- Bitcoin and Ether drop amid U.S. commerce tariff announcement, triggering vital market volatility.

- Regardless of the downturn, Bitcoin held above $90K, with many traders urging to “purchase the dip.”

Amid escalating considerations over a possible world commerce warfare, Asian inventory markets skilled vital declines.

This adopted U.S. President Donald Trump’s announcement of sweeping tariffs on Canada, China, and Mexico. The financial uncertainty despatched shockwaves via the markets, affecting cryptocurrencies as nicely.

Main digital belongings, together with Bitcoin [BTC] and Ethereum [ETH], witnessed steep drops. BTC briefly fell to a three-week low of $91,441.89, whereas ETH plummeted by 24%, reaching its lowest worth since September.

The downturn continued into the weekend, with Bitcoin slipping additional by 7%. The CoinDesk 20 Index, which tracks the highest 20 cryptocurrencies, noticed a pointy 19% drop.

As investor sentiment weakened, considerations about future stability have risen.

Tariff warfare sends shockwaves in crypto

In actual fact, the crypto market has skilled its largest liquidation so far.

Commenting on this, a crypto investor often known as ‘The Wolf of All Streets’ pointed out,

“$2B liquidated in 24 hours. That’s a report. Greater than the Covid dump. Greater than the FTX collapse. Epic.”

Including to the fray was one other X (formerly Twitter) user who stated,

“Be fearful when others are grasping, be grasping when others are fearful.”

Nevertheless, regardless of the current downturn, Bitcoin has managed to carry above the $90K mark. As per CoinMarketCap, BTC was buying and selling at $95,375, at press time, after a 4.36% drop up to now 24 hours.

Whereas some traders, like ‘The Wolf of All Streets,’ expressed cautious optimism about additional worth dips, emphasizing a reluctance to promote in such an oversold market, the broader crypto neighborhood stays hopeful.

Neighborhood stays optimistic amidst large crypto liquidation

Many are urging others to ‘purchase the dip,’ suggesting a optimistic outlook for Bitcoin’s long-term potential even amidst the present volatility.

Echoing related sentiments was one other X user who added,

“I haven’t misplaced hope out there but, I’d say this was only a MASSIVE liquidity sweep, BTC has bounced off a long run assist.The entire market is oversold.”

He continued,

“I wouldn’t be shocked if the market continues downwards however we’ll see a restoration withing the approaching week.”

Not too long ago, Robert Kiyosaki, famend writer of Wealthy Dad, Poor Dad, described Bitcoin’s current dip following Trump’s tariffs as a “shopping for alternative.”

He sees this market correction as a beautiful likelihood for traders.

Nevertheless, Kiyosaki additionally emphasizes that the U.S. fiscal debt stays a much more urgent situation, one that can proceed to drive curiosity in belongings like Bitcoin, gold, and silver as protected havens throughout instances of monetary uncertainty.

He stated,

“Trump tariffs begins: Gold, silver, Bitcoin might crash. Good. Will purchase extra after costs crash. Actual downside is DEBT…which is able to solely worsen. Crashes imply belongings are on sale. Time to get richer.”

What lies forward for Bitcoin?

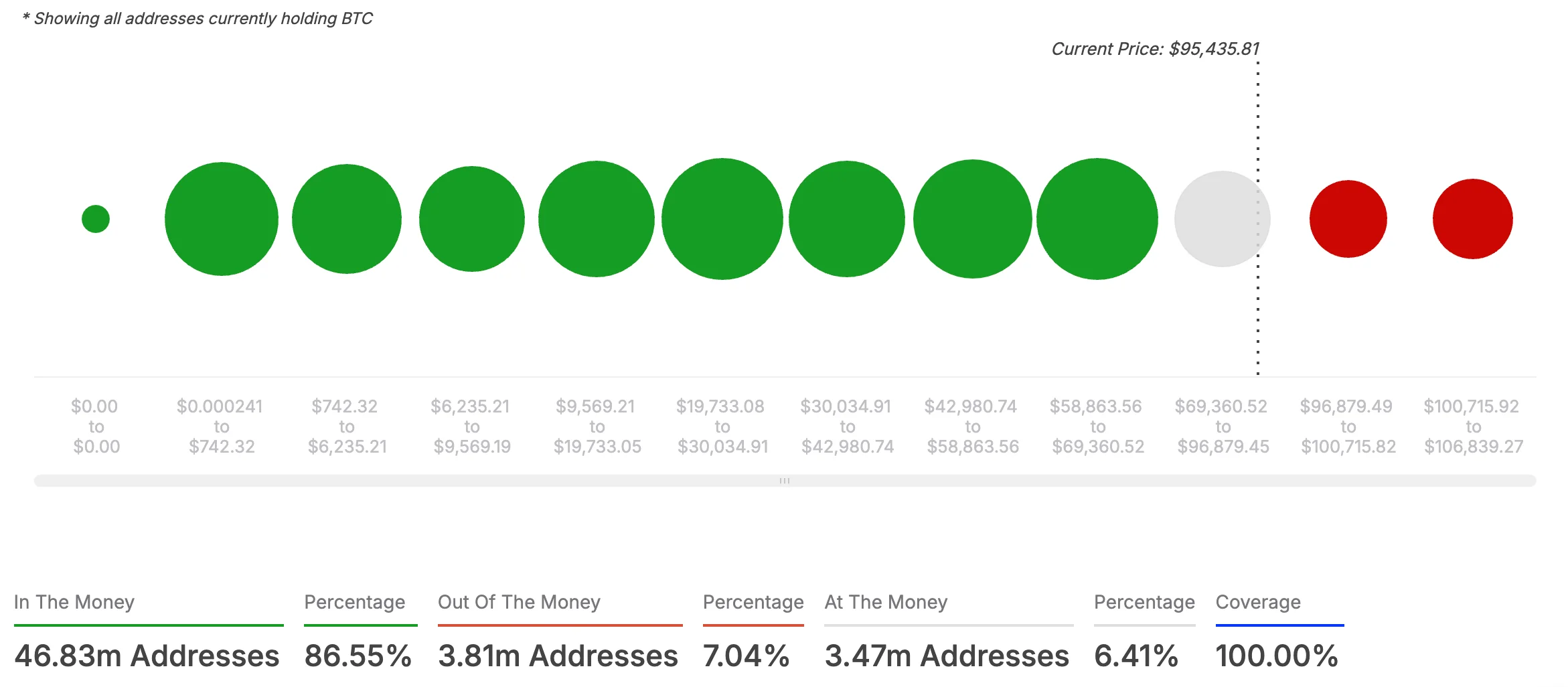

Moreover, current information from AMBCrypto, based mostly on IntoTheBlock’s insights, reveals a largely optimistic sentiment within the Bitcoin market.

A big 86.55% of Bitcoin holders are presently “within the cash,” holding tokens valued above their buy worth, which alerts optimism and potential for a worth surge.

In distinction, solely 7.04% of holders are “out of the cash,” with their tokens valued decrease than their unique buy worth.

This disparity displays rising bullish sentiment within the cryptocurrency neighborhood, regardless of exterior pressures like rising commerce tensions and market volatility.

When evaluating current occasions to main market crashes in cryptocurrency historical past, the liquidation figures throughout the FTX collapse in November 2022 are significantly notable.

In that occasion, the market noticed over $2.8 billion in liquidations inside 24 hours, surpassing even the $1 billion liquidations throughout the COVID-19 market downturn in March 2020. This highlights the severity of market reactions to vital occasions.

It additionally serves to underline the resilience of the crypto market, with many traders persevering with to see Bitcoin and different digital belongings as long-term alternatives regardless of the continued volatility.