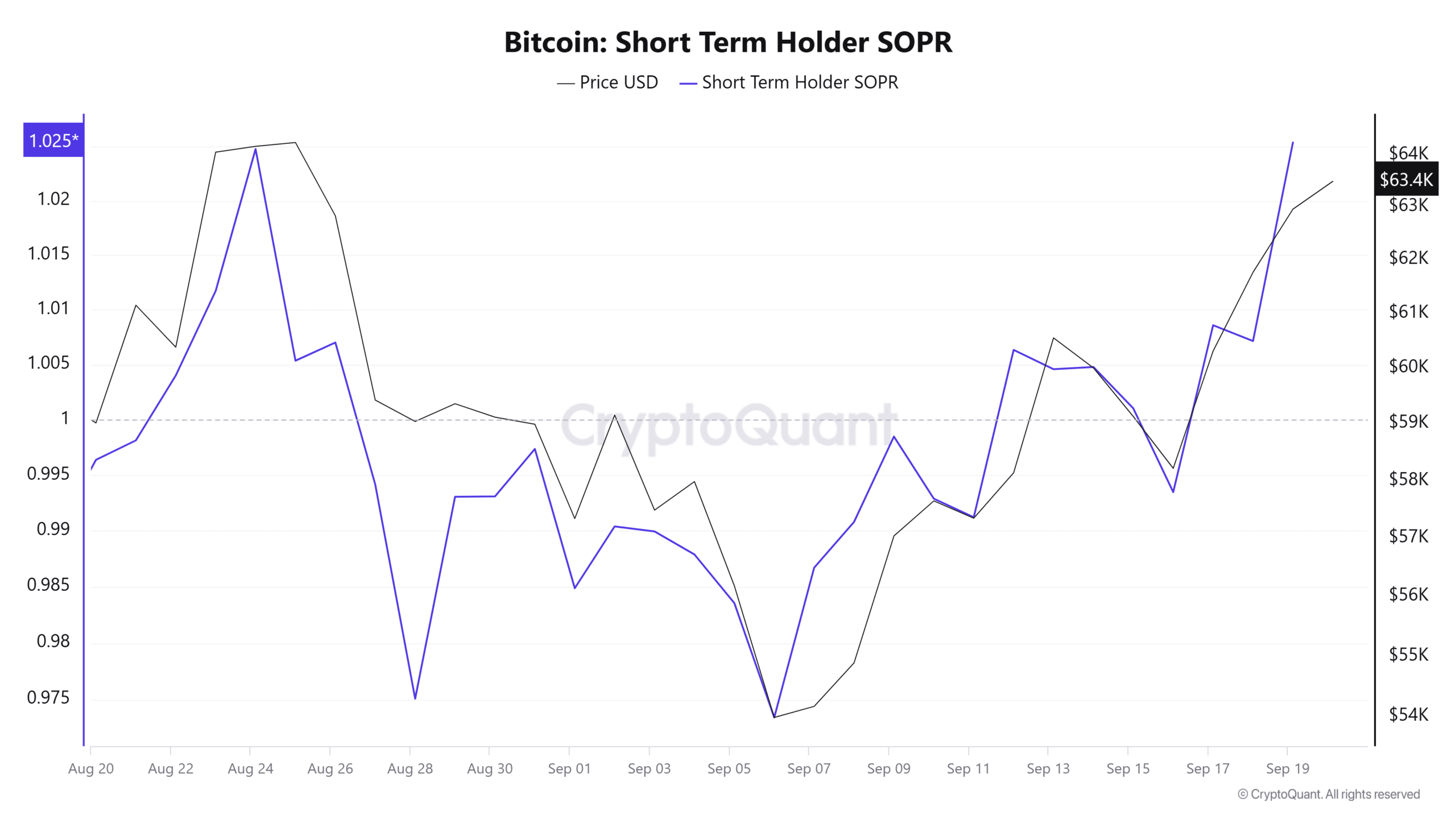

Knowledge from CryptoQuant confirmed that after Bitcoin broke $60K earlier this week, short-term holders turned a revenue. This cohort was beforehand underwater.

The shift in profitability is seen within the short-term Output Revenue Ratio (SOPR), which has made a pointy improve from beneath 1 to its highest stage since late August.

This metric indicated a shift in market sentiment from unfavourable to constructive. The Bitcoin Fear and Greed Index confirmed this because it elevated to 54, the very best stage in additional than three weeks.

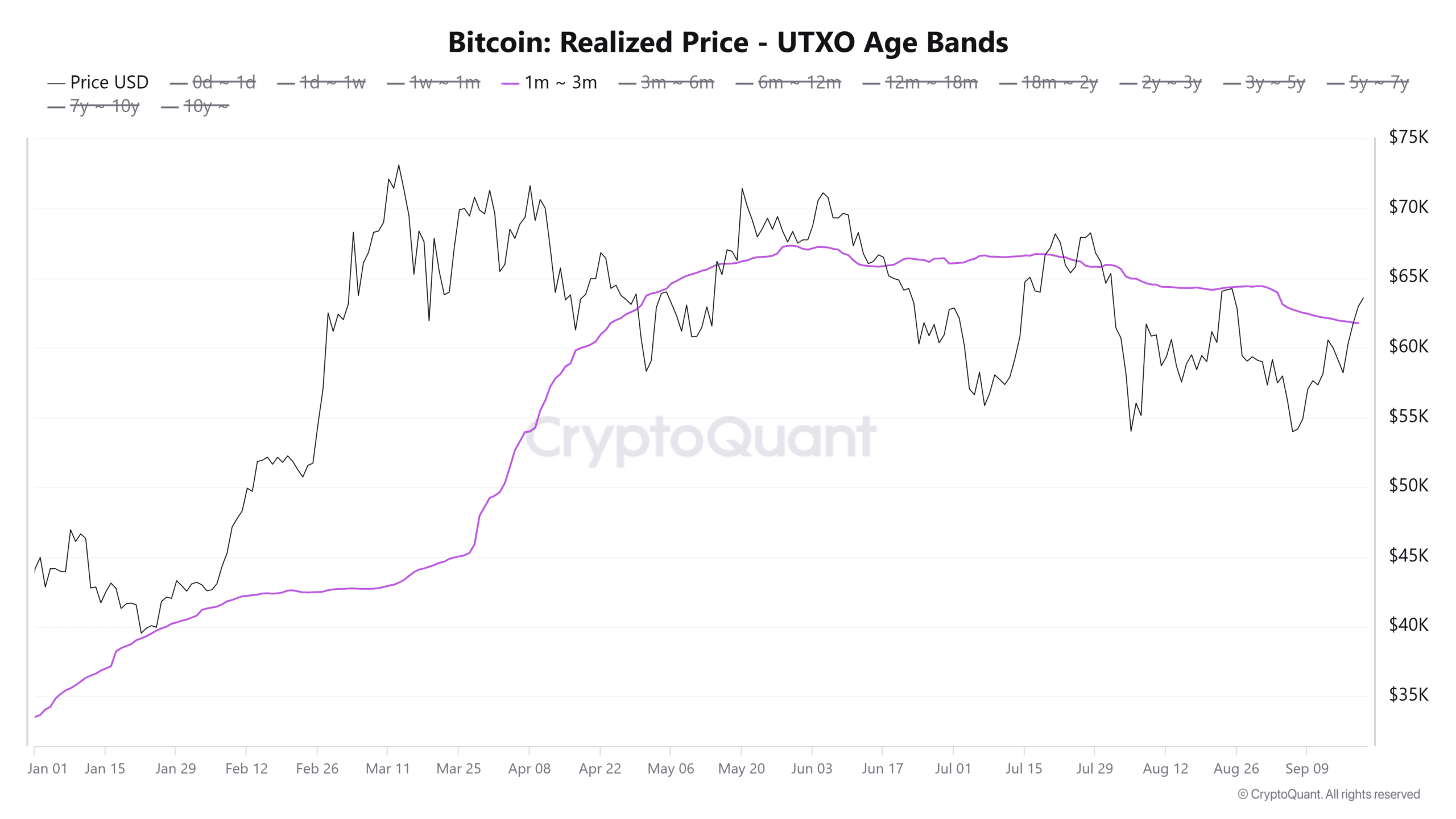

Brief-term holder profitability can be seen within the Realized Value — UTXO Age Bands. Merchants which have held BTC for one to 3 months have been beneath their common purchase worth since August.

These merchants re-entered profitability on the 18th of September, after BTC rallied above $61,800.

Per CryptoQuant analyst Avocado_onchain, the common purchase worth of short-term holders acts as a robust resistance stage. With Bitcoin breaking above it, it suggests a robust bullish development.

Danger of profit-taking

The widespread profitability amongst short-term Bitcoin holders reveals bullish sentiment, but it surely additionally poses a threat to the short-term rally in the event that they determine to promote.

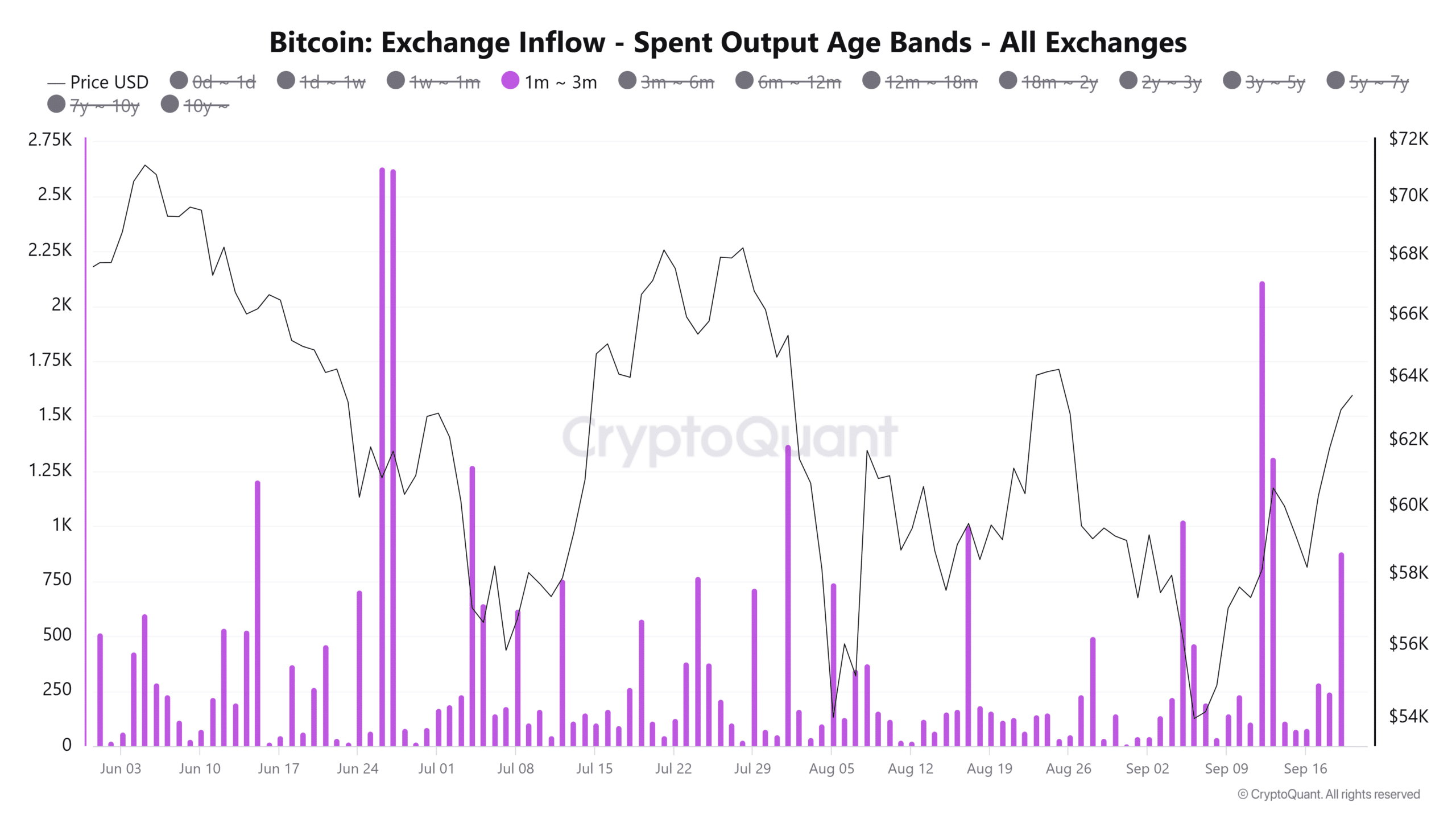

The cash distributed by these holders have reached a weekly excessive as seen within the Trade Influx — Spent Output Worth Bands coinciding with the acquire in worth.

This implies that short-term holders might be taking income after realizing features.

Nevertheless, provided that the promoting exercise has not dampened the rally, a excessive variety of short-term merchants promoting at income may stir the curiosity of latest patrons.

Merchants must also be careful for the $64,000-$70,000 ranges as 4.5M Bitcoin addresses that purchased at these costs are nonetheless underwater per IntoTheBlock knowledge.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

As such, Bitcoin will face resistance because it approaches this zone.

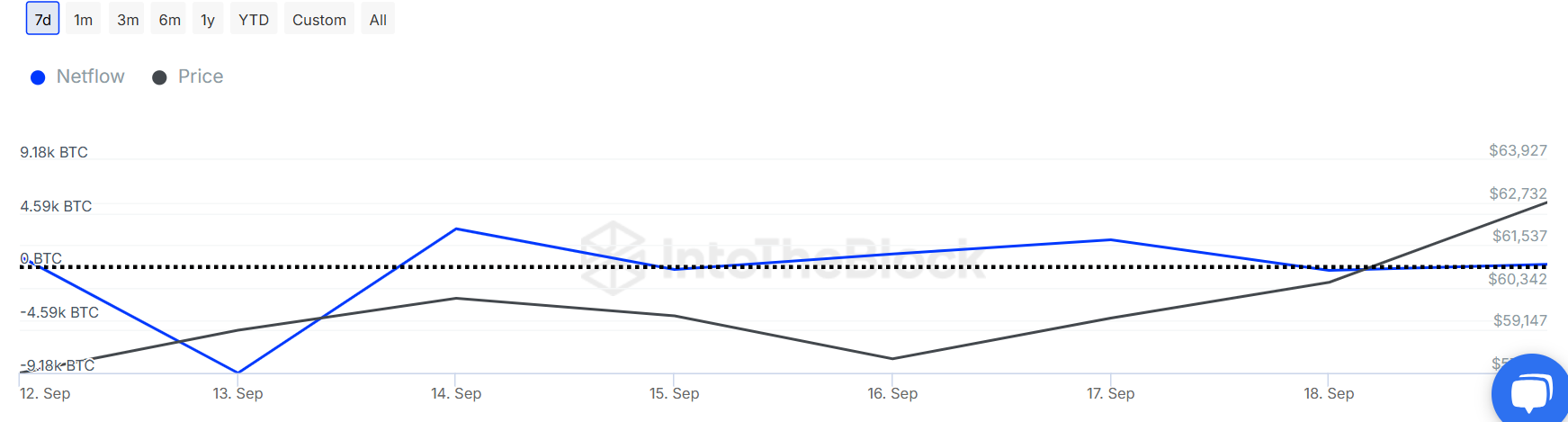

Nonetheless, whales are but to work together with BTC amid the current features. Giant holder netflow has been predominantly flat within the final two days after a interval of accumulation. This reduces the danger of enormous sell-offs.