- Crypto inflows of $644 million have damaged the one-week outflow streak, signaling renewed investor confidence

- Bitcoin has continued to take care of its supremacy throughout the market

The crypto market noticed a serious turnaround final week, with $644 million in inflows – Ending 5 weeks of outflows. This shift is an indication of rising investor confidence, particularly as institutional demand rises.

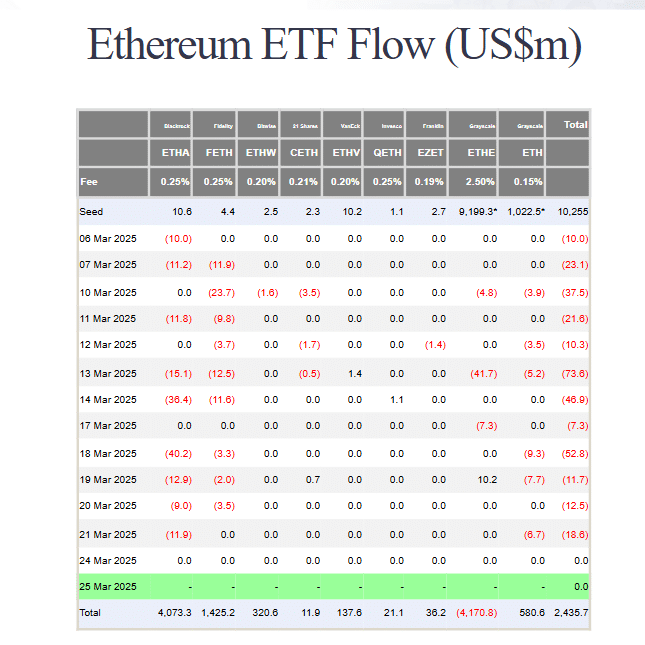

Bitcoin [BTC] led the restoration, pulling in $724 million, reversing its $5.4 billion outflow pattern from earlier weeks. Quite the opposite, Ethereum [ETH] confronted $86 million in outflows, whereas Solana [SOL] gained $6.4 million, displaying that traders stay selective.

Crypto inflows present Bitcoin’s assist is unhinged

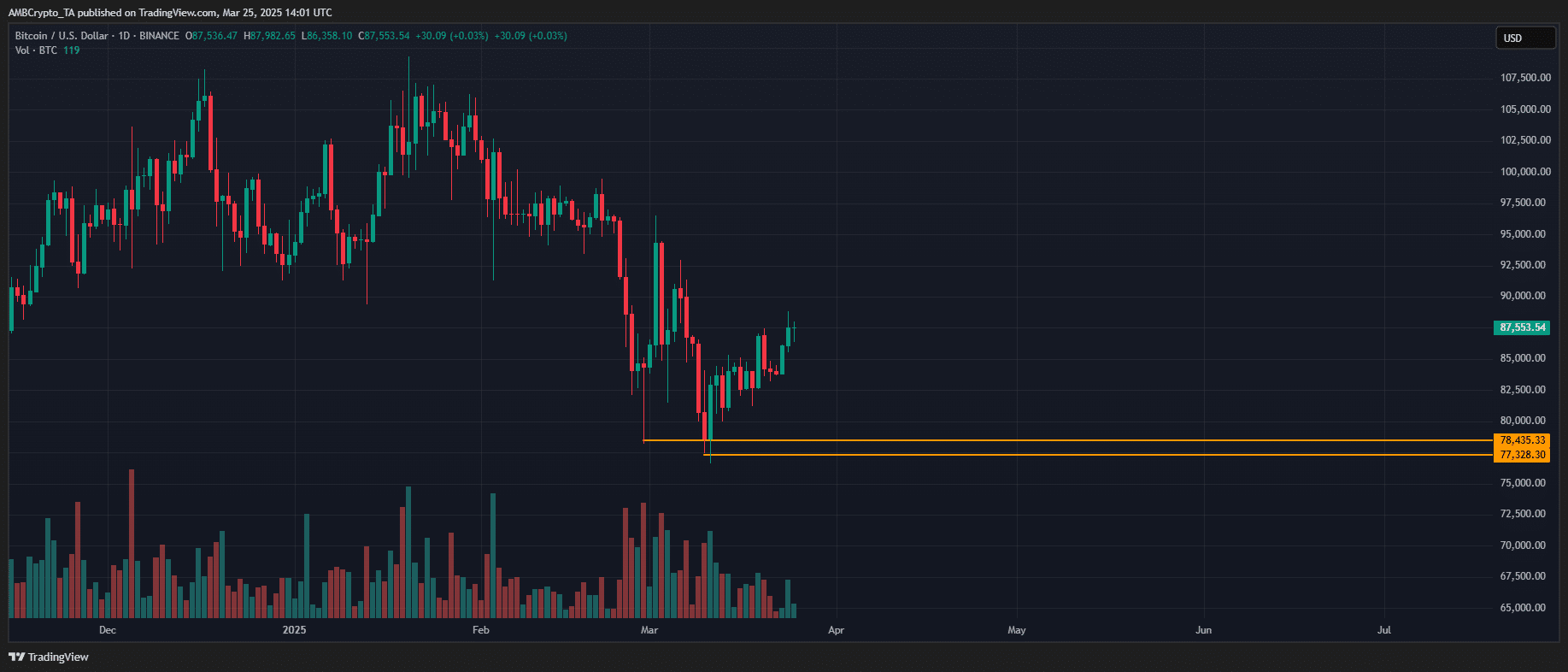

Regardless of successive market shocks, Bitcoin’s dominance stays strong, holding regular above 60% – The identical stage noticed previous to the elections. Curiously, this stability follows a considerable retracement from its all-time excessive of $109k to its large drop to $78k.

The value motion is indicative of strong conviction. Regardless of short-term fluctuations, a bullish continuation in the direction of a brand new all-time excessive stays a believable situation. Particularly with upward momentum prone to construct over the long-term horizon.

The $724 million in crypto inflows additional confirmed sustained demand for BTC, bolstering its market dominance.

Nevertheless, the disparity in crypto inflows additionally revealed underperformance in altcoins, significantly Ethereum. In reality, the crypto has seen consecutive outflows from ETFs over the previous two weeks.

This pattern has solely bolstered Bitcoin’s dominant place, because it continues to seize the lion’s share of institutional capital.

Amid hypothesis of a bearish Q2 pushed by shifting fiscal and financial insurance policies, the $644 million crypto inflows into digital belongings could act as a essential catalyst for a market reversal.

The inflows into Bitcoin sign sturdy institutional confidence. This, coupled with lowered promoting stress, may gas upward momentum, doubtlessly mitigating broader market headwinds and triggering a rebound within the coming quarters.

Bitcoin’s place in a bearish Q2 – Navigating market headwinds

With Q2 set to unfold underneath bearish situations, President Trump’s reciprocal tariffs, efficient 02 April , may compound present macroeconomic pressures.

Traditionally, such macro headwinds have led to vital worth corrections in Bitcoin. The asset has even misplaced the essential $80k assist zone on two separate events.

Quite the opposite, on-chain metrics and crypto inflows instructed that whereas volatility could intensify, Bitcoin’s long-term market construction and demand may provide structural assist.

However, the $5.4 billion in outflows from BTC ETFs over the previous few weeks warrants consideration. Whereas Bitcoin’s dominance stays unshaken, the true take a look at of its resilience is quick approaching.

If institutional and retail inflows proceed to reflect latest patterns, Bitcoin may doubtlessly climate the uneven market situations.

Nevertheless, ought to crypto inflows reverse, FOMO may dissipate, placing Bitcoin’s rally in danger. In such a situation, a possible retraction to the $80k assist zone would stay a viable draw back goal, with higher danger of a deeper correction.