- Blackrock’s Head of Digital Belongings believes Bitcoin may thrive in a recessionary atmosphere

- Bitcoin’s position as a secure haven is being examined proper now

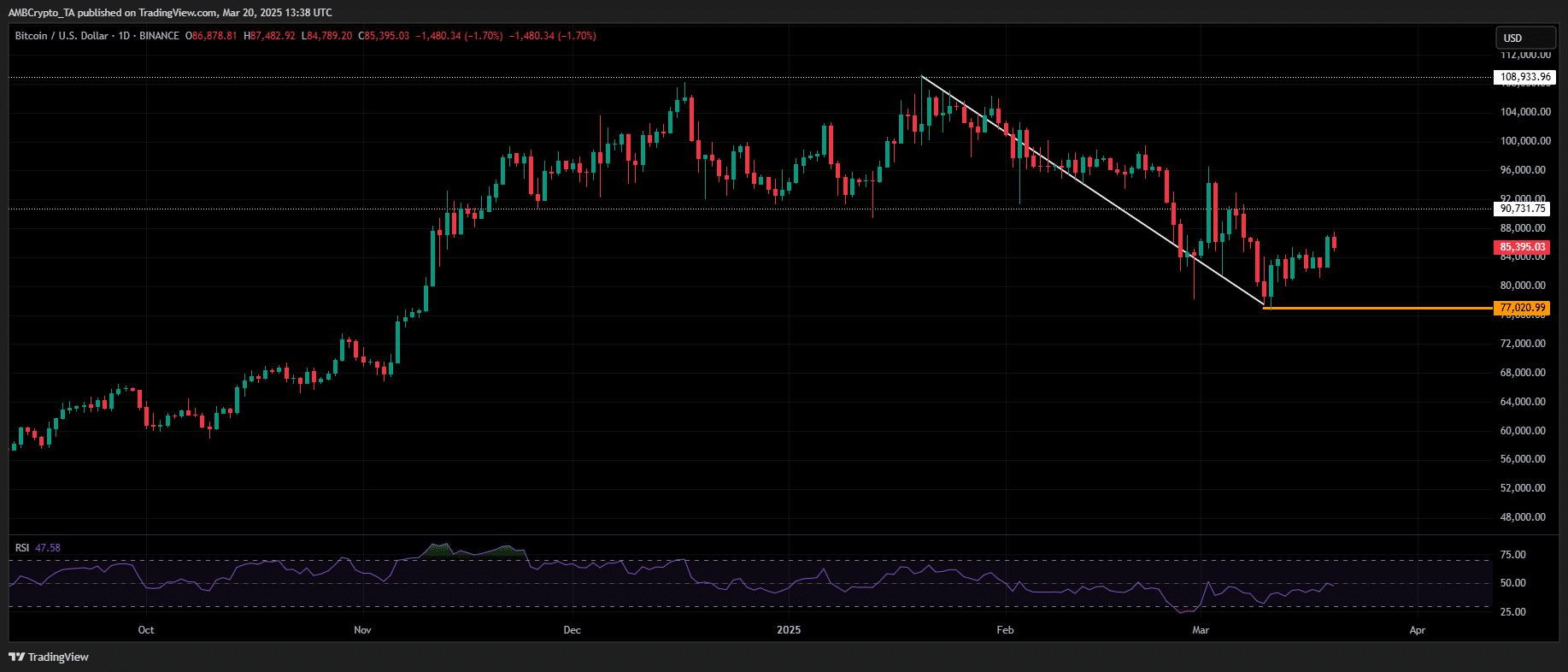

Bitcoin [BTC], on the time of writing, was buying and selling at $85,387, up 2.30% within the final 24 hours. Nevertheless, market sentiment stays divided. In actual fact, inflows have dropped by 54%, from 58.6K BTC/day to 26.9K BTC/day.

Regardless of this, Blackrock’s Robbie Mitchnick believes Bitcoin may thrive, even in a recession. He identified that Bitcoin advantages from fiscal stimulus, decrease rates of interest, and financial easing – All frequent throughout financial downturns.

Moreover, fears of social unrest could push extra individuals in the direction of Bitcoin as a hedge. As Q2 unfolds, Bitcoin’s position as a secure haven can be put to the final word take a look at. Will it show its resilience?

Blackrock’s bullish outlook on Bitcoin

Via its iShares Bitcoin Belief ETF (IBIT), Blackrock has established itself as a serious institutional participant within the Bitcoin market, holding 570,582 BTC in its treasury. This features a notable addition of twenty-two,076 BTC this yr alone.

In a latest interview, Robbie Mitchnick, Blackrock’s Head of Digital Belongings, attributed Bitcoin’s decline beneath $80k on 10 March to “untimely expectations” across the financial outlook.

In accordance with AMBCrypto, key elements embody early charge reduce hypothesis, Bitcoin’s evolving position as a strategic reserve, and inadequate consciousness of the U.S debt disaster.

Additional compounding these pressures are Trump’s strict tariff plans. Whereas the short-term market response led to the sharp “dip,” Blackrock’s $218.10 million in inflows – its month-to-month excessive – has strengthened Mitchnick’s thesis.

The chance of a U.S recession has returned to the forefront after the FOMC assembly, with Chairman Jerome Powell adopting a “wait-and-see” stance. Basically, the potential for a recession can’t be totally dominated out simply but.

Bitcoin’s resilience amid recessionary cycles

A key bullish sign throughout a recession is financial slowdown. Weak labor information dampens combination demand, prompting the Federal Reserve to inject liquidity through rate of interest cuts.

This liquidity inflow usually helps threat property like Bitcoin within the medium time period.

Nevertheless, whereas Blackrock maintains a bullish place, a recession usually unfolds via a quick cycle of declining demand, rising unemployment, and market corrections. This might put Bitcoin’s safe-haven narrative to the take a look at.

Bitcoin’s 22% decline from its all-time excessive of $109k may probably sign the onset of a bigger market correction, with extra volatility forward. This, except Trump’s financial retest triggers a shift in market situations.

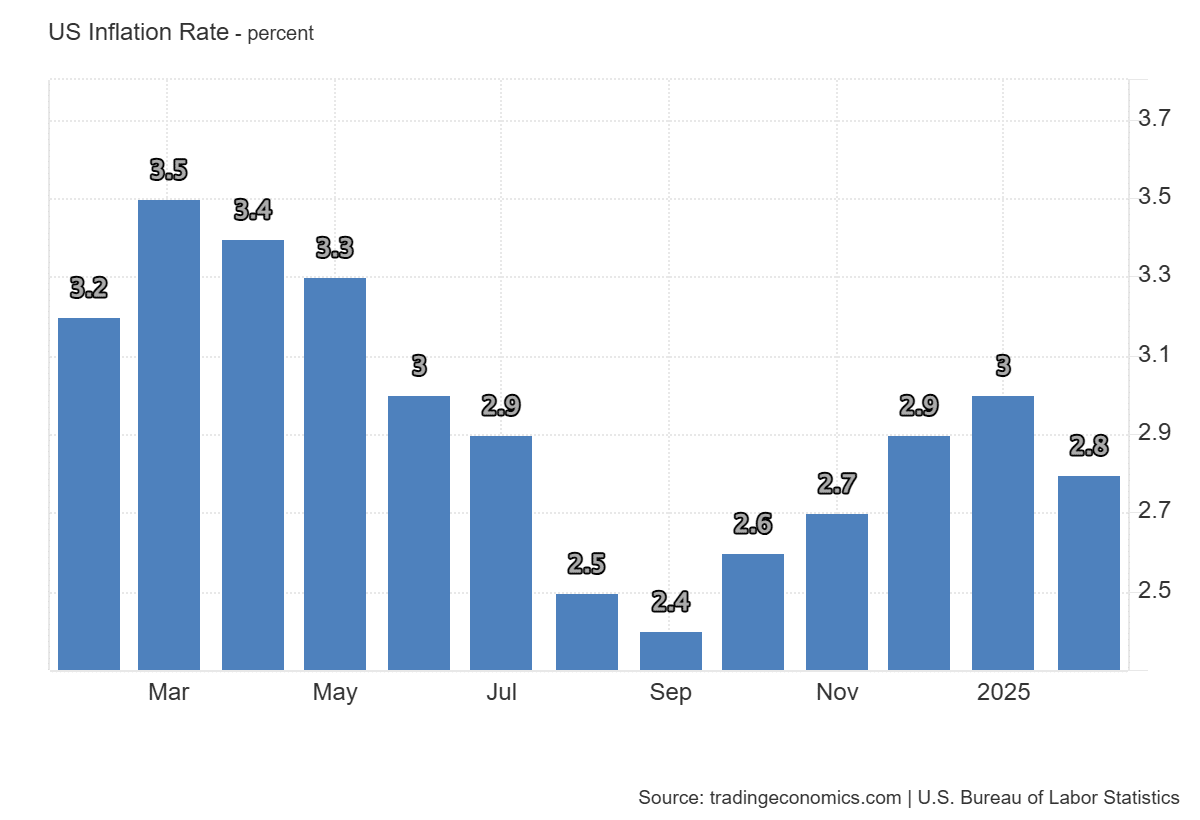

In February, inflation noticed a month-on-month decline of 0.2%, dipping from 3% in January.

This easing inflationary stress has led the Fed to halt charge hikes, although the potential for additional hikes stays on the horizon.

Blackrock’s bullish thesis hinges on a extra pronounced market flush-out – An indication {that a} deeper correction could also be required earlier than a bull market can really materialize.