- Analysts imagine that BTC is perhaps on the verge of a serious rally, citing historic on-chain indicators.

- Nevertheless, profit-taking continues to use downward stress, limiting fast features.

Bitcoin [BTC] has delivered spectacular efficiency, accounting for a 46.59% month-to-month achieve and boosting its market capitalization to $1.94 trillion.

Even so, momentum has slowed, with no clear market course rising but. Over the previous 24 hours, BTC’s worth has edged up by 0.80%, preserving it in a consolidation section.

AMBCrypto’s evaluation means that whereas BTC is range-bound, historical past exhibits it tends to interrupt increased as soon as market sentiment improves.

BTC nonetheless has room to rally

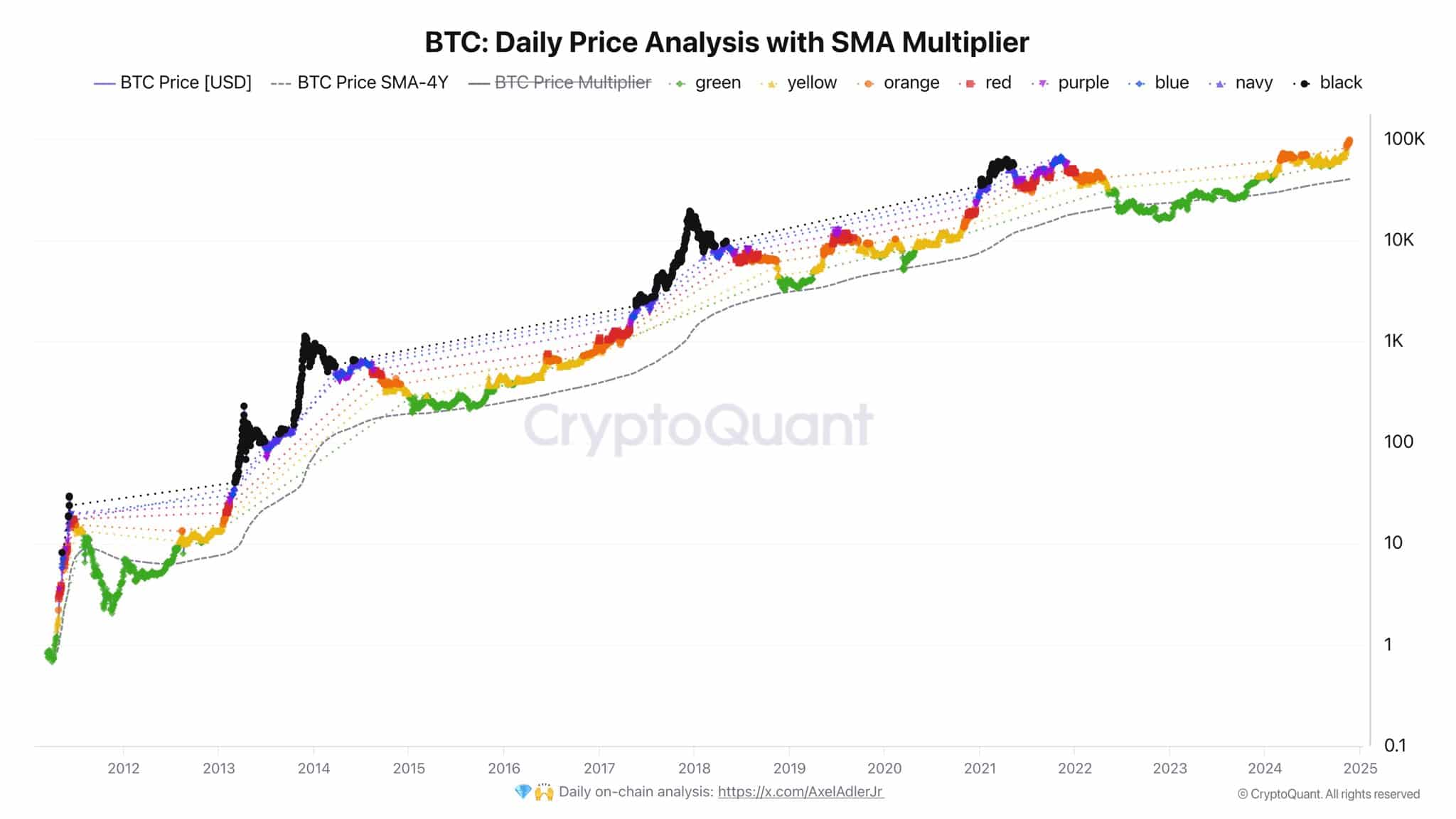

In line with a chart shared by Alex Adler Jr., Bitcoin has but to succeed in its cyclical peak.

The chart examines BTC’s efficiency utilizing the Easy Transferring Common (SMA) Multiplier, a instrument designed to trace worth developments throughout market cycles.

The evaluation makes use of color-coded zones—starting from inexperienced (starting of cycle) to black (high of cycle)—to symbolize Bitcoin’s market sentiment throughout completely different phases, from accumulation to peak hypothesis.

In his put up, Adler said:

“The orange dot has arrived. Pink, purple, blue, navy, and black—are coming.”

This implies BTC remains to be removed from the height of its cycle, with 5 extra phases forward. Traditionally, these phases comply with a predictable sample, with the ultimate “black” section marking the onset of a decline.

If this sample holds, BTC might surpass the extremely anticipated $100,000 goal that has captured market consideration.

AMBCrypto explored extra insights into why Bitcoin, regardless of these promising metrics, has but to see its rally totally materialize.

Revenue-taking exercise slows BTC rally

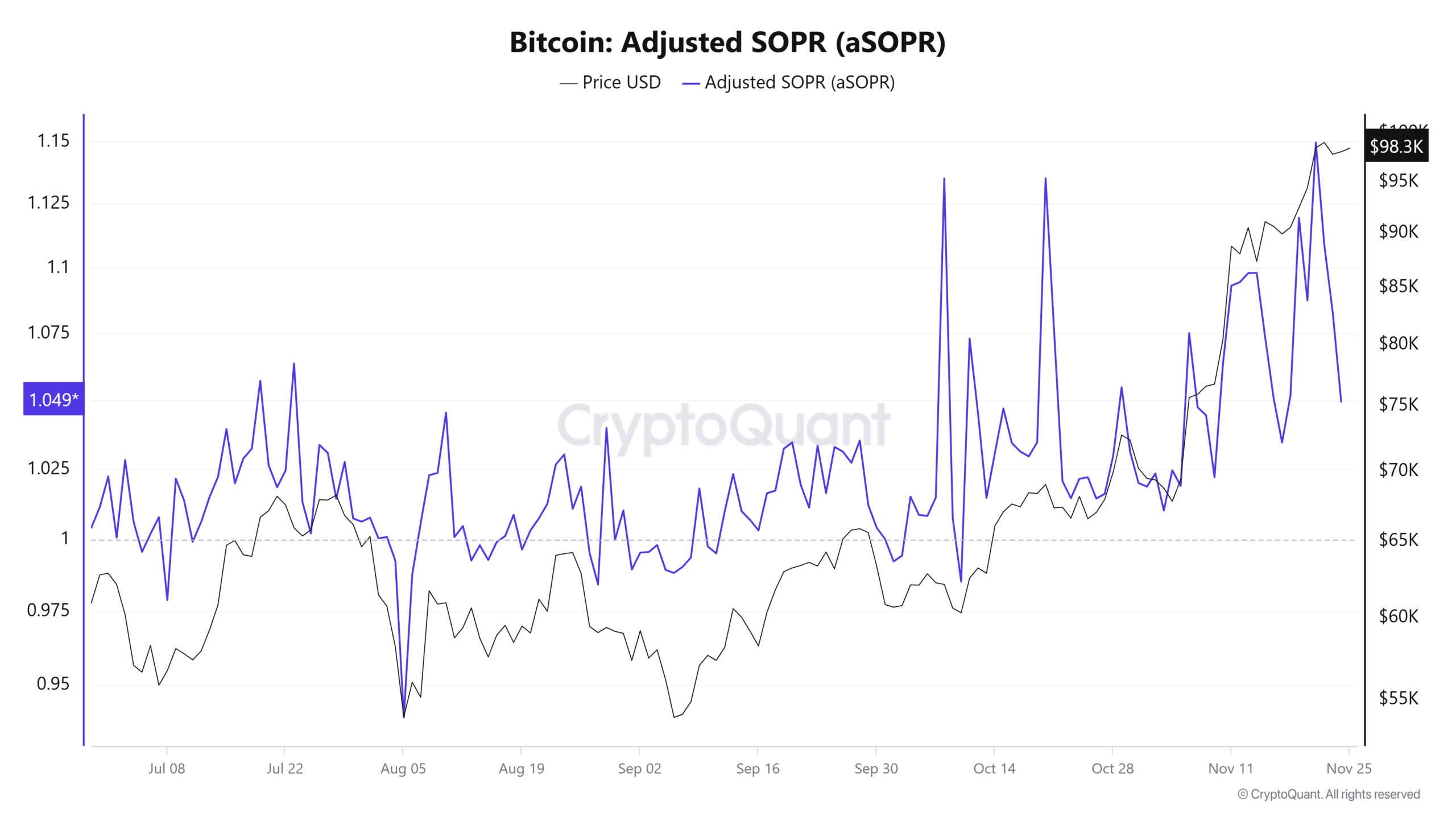

CryptoQuant’s latest insight reveals that heightened profit-taking exercise is weighing on Bitcoin’s (BTC) worth momentum, stopping it from making vital upward strikes.

The Adjusted Spent Output Revenue Ratio (aSOPR), which measures whether or not buyers are promoting their BTC holdings at a revenue or loss, sat at 1.049 at press time.

A studying above 1 signifies that buyers have been promoting at a revenue, and this has added stress on BTC’s worth, slowing its rally.

Moreover, the Take Purchase/Promote Ratio, an indicator that exhibits whether or not consumers or sellers dominate the market, learn 0.963 on the time of writing.

This means that promoting quantity outweighs shopping for quantity, giving bears the higher hand and additional delaying BTC’s upward motion.

Traders preserve BTC from dropping

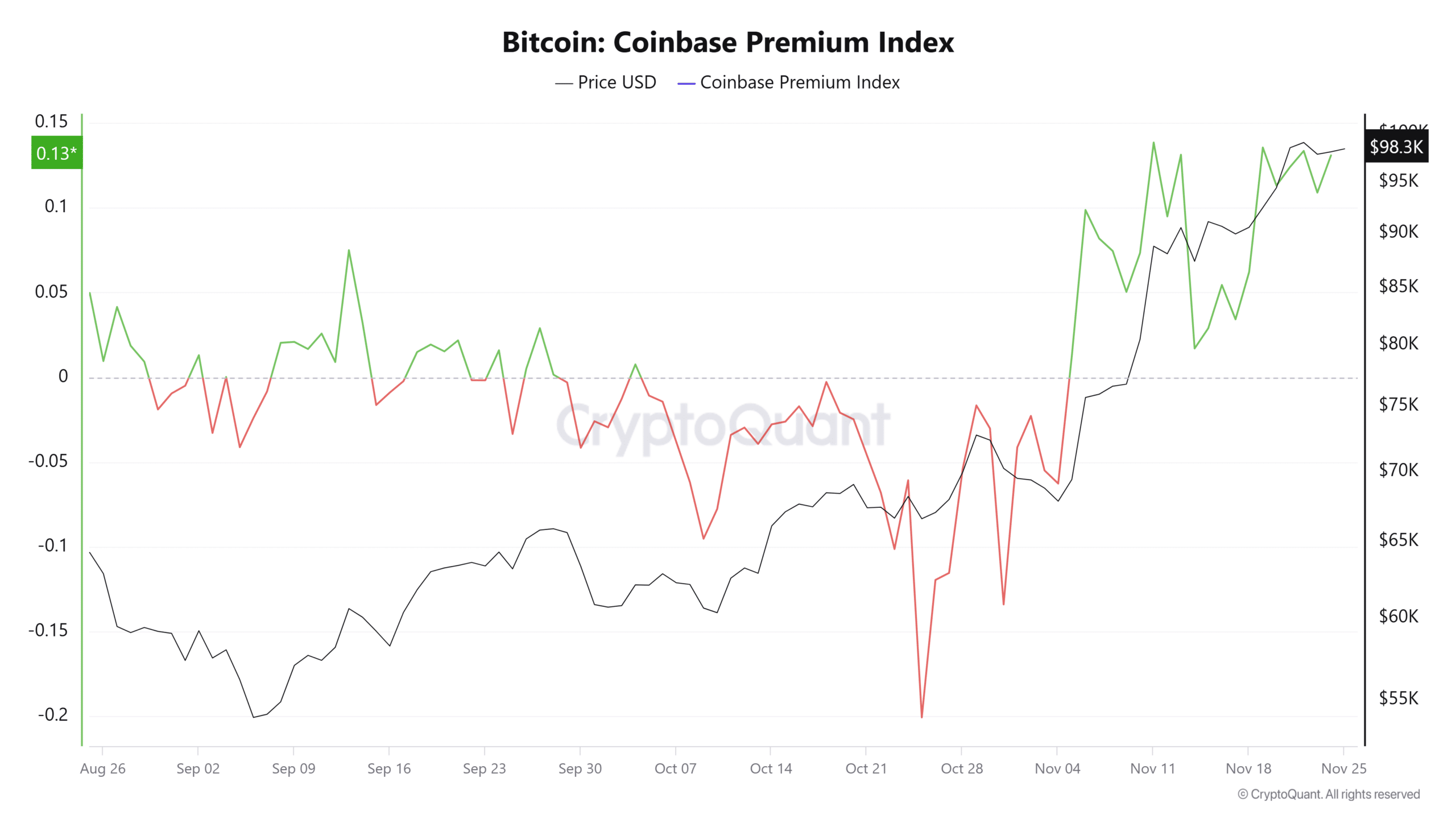

CryptoQuant studies that U.S. buyers have been actively shopping for Bitcoin (BTC) in current days.

The Coinbase Premium Index, which measures the value distinction between BTC on Coinbase and Binance, has ticked increased, sitting at 0.1308. That is near its November excessive of 0.1384.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

A constructive studying on this index—above zero—signifies stronger shopping for exercise from U.S. buyers in comparison with different markets.

This elevated demand has helped stabilize BTC’s worth, stopping additional declines.