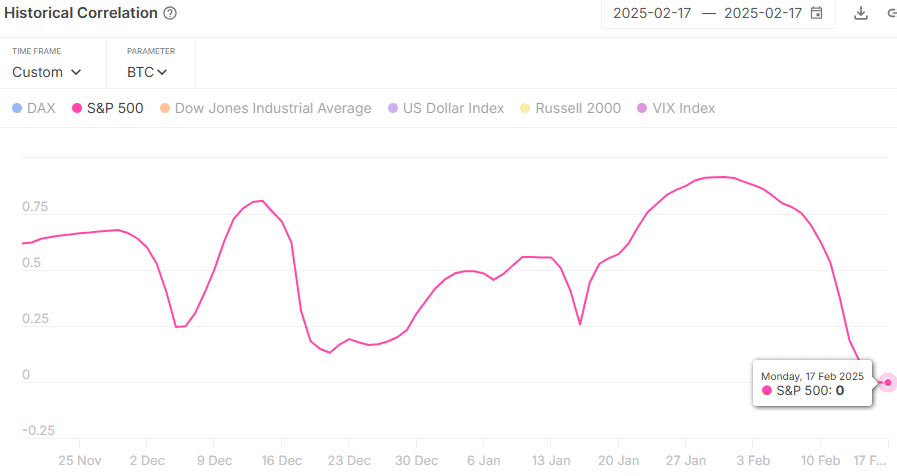

- BTC S&P correlation hits zero, signaling Bitcoin’s full decoupling from conventional markets.

- Speculations on whether or not Bitcoin’s independence from equities might set off a serious value surge are rife.

Bitcoin [BTC] has lengthy been seen as a threat asset, shifting in tandem with equities throughout occasions of market uncertainty. However a brand new shift is rising.

The correlation between Bitcoin and the S&P 500 has fallen to zero, signaling a whole decoupling from conventional markets.

This break comes after months of optimistic correlation and echoes previous situations the place Bitcoin surged following comparable divergences.

As market watchers assess what this implies for the crypto market, one does marvel: Is Bitcoin on the verge of one other main rally?

Understanding correlation in monetary markets

Correlation measures how the worth actions of two belongings relate to one another. A correlation near 1 signifies they transfer in sync, whereas -1 suggests an inverse relationship.

A zero correlation, as seen now, means there isn’t a connection between Bitcoin and the S&P 500, declaring a shift in Bitcoin’s market habits.

Traditionally, Bitcoin’s correlation with conventional belongings has fluctuated. Intervals of excessive correlation align with broader financial uncertainty.

Nonetheless, a correlation drop to zero has usually signaled a shift in Bitcoin’s value trajectory.

The shift in correlation

In January, Bitcoin and the S&P 500 confirmed a near-perfect correlation, shifting in tandem for the primary time in latest reminiscence.

This was notable as a result of Bitcoin is often thought-about a separate asset class, not intently tied to conventional monetary markets.

Bitcoin’s alignment with the S&P 500 prompt that broader fairness market sentiment was influencing its value.

Since early February, this correlation has sharply declined, reaching zero. This dramatic shift signifies that Bitcoin’s value actions are now not intently tied to inventory market tendencies.

The decoupling of Bitcoin from the S&P 500 might signify a brand new section for the cryptocurrency, pushed extra by its distinctive elements than exterior market influences.

Graphical evaluation of the correlation development additional confirms this sharp drop.

Traditionally, such decouplings have usually preceded vital value actions for Bitcoin, indicating that the asset could also be getting ready for notable volatility quickly.