- Whales collected over 22,000 BTC, pushing whole whale holdings past 3.44 million BTC

- Bitcoin’s netflows weakened in March, dropping by -27.69% over seven days

Massive Bitcoin holders and retail buyers have been accumulating at an aggressive tempo these days, signaling robust market confidence.

In reality, on-chain knowledge revealed that whales acquired over 22,000 BTC in simply three days, pushing whole whale holdings past 3.44 million BTC. The surge in demand coincided with a pointy value hike, pushing Bitcoin [BTC] from $82,000 to just about $98,000.

Value mentioning, nevertheless, that on the time of writing, the cryptocurrency was again buying and selling below $80,000.

That’s not all although, with there being a historic spike in retail demand too. Particularly with accumulator addresses climbing to an all-time excessive of 320,000.

This twin accumulation by each large-scale buyers and smaller holders hinted at a coordinated bullish momentum. Therefore, the query – Is the shopping for spree sustainable?

“Purchase the dip” or whale manipulation?

A more in-depth take a look at Ali’s on-chain knowledge confirmed a gentle hike in whale Bitcoin holdings all through February and early March. Over the previous month, whales acquired roughly 60,000 BTC – Marking one of the aggressive accumulation phases in latest historical past.

The correlation between whale exercise and value actions appeared evident too.

Bitcoin’s value fluctuated between $82,000 and $98,000, with a dip in late February, adopted by a powerful restoration in early March. The timing of those purchases instructed that sometimes, giant holders have been strategically accumulating throughout corrections.

Are the largest gamers leaving the desk?

Possibly, sure. Information from Glassnode and IntoTheBlock revealed essential patterns in accumulation and distribution, highlighting their influence on the worth motion.

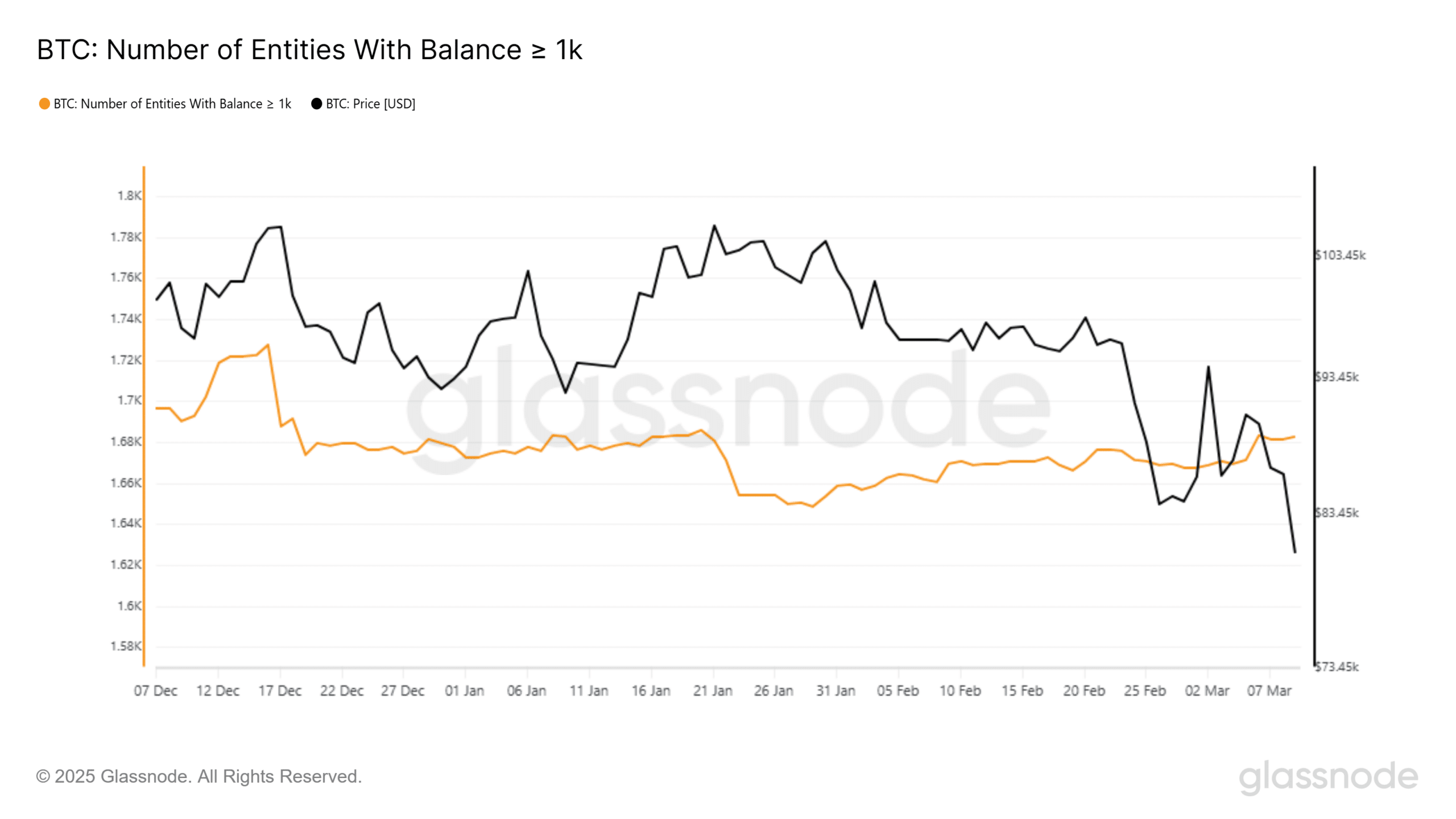

Entities holding ≥1,000 BTC have been decreasing their holdings since Bitcoin peaked at $106,159 in January. The variety of such entities dropped from 1,720+ in December to 1,683 by March – A decline of about 2.14% over three months.

This appeared to be in step with Bitcoin’s value dropping from $106k in January to $80k in March. Such a discount instructed that whales both took earnings or redistributed their holdings.

A pointy drop in whale entities occurred between 7-9 March, correlating with Bitcoin’s value falling from $84,197 to $80,795. Traditionally, such declines point out vital sell-offs or capital rotation into different belongings.

December’s stability in whale holdings aligned with a value vary of $68k–$72k, displaying minimal volatility earlier than the January rally.

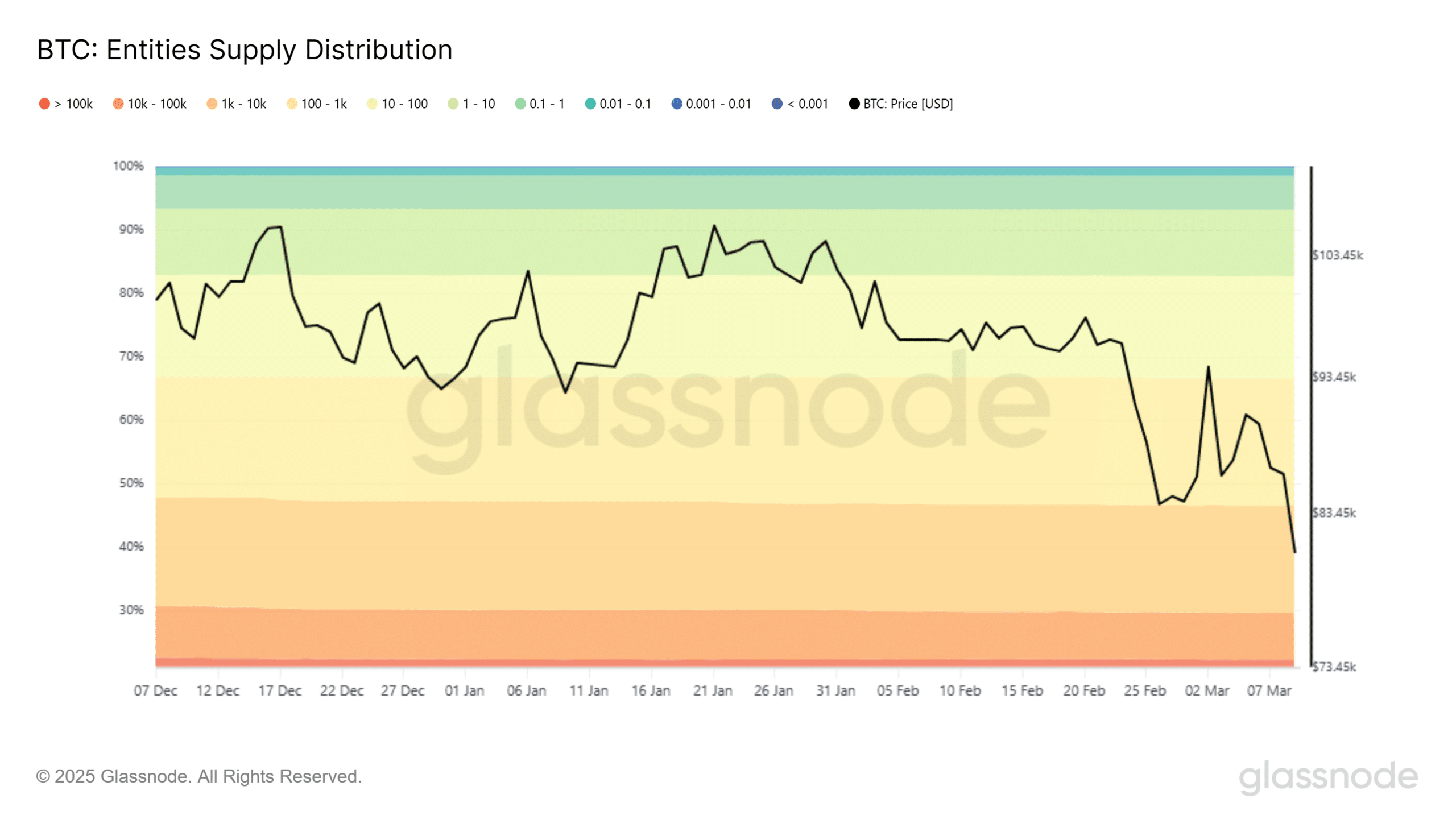

The availability held by whales (≥100k BTC) ranged from 22.261% in February to 22.173% in March – A small however noticeable discount.

Who’s actually in management?

The 1k–10k BTC cohort noticed a bigger shift, falling from 16.963% in February to 16.192% in March, suggesting mid-sized whales have been promoting extra aggressively.

Retail addresses (<1 BTC) continued to build up Bitcoin, displaying constant development regardless of volatility. The ten–100 BTC class remained secure, indicating that mid-sized holders are much less reactive to cost modifications than whales.

The info confirmed a basic accumulation-distribution cycle, with giant whales taking earnings post-rally and smaller gamers stepping in.

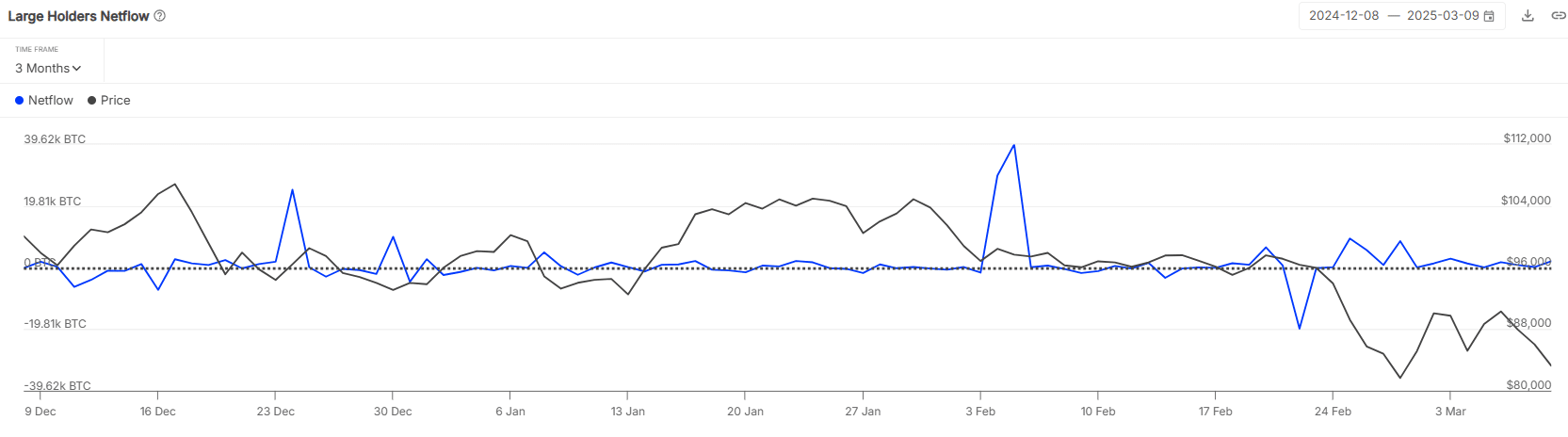

Netflow knowledge from IntoTheBlock supplied additional affirmation of whale conduct.

The biggest internet inflows occurred on 5 February, with +39.62k BTC coming into giant holders’ wallets at $97,692. This meant that whales had been accumulating at excessive costs, anticipating additional good points.

Nevertheless, a drop in netflows adopted, with solely +2.08k BTC on 9 March – An indication of diminished demand from giant holders.

Bitcoin’s value decline from $97k in early February to $80k in March aligned with the sharp fall in its netflows.

The 7-day netflow change dropped by -27.69%, whereas the 30-day netflow plummeted by -546.90%—Pointing to potential exhaustion in institutional accumulation.

And but, wanting on the larger image, the 1-year netflow was up by +714.19% at press time. This indicated that whereas short-term whale curiosity could also be fading, long-term conviction has not disappeared solely.

A ticking time bomb or a bullish setup?

Whale exercise has been the driving drive behind Bitcoin’s latest value motion. Massive holders accumulated aggressively earlier than the January peak of $106,000, however started distributing in February. The discount in netflows and the drop in 1,000–10,000 BTC holders instructed that some whales are already cashing out.

Bitcoin’s decline to $80,000 and under aligned with this distribution development. If whales proceed offloading, Bitcoin might face additional corrections. Nevertheless, the persistent development in retail demand and long-term netflows implies that not all buyers are dropping religion.

Whether or not Bitcoin’s subsequent transfer is one other rally or a deeper pullback will rely upon one key query – Are the remaining whales nonetheless keen to purchase?