- Bitcoin’s yield has surpassed U.S. 30-year Treasury Bonds, strengthening its enchantment as a macro hedge.

- U.S. Senator Lummis and ex-Treasurer Rios endorsed Bitcoin as a possible reserve asset, fueling long-term bullish sentiment.

Bitcoin’s [BTC] has now outpaced the 30-year U.S. Treasury Bond in yield efficiency—a serious macro sign that’s onerous to disregard.

This motion is fueling the narrative that Bitcoin may very well be one thing higher than only a speculative instrument.

As outdated bond yields path, Bitcoin is changing into more durable to disregard by institutional traders.

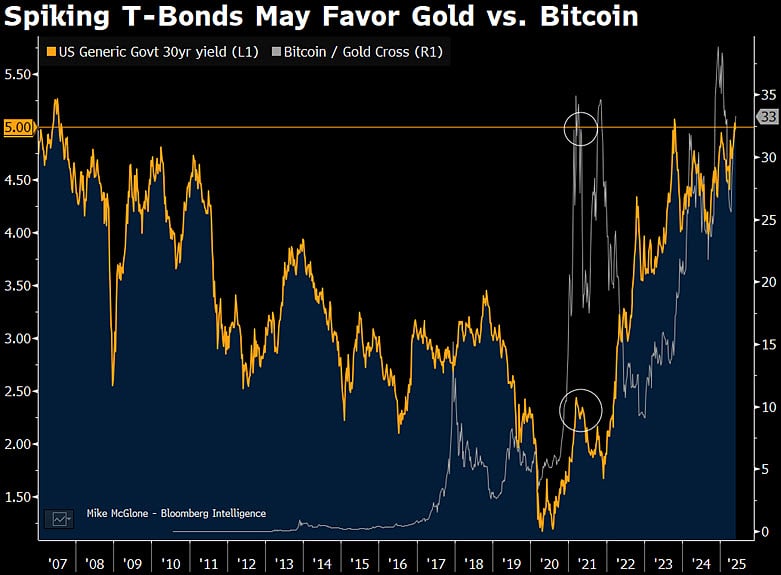

Furthermore, the yield divergence isn’t remoted. It comes as Bitcoin’s value habits more and more mirrors that of gold, strengthening its place as “digital gold.”

Gold and Bitcoin transfer in sync

The vital facet to notice on this case is Bitcoin’s rising correlation with gold, with each belongings now shifting in higher synchronicity. This isn’t only a technical coincidence—investor habits is driving the shift.

The hedge enchantment of Bitcoin is gaining mainstream recognition.

Senator Lummis and U.S. Treasurer endorse BTC

U.S. Sen. Cynthia Lummis was within the headlines when she stated the U.S. ought to intention to carry 5% of worldwide Bitcoin provide, simply because it does with gold.

She was not alone in making that commentary.

Former U.S. Treasurer Rosie Rios added gasoline to the fireplace together with her declaration,

“Bitcoin is right here to remain… The prepare has left the station.”

These public remarks by high officers are thought-about to be early alerts of parliamentary curiosity. In addition they seize what the market is just starting to think about—a future state of affairs the place BTC is included in nationwide reserves.

Open Curiosity spikes as establishments get onboard

Since early Could, the BTC’s Open Curiosity accelerated dramatically—one thing which is interpreted as an indication of rising institutional demand.

With yields larger than long-term bonds and rising political help, Bitcoin is rapidly changing into a severe contender for reserve asset standing.

This surroundings lays the groundwork for a potential long-term bullish breakout. The mix of macroeconomic shifts and vocal legislative help may propel BTC’s value even larger.

So, what might be anticipated for BTC?

As Bitcoin’s returns proceed to outpace these of conventional belongings and its connection to gold strengthens, persons are starting to view it in a brand new gentle.

If politicians persist in advocating for its inclusion in reserves, Bitcoin may observe a trajectory beforehand reserved for gold.