- Bitcoin’s inflows to Binance drop considerably, signaling diminished promoting stress and a cautious market temper

- Brief-term holders present decreased exercise, suggesting a shift towards a impartial or hold-oriented stance

Bitcoin’s [BTC] short-term merchants seem like settling down.

A big lower in BTC inflows to Binance, together with diminished exercise from 1-3 month holders, suggests a change in market sentiment. Brief-term merchants, who beforehand drove promoting stress, at the moment are holding onto their cash.

Whereas Binance’s inflows decline, different exchanges are witnessing elevated exercise, indicating a shift from risk-taking to cautious restraint.

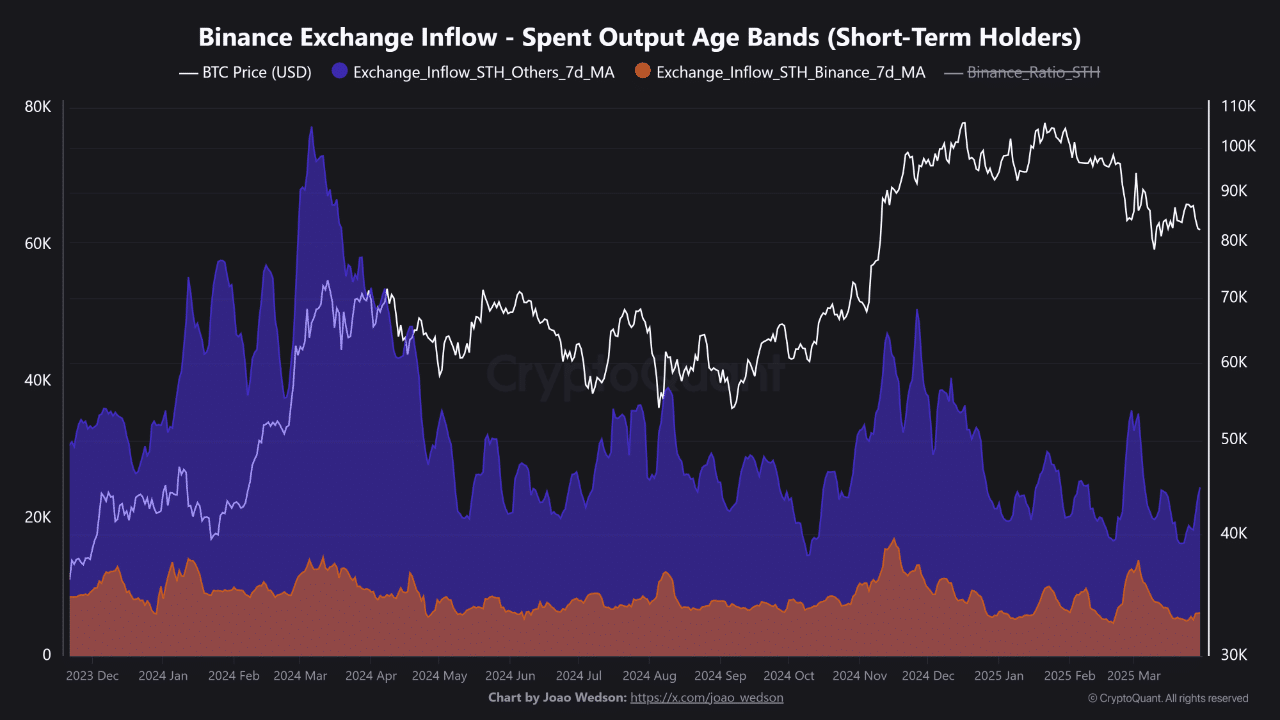

Decreased Bitcoin circulate to Binance

A notable change in BTC inflows to Binance typically displays shifts in investor sentiment or strategic strikes throughout the crypto market.

Current knowledge reveals a pointy drop in Bitcoin transfers from short-term holders (STHs) to Binance, falling to simply 6,300 BTC. As compared, a mean of 24,700 BTC has been despatched to different exchanges.

This decline signifies a doable discount in promoting stress on Binance, with merchants adopting a extra cautious or impartial stance.

If this development continues, it may influence Binance’s liquidity and buying and selling quantity, probably influencing Bitcoin’s value stability. In the meantime, the rise in BTC inflows to different exchanges hints at shifting buying and selling preferences throughout the crypto group.

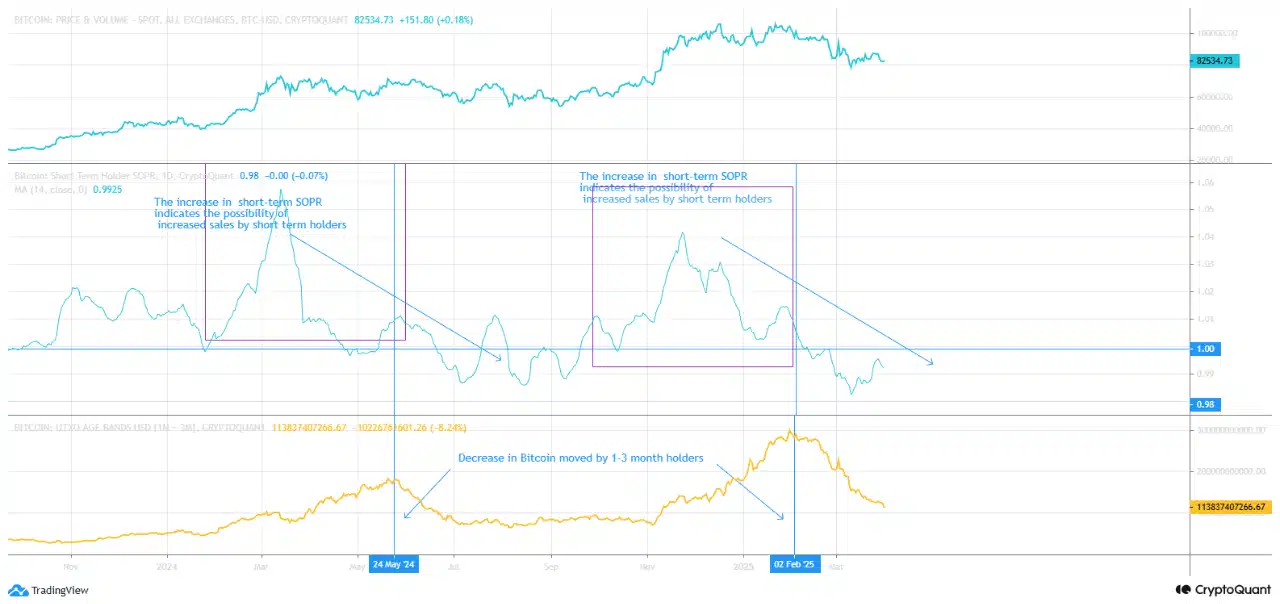

Shift in STH exercise

Brief-term Bitcoin holders play a essential function in driving market sentiment and influencing promoting stress.

Their conduct typically displays short-term profit-taking or loss-cutting choices, making them key indicators of market momentum.

Current knowledge highlights a major lower in BTC exercise from short-term holders. Each the Brief-Time period SOPR and UTXO Age Band metrics present diminished motion, suggesting elevated hesitation to promote.

Following profit-taking from latest trades, these holders seem to have entered a extra cautious, hold-focused part.

This shift signifies a possible discount in promoting stress and factors to a extra balanced or impartial market outlook within the close to time period.

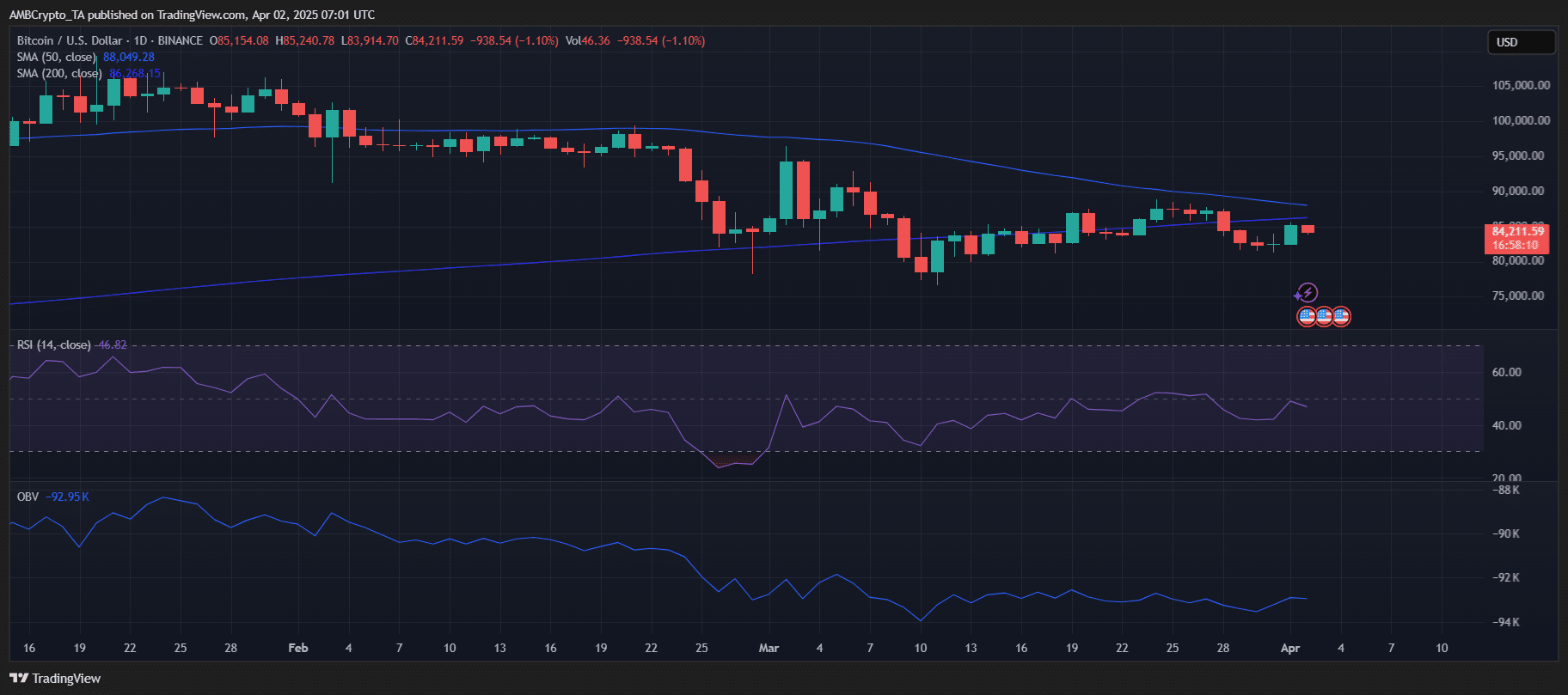

Bitcoin value outlook

Bitcoin’s latest try to interrupt above the 50D SMA at $86,268 confronted resistance, pushing the value again towards $84,211.

At press time, the RSI at 46.82 indicated that the market was in a impartial to barely bearish zone, suggesting that purchasing momentum stays weak.

Moreover, the OBV was at -92.95 Ok, hinting at low buying and selling quantity and diminished shopping for stress. If BTC fails to reclaim the 50-day SMA, it may retest help close to the 200-day SMA at $88,049. Conversely, a profitable breakout could set the stage for restoration.