Bitcoin’s [BTC] Funding Fee is nearing a vital threshold. Whereas the Mixture Funding Fee stays constructive, there’s a growing trend of destructive Funding Charges throughout main exchanges.

This has raised questions on what this would possibly imply for Bitcoin’s short-term worth motion.

Traditionally, destructive Funding Charges have typically been related to market bottoms, suggesting that the present shift may sign a possible native backside for BTC.

Unfavorable Funding Charges: A sign for market bottoms?

Bitcoin’s Aggregated Funding Fee stays constructive, however information reveals an important shift. Pockets of destructive Funding Charges are showing throughout main exchanges.

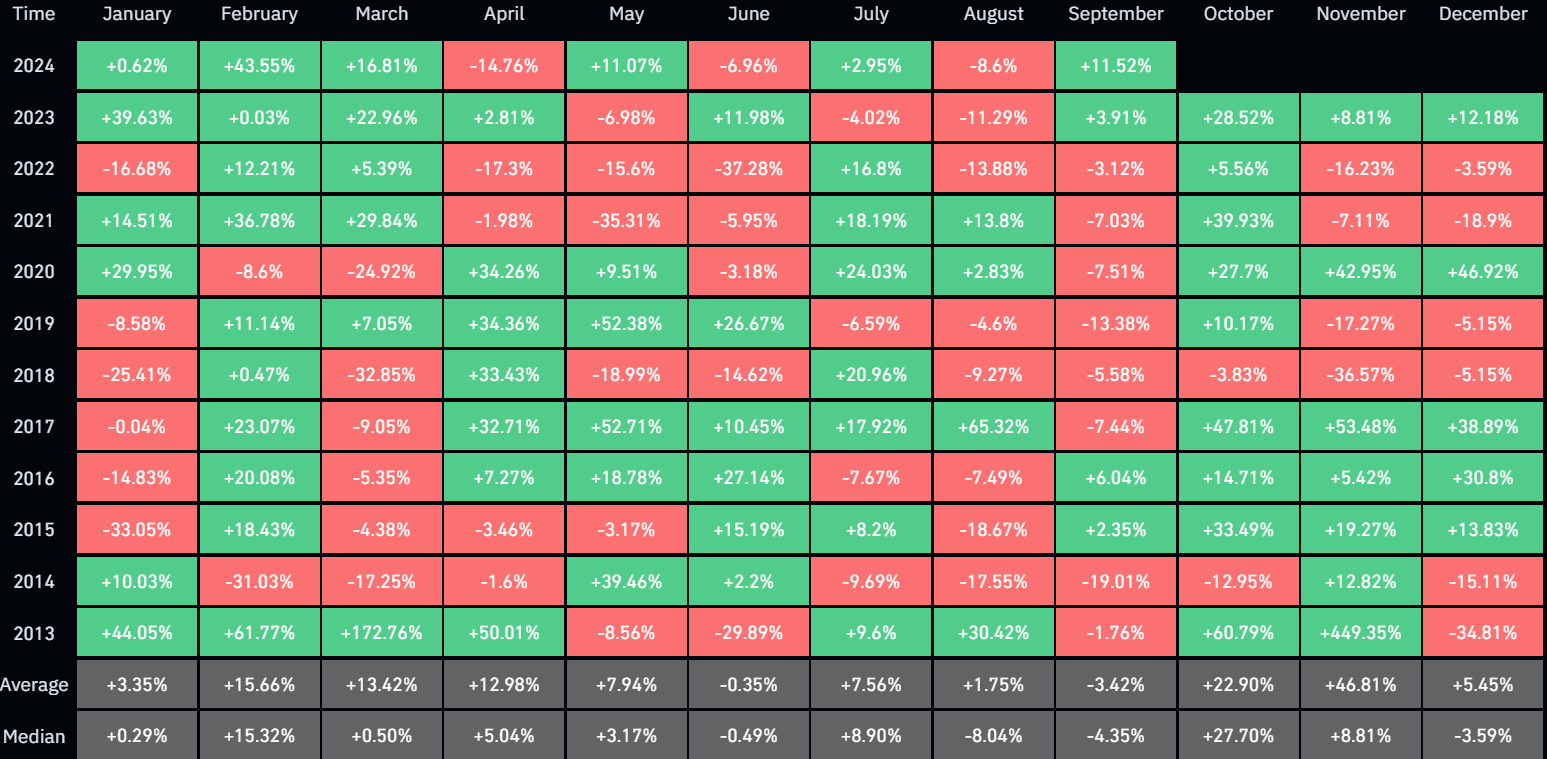

Traditionally, such occurrences have coincided with native bottoms. This was seen in mid-2022 and early 2023 when destructive spikes preceded worth reversals.

The present decline in funding suggests rising short-interest. Merchants are paying to maintain quick positions open. If this pattern intensifies, it may set the stage for a brief squeeze, forcing liquidations and driving BTC’s worth increased.

Nonetheless, not all destructive funding occasions result in quick rebounds. Market construction and liquidity situations will decide if this indicators a real backside or merely displays non permanent bearish sentiment.

What comes subsequent?

If the Funding Fee shift follows historic traits, Bitcoin could also be approaching an area backside. This opens the door for a worth rebound. A brief squeeze situation may set off sharp upward momentum, particularly if extreme quick positions are liquidated.

Nonetheless, persistent destructive funding may also point out deeper market skepticism.

This might result in extended sideways motion relatively than a direct restoration. Moreover, exterior elements like macroeconomic situations, ETF flows, and total market liquidity will closely affect BTC’s trajectory.

Bitcoin: Sideways motion or breakout forward?

Bitcoin is buying and selling at $98,288 at press time, reflecting a interval of consolidation after a number of makes an attempt to push previous resistance ranges.

The RSI at 50.93 signifies impartial momentum, suggesting neither overbought nor oversold situations.

This aligns with the OBV, which stays weak at -90.38K, signaling an absence of robust accumulation.

Bitcoin’s worth motion reveals it’s caught in a spread. Resistance is close to $100,000, and assist is round $92,000-$94,000. A breakout above psychological resistance may set off renewed bullish momentum.

Failure to carry assist would possibly result in a deeper correction. Given the latest destructive Funding Fee pattern, a brief squeeze may present the required catalyst for a decisive transfer.